I am delighted to announce that Pall Mall Art Advisors has been acquired by the London based company, The Fine Art Group. Over its 20-year history, The Fine Art Group, founded by Philip Hoffman, has established itself as a powerful presence in the global art market, evolving from its origin as The Fine Art Fund into a comprehensive art services group spanning art advisory, art secured lending, art agency, art investment and valuations. The Fine Art Group serves the upper end of the art market and offers unrivaled in-house expertise in fine art and jewelry.

This merger cements our position as the market leading independent art services group for every stage of the art collecting cycle. The sale makes perfect sense as we continue to focus on expanding our services and global footprint. Both companies share the same guiding principles of providing transparent and independent white glove service to exceed our clients’ expectations. Like Pall Mall Art Advisors, The Fine Art Group has a strong commitment to developing long-standing client relationships and meeting their evolving needs in a changing market.

We plan to consolidate our brand to be represented under The Fine Art Group name, which will be rolled out over the next few months. My colleagues and I look forward to connecting with you soon to discuss in greater detail this exciting news and the extension of specialty services it offers you.

Anita Heriot

President, the Americas, The Fine Art Group

Read more about the merger on Artnet.com.

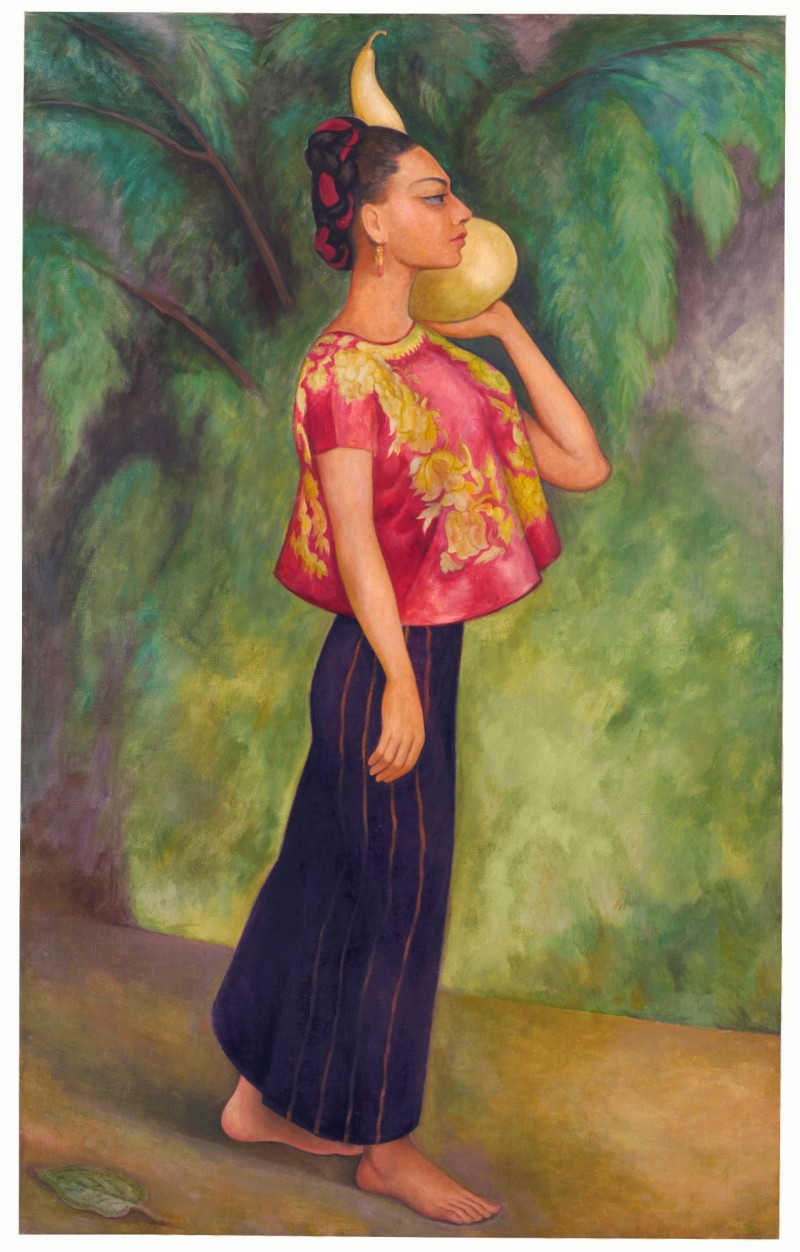

A welcome return to the regular auction schedule saw Christie’s and Sotheby’s execute five major evening sales across three nights totalling $1.29 billion, with Phillips opting instead to hold their New York sales in June at their new headquarters. Despite Christie’s merging their Post-War & Contemporary and Impressionist departments, previously holding just one evening sale, the auction house held two 21st and 20th Century evening sales, proving that the sale categories continue to be malleable depending on the material the houses bring in. Despite heavy investment in their live streaming technologies from both sides, Sotheby’s format still triumphs in terms of streamlining global bids from multiple desks. Most refreshing, however, was room bidding on several lots during the Sotheby’s sale, fielded by auxiliary auctioneer Quig Bruning. Diego Rivera’s Retrato de Columba Dominguez de Fernandez (1950) even sold to a woman in the room for $7.4 million (premium) and marking a promising step forward for the next round of sales.

