Have you recently inherited a piece of jewelry or art that is not yet insured? It’s also possible that the worth of a valuable you own has increased over the years without your knowledge, and it’s no longer adequately protected by your policy.

I cannot stress enough that appraising your valuables is critical for securing adequate insurance. But how do you go about having the appraisal done? Read my interview with Colleen Boyle of The Fine Art Group below. With over 20 years of experience in the art and financial world, she shares her views on the importance of appraising your valuables to secure adequate insurance coverage and how to find a qualified appraiser.

Q & A WITH COLLEEN BOYLE

WHY IS THE APPRAISAL OF ANY VALUABLE IMPORTANT?

Having adequate insurance coverage—An appraisal process will help you identify what you own, know the value, and document your valuables in the form of either a visual inventory (photographs/videos), a written report, or a combination of both. This is extremely helpful, if not a must, to adjust your existing contents coverage within your Homeowners policy or to select sufficient insurance coverage for all your items so you can be made whole should a loss occur.

To demonstrate my point, here’s an example. The Fine Art Group conducted an appraisal for a client of mine who had a total contents coverage at $250,000. As a result of the evaluation, we discovered they had a little less than $1 million worth of books and manuscripts—they had absolutely no idea they were worth that amount of money. They scheduled some of the valuables on their insurance policy, and they also increased their contents coverage on their Homeowners’ policy to cover all the other items in their house (furniture, decorative items, etc.). Approximately a year and a half later, that client had an electrical fire. Because they had proper visual and written documentation of all of their lost valuables, it helped make the claims process more efficient, and they were reimbursed for everything they had lost in the fire.

HOW DO YOU SELECT THE RIGHT APPRAISER?

Work with your insurance advisor to select an appraiser that fits your needs; your advisor might even already have a trusted relationship with a reputable appraiser. This relationship will provide you with more comprehensive protection all around, because it takes both a proper appraisal and a strong policy to protect your valuables. When your insurance and appraiser professionals work together closely, they are more likely to catch gaps in coverage and value changes.

For instance, a client of mine wanted to make sure their Andy Warhol screen print scheduled on their insurance for $22,000 was protected during their move. The Fine Art Group reviewed the schedule, and it turned out the piece was actually worth over $200,000. We recommended that the piece be revalued at the current retail replacement value, and we worked with the insurance advisor to have the client’s current policy changed to reflect the correct value so that it would be protected during transportation.

WHAT QUALIFICATIONS SHOULD A GOOD APPRAISER HAVE?

Here are six selection criteria to consider:

- Industry recognition: I highly recommend selecting an appraiser who is a member of at least one of the three industry associations (Appraisers Association of America, International Society of Appraisers, and American Society of Appraisers). These associations have strict criteria for accepting new members, and they require annual continuing education to keep current.

- Certification: A good appraiser should also stay up-to-date on their USPAP—an exam taken every other year that keeps appraisers current on tax law changes, updates in IRS appraisal requirements, and insurance market developments.

- Specialized expertise: Many appraisers don’t have deep expertise in every valuable you might have. But, it behooves you to find an appraiser who specializes in knowledge of multiple valuables (jewelry, art, antiques, wine collection, sports memorabilia) so you are receiving an accurate evaluation and recommendations for protecting all of your different assets.

- Security: If an appraiser is coming to your home, would you be concerned with your privacy and security? Only a few companies address this concern. For instance, at The Fine Art Group we conduct background checks on our appraisers, and we also send a bio and a photograph of the appraiser to you prior to the appointment. This is not a standard process, so be sure to select an appraisal company that makes you feel comfortable.

- Confidentiality: Although non-disclosure agreements are important for people who are concerned with confidentiality, they are not offered by all appraisal companies. Make sure to work with an appraiser that ensures your information won’t be shared with anyone, including attorneys, wealth advisors, and fellow coworkers, without your express permission.

- Fiduciary and advocate: Appraising is more than just a transaction. A good appraiser serves in a fiduciary role protecting your best interests when providing guidance on handling your valuables and ensuring you have proper insurance coverage. For example, at The Fine Art Group we protected the interests of one of our clients by identifying the best international auction house where their artwork would sell for the most money (which was overseas), and then also helped ship the piece.

If you have any questions about selecting the right appraiser or evaluating and insuring your valuables, contact me at john@psafinancial.com.

ABOUT THE AUTHOR

Joining PSA in 1981, John Lannon, vice president, is the longest tenured account executive, with 34 years of service and is consistently ranked as a leading personal lines broker at PSA. John was instrumental in launching PSA’s Private Client Group, catering to the affluent market, bringing together the elite insurance carriers in the industry for the implementation in regional, national, and worldwide scenarios.

Read the entire article at Personal Insurance.

UPCOMING AUCTION SALES FOR MOTHER’S DAY GIFTING

Let a Fine Art Group Advisor assist you with finding the perfect gift for Mother’s Day.

The Fine Art Group team reviews art fairs and all major auction and dealer catalogues. We are positioned to be able to source the rare and unique, whether it be jewelry, fine art, wine, rare books or other decorative arts.

Freeman’s – Jewelry & Watches

Lot 159

Cartier

An eighteen-karat gold, turquoise, and cultured pearl bracelet, Cartier Inc.

rope twist design set with 5.4mm cultured pearls and turquoise beads with gold rope.

Length: 7 1/4 in.

Estimate: $6,000-$8,000

Freeman’s – Jewelry & Watches

Lot 29

A gold compact with eight platinum and diamond charms

square compact with textured gold and eight applied platinum and diamond charms designed as a carriage, scottie dogs, equestrian, and other animals.

52.8 dwt.

Length: 2 1/4 in.; Width: 2 1/8 in.

Estimate: $4,000-$6,000

Swann Auction – Contemporary Art

Sale 2509, Lot 177

Andy Warhol

Letter to the World (The Kick)

Color screenprint on Lenox Museum Board, 1986. 905×905 mm; 35 5/8×35 5/8 inches (sheet), full margins. Edition of 100. Signed and numbered 75/100 in pencil, verso (the two zeros effaced). With the Andy Warhol Art Authentication ink stamp and annotation “A126.066” in pencil, verso. Printed by Rupert Jasen Smith, New York. Published by Martha Graham Center of Contemporary Dance, Inc., New York. From Martha Graham. A very good impression with strong colors. Feldman 389.

Estimate: $25,000-$35,000

Swann’s Literature

Lot 121

F. Scott Fitzgerald

Tender is the Night

New York: Scribner’s, 1934. First Edition, first printing

Estimate: $3,000-$4,000

Rago’s Modern Ceramics and Glass

Lot 121

Paul Stankard

Paperweight with root people, bee, flower, and word canes

Millville, NJ

1995

Lampworked glass, polished clear glass

Etched signature, date/H16

Estimate: $1,000-$1,500

Rago’s Modern Ceramics and Glass

Lot 121

Harriot Wilcox for Rookwood

Exceptional Painted Mat vase with poppies (uncrazed), Cincinnati, OH, 1902 Flame mark/II/192CZ/H.E.W.10″ x 5 1/2″The companion piece to this vase is in the permanent collection of the Metropolitan Museum of Art, New York.

Estimate: $2,000-$3,000