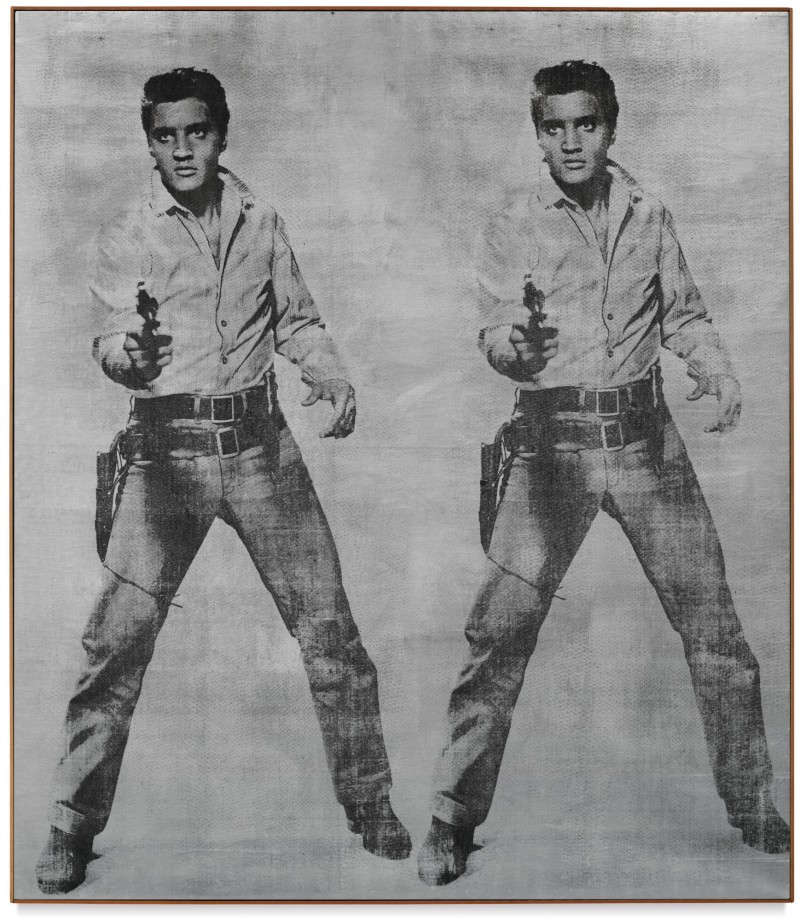

Despite Christie’s achieving an overall higher turnover with $691.6 million (premium) versus $597 million (premium) for Sotheby’s, in terms of material it felt as if Sotheby’s had the lead for the week. This was largely due to the stand alone Marion Collection sale which achieved $157.2 million (premium). Despite totalling towards the lower end of the presale estimate due to four unsold works, the sale saw new auction records achieved for Kenneth Noland, Larry Rivers and Richard Diebenkorn and impressive bidding on the major Warhol, Elvis 2 Times (1963), whose market has been somewhat subdued in recent years. Estimated at $20 – 30 million, the double portrait sold for $32 million hammer ($37 million premium). Christie’s also had comparatively healthy Warhol results in their 20th Century sale later in the week, with both lots reaching around their high estimates.

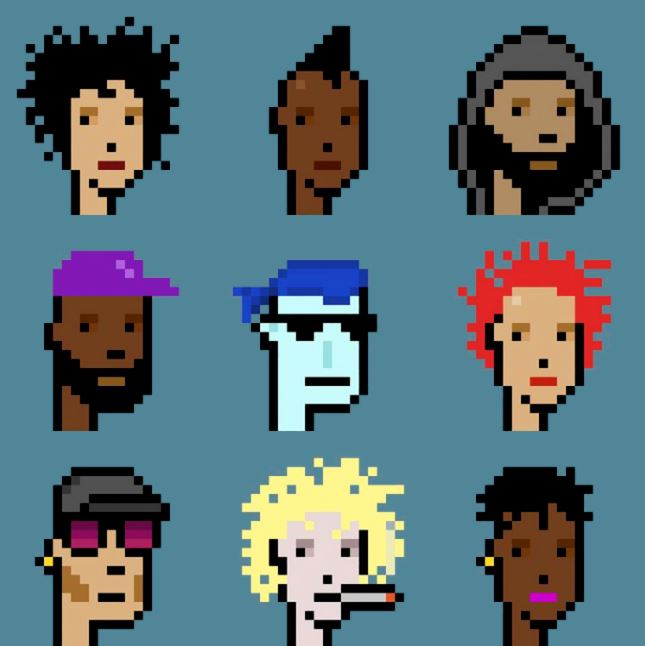

On the completely opposite end of the art historical timeline, following the recent headline grabbing Beeple price, Christie’s unsurprisingly opted to include an NFT artwork in their 21st Century evening sale which no doubt boosted their bottom line as 9 Cryptopunks sold for $16.9 million (premium), estimated at $7 – 9 million. A few weeks before Phillips and Sotheby’s had both followed suit, holding their own standalone NFT auctions selling for several million dollars. While their value is currently the subject of much speculation, with the new evening sale status NFTs seem to be gathering staying power, at least for the short term.

In the spirit of technological shifts, the consignor and Sotheby’s opted to allow their Banksy Flower Thrower painting to be paid for in cryptocurrency which undoubtedly boosted the extraordinary result hammering at $11 million ($12.9 million with premium) to a west coast collector, against an estimate of $3-5 million. Notably Sotheby’s required their buyer’s premium to be paid in US dollars.

Strength of the Asian market continued and in terms of bidding roughly a third of lots across all the sales saw bidding from Asia. Christie’s reported that the Asia-Pacific area represented 25% of buyers from their 21st Evening sale and 20% in their 20th Century evening sale. Key lots by George Condo, Leonor Fini, Picasso’s Femme assise en costume vert and a Monet still life, among others, were all sold to phone bidders from Sotheby’s and Christie’s Hong Kong desks.

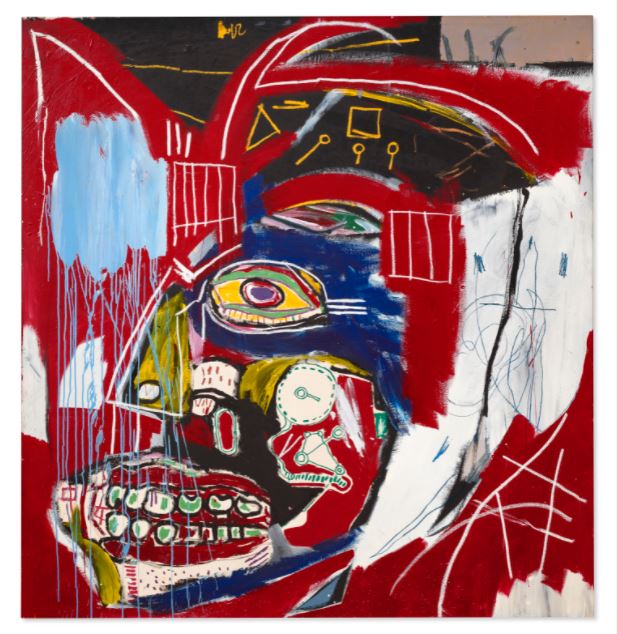

The major turnover generator of the week for both houses was Jean-Michel Basquiat. Christie’s lot, In this Case (1983) sold by Valentino co-founder Giancarlo Giammetti, went beyond its unpublished pre-sale estimate of around $50 million to a New York phone bidder for $81 million hammer ($93.1m with premium). Sotheby’s likely expected their top lot Versus Medici (1982) to do better but it sold to Lisa Dennison’s client Steve Wynn for $44 million hammer ($50.8 million with premium).

The result for Picasso’s Femme assise près d’une fenêtre (Marie-Thérèse) (1932) also showed the continued strength in long term value for the artist. Previously selling for $44.8 million in 2013, this time it went to Vanesso Fusco’s client on the phone for $90 million hammer ($103.4 million premium), the only lot of the week to sell in excess of $100 million including fees.

Despite some healthy bidding for Basquiat, Picasso and the major Monet waterlilies at Sotheby’s, these solid results were for deservedly A-grade material. Whereas works by other auction stalwarts including Gerhard Richter, Christopher Wool and Cy Twombly, among others, primarily sold on one or two bids. This is both a reflection of the continued selectiveness of the market as well as a shift in taste to the new generation of art stars, albeit at lower price points, where lots saw the most competitive bidding. Five artists under the age of forty-five set new auction records, notably Nina Chanel Abney ($990,000 premium), Lynette Yiadom-Boakye ($1.95 million premium) and Salman Toor ($867,000 premium) to name a few. Another noteworthy price from the week included a spectacular and deserved new auction record for Robert Colescott’s George Washington Carver Crossing the Delaware: Page from an American History Textbook (1975), selling for $15.3 million (premium) above the $12 million high estimate. The result was over sixteen times higher than the previous record of $912,500. The work sold to the Lucas Museum of Narrative Art in Los Angeles.

Overall, the results proved a healthy, recuperative global art market, following the past twelve turbulent months. Phillip’s delay to June may have assisted in slightly curbing supply but the successive slew of auction records and excellent sell through rates speak for themselves. The auction houses continue to show excellent adaptability to help ensure this, whether it be last minute lowering of reserves, withdrawals or the securing of guarantees. With 78% of works guaranteed by value in both Christie’s evening sales and 48% and 57% respectively in Sotheby’s Contemporary and Impressionist & Modern sales, these remain essential tools for the sustained stability of the auction market.

Image 1: Image courtesy Sotheby’s; Image 2: Image courtesy Sotheby’s; Image 3: Image courtesy Christie’s; Image 4: Image courtesy Sotheby’s; Image 5: Image courtesy Sotheby’s; Image 6: Image courtesy Christie’s; Image 7: Image courtesy Christie’s; Image 8: Image courtesy Sotheby’s

FURTHER READING

- Morgan Long Speaks with Barron’s About Guaranteed Works at Spring 2023 Auctions

- Watch The Educated Eye: How to Navigate a Multi-Category Collection at Auction

- May 2023 Auction Season: Our Team’s Top Picks & Insights

“We all miss the sense of occasion that comes with going to an auction,” Mr. Jennings said. “I’m really anxious to get into one.”

For the first time since the start of the pandemic, Sotheby’s invited a select few collectors and dealers to attend their live streamed auctions in real life, and finally bid in person rather than online or over the phone.

Managing Director Guy Jennings and Senior Director Morgan Long were recently asked to comment on this, speaking to The Wall Street Journal last week about their own viewing habits and how different it is to participate in the auctions from the comfort of their own homes.

To read the article in full, please click here.

CEO of Art Finance and Group General Counsel Freya Stewart was recently invited to speak at the STEP Bermuda Webinar Series: Art Finance.

In the session, Freya demystified Art Finance, including discussion on: what types of collectors use Art Finance and for what purposes; what the key commercial terms are; and the eligibility and execution process. Freya specifically touched on how and why Bermuda based clients, and Trustees globally, use The Fine Art Group’s Art Finance services, together with relevant case studies from The Fine Art Group’s loan portfolio. Finally, Freya offered insights into current issues in the world of Art Finance and the year ahead.

WATCH NOW THE STEP BERMUDA WEBINAR

Pall Mall Art Advisors & Hagerty Insurance Present:

Next Generation Collectors

THURSDAY, MAY 13, 2021 – 2PM EST / 11AM PST

In our next 30 minute webinar Anita Heriot and John Wiley will be speaking on the subject of Next Generation Collectors.

TOPICS DISCUSSED

- Non Fungible Tokens (NFTs) & their impact on the market

- What are Millennials interested in and where are they buying

- 2021 Bull Market Art & Cars List

EVENT DATE

- Thursday, May 13, 2021 – 2pm EST / 11am PST

EVENT LENGTH

- 1 hour

FORMAT

- Live interactive webinar

The Expert’s Perspective: Where is the Value?

TUESDAY, MAY 4, 2021 – 4PM BST / 11AM EST / 8AM PST

Delve into the world of value as leading specialists from The Fine Art Group and Pall Mall Art Advisors debate their respective fields, and where they see lasting value in the current art market.

Is it Post-War & Contemporary or Impressionist & Modern?

Join Us Tuesday, May 4, 2021 – 4pm BST / 11am EST / 8am PST

EVENT DATE

- Tuesday, May 4, 2021 – 4pm BST / 11am EST / 8am PST

WEBINAR LENGTH

- 1 hour

FORMAT

- Live interactive webinar

PART II: ART FINANCING TODAY

The Fine Art Group is proud to present The Expert’s Perspective: A Three-Part Series, produced in partnership with Risk Strategies.

Over the coming months, The Fine Art Group will be releasing a three-part series exploring the current market, the increasing popularity of Art Finance and the art of pricing Fine Art.

Hear from the experts on the current themes from the world of art finance. This event will demystify the process and uncover what lies ahead in the art lending industry.

Further Reading

- Spear’s Magazine Lists Philip Hoffman & Freya Stewart as Top Professionals in Art Advisory and Art Finance

- Artnet Art-Secured Lending Brokerage Program

“Bank of America suggested investors seek out funds like the Fine Art Group, Classic Car Fund, and the London International Vintners Exchange Fine Wine Fund Index (FWIFFWID), in addition to REITs and commodity funds if they’re looking for real asset exposure.”

In a recent note, Bank of America’s chief investment strategist, Michael Hartnett, reports that real estate, commodities, and collectibles could outperform stock market returns over the next decade.

Hartnett notes that real assets are a more overlooked part of the market that may offer investors protection against inflation while diversifying their portfolios, which is why he encourages investors looking for real asset exposure to seek out funds such as those offered at The Fine Art Group.

To read the full article, and to learn more about Michael Hartnett and Bank of America’s advice to the smart investor, please click here.

PART I: ART MARKET UPDATE

The Fine Art Group is proud to present The Expert’s Perspective: A Three-Part Series, produced in partnership with Risk Strategies.

Over the coming months, The Fine Art Group will be releasing a three-part series exploring the current market, the increasing popularity of Art Finance and the art of pricing Fine Art.

Please join our Senior Art Team as they provide a timely and informative market analysis following the March auctions in London and other recent public and private transactions.

WATCH NOW

Further Reading

- The Asking Price: Understanding Value 1

- Morgan Long Speaks with Barron’s About Guaranteed Works at Spring 2023 Auctions

- Guy Jennings Speaks With The Art Newspaper

23rd March saw the first major evening auctions of 2021 following an unprecedented year of upheaval and change. The auction houses attempted to centre their sales around the March London calendar slot, albeit later, in an effort to restore the old schedule. Upon the eventual announcement of the timeline for the loosening of social controls, Phillips decided to delay their 20th Century and Contemporary sales to mid-April to allow for more ‘In person’ viewings for their sales. Sotheby’s and Christie’s chose to continue with their schedule which meant private collectors were unable to physically view the sale but art trade were. In keeping with the houses’ ever creative approach to our current situation, on some occasions they opted to bring works to local collectors, to help stimulate as much pre-sale interest as possible given the circumstances.

All of the houses opted for mixed category evening sales, perhaps a signal insert that they struggled to get consignments, however, not a trend we see declining, having long been in play before Covid. The Leonardo sale at Christies being a key turning point, it is a fantastic stimulus for other areas of the market, including Old Masters and Modern British, that lack the same marketing budget and often command less global attention. The strategy paid off in both cases. Sotheby’s Modern Renaissance sale, with artworks from 1500 to present day, totalled £81.6 million (hammer) against a presale estimate of £60- 86.5 million and 87% lots sold. Whilst Christie’s totalled £100.5 million (hammer) against the presale estimate of £66.6 – 96.7 million. Also further bolstered by a £40.4 million (hammer) sale total from Olivier Camu’s Surrealist sale, traditionally held this time of year.

The mixed category format facilitated some extraordinary prices for artists not traditionally included in the evening sale setting. Notably a new record for British sculptor Frank Dobson whose work rarely comes to auction. The female torso which once belonged to Alberto Giacometti, surpassed its estimate of £250,000 to sell for £2.04 million (including premium), smashing the 2005 record of £338,500 (premium). Czech artist František Kupka, known for his association with Kandinsky and Malevich also reached a new record of £7.55 million (including premium), tripling the low estimate.

Despite March usually being a London slot, both houses decided to spread their sales across multiple locations, in keeping with the international relay style auction approach developed last year. Sotheby’s held a Paris Impressionist and Modern auction before the London sale, in an effort to mirror the volume offered by Christie’s with their Surrealist sale. Totalling €30.4 million above the presale estimate of €19.3 – 28.9 million, the sale was a remarkable success with 91% lots sold. The relay tactic, stitching Paris evening sales to marquee auction calendar moments, seems to be attracting significant global bidding. To attest to the interest in the Sotheby’s Paris sale, the London sale start time was delayed due to the high volume of bidding in the Paris segment, with even in person room bidding for a Renoir sculpture with harked back to an almost immemorable time. The most notable result was €13.1 million (premium) for an 1887 Van Gogh canvas, against an estimate of €5 – 8 million, acquired by the Reuben family. Despite the slight hiccup with a phantom online bidder, the work saw bidding from New York, Paris, London and Hong Kong, proving that Paris is a solid stage for major lots.

72 x 48 in. (183 x 122 cm.). Sold for HKD 323,600,000 in We Are All Warriors: The Basquiat Auction on 23 March 2021 at Christie’s Hong Kong.

Christie’s also opted to hold a one lot Basquiat Hong Kong auction, despite technically being taken by Jussi Pylkkänen from the rostrum in London, the sale was indeed in Hong Kong dollars. Belonging to collector Aby Rosen, the 1982 warrior painting saw three bidders from New York and Hong Kong compete before it went to Jacky Ho in Hong Kong. It was a solid indicator of the continued appetite Basquiat, this latest result marked a $30 million profit on the seller’s 2012 investment; also providing positive foundations the forthcoming 1982 Versus Medici painting to be sold at Sotheby’s in New York in May, estimated to fetch between $35 – 50 million.

The Christie’s consignment hammered within estimate at HK$280 million ($36 million) or HK$323.6 million ($41.8 million) including premium, which ultimately beat the recent Richter, to become the most expensive piece of Western art sold in a Hong Kong auction. The success of the lot was a sign of the continuing strength of the Asian market off the back of seventeen records at Christie’s December Hong Kong auction and Art Basel’s recent Art Market report confirming China overtook the US to become the largest auction market in 2020. Significant Asian bidding on roughly a quarter of the lots across the sales attested to this and to make sure these sales remained accessible to global collectors these ‘evening sales’ were in fact held at 1 and 3pm respectively to allow for more social hours.

The Banksy market showed no signs of slowing with a new auction record at Christie’s for a painting donated to Southampton hospital, sold to raise fund for the NHS. The work hammered for a staggering £14.4m hammer (£16.76 million with premium) against an estimate of £2.5 – 3.5 million and was chased by six bidders before selling to Tessa Lord’s client on the phone. Sotheby’s also reached an extraordinary price for a signed edition of Girl with Balloon selling to an online bidder for £1.2 million (premium). Despite being catalogued as an artist proof edition of eighty-eight, it belongs to a wider edition of 150, and an unsigned edition of 600, and speaks to extreme level of demand for Banksy at the moment. Interestingly, these works saw no US bidding with collector interest based solely in the UK or Asia.

In demand primary market artists also continued to see the most spirited bidding with several artist’s auction debuts selling for well beyond their estimates. Despite Issy Wood’s ‘auction debut’ in fact taking place the day before with a successful result via Loic Gouzer’s fair warning app, herself alongside Joy Labinjo, Amoafo Boako, Claire Tabouret, as well as continued demand for last year’s breakout auction star Matthew Wong all ignited the early parts of the sales.

An overall sense from the last few auctions was that bidding was thin for lots at higher price points and from more traditional or established segments of the market. And whilst this rang true for some pieces from these sales, including a Francis Bacon selling on just one bid at £4.3m with a rumoured estimate of £8-12m, several lots did extremely well. Perhaps reflecting that collectors feel more confident transacting at these price levels now the art market has weathered the past 12 months and there is some light at the end of the tunnel. Two major Picasso paintings at Christie’s both sold significantly above their last auction results. Works by Fautrier saw serious bidding across both houses, with Christie’s reaching a new record and Olly Barker at Sotheby’s taking some twenty minutes over a 1966 painting which sold for nearly quadruple the high estimate to Martin Klosterfelde’s client for £3.1 million (premium).

Other high prices included Edvard Munch’s Embrace on the Beach, which sold for £16.3 million (premium) to a Hong Kong client, above a £12 million high estimate and an Arshile Gorky landscape, Garden in Sochi, set to sell for a high estimate of £2.8 million, instead it sold for £8.6 million to Bame Fierro March’s client.

These results proved encouraging for the first marquee moment of the year for the art market. The three-month gap certainly helped build appetite and demand. The continued lack of physical art fairs works in the favor of the auction houses, the sheer size of their organizations has allowed them to tour major artworks, arrange delivery for physical viewings and remain open for trade which has offered them a significant advantage to the now monotonous experience of an online viewing room. As the year progresses it will be interesting to see if this level of bidding will be sustained but with such solid infrastructure in place to conduct these global sales with ease, there is an overwhelming sense that the location of sales is no longer a barrier to bidders. Collectors are attracted to the works no matter where and this yields excellent results as they continue to capture the interest of the international collector base.

Image 1: Image courtsey Sotheby’s; Image 2: Image courtsey Sotheby’s; Image 3: Image courtsey Christie’s; Image 4: Image courtsey Christie’s; Image 5: Image courtsey Sotheby’s; Image 6: Image courtsey Sotheby’s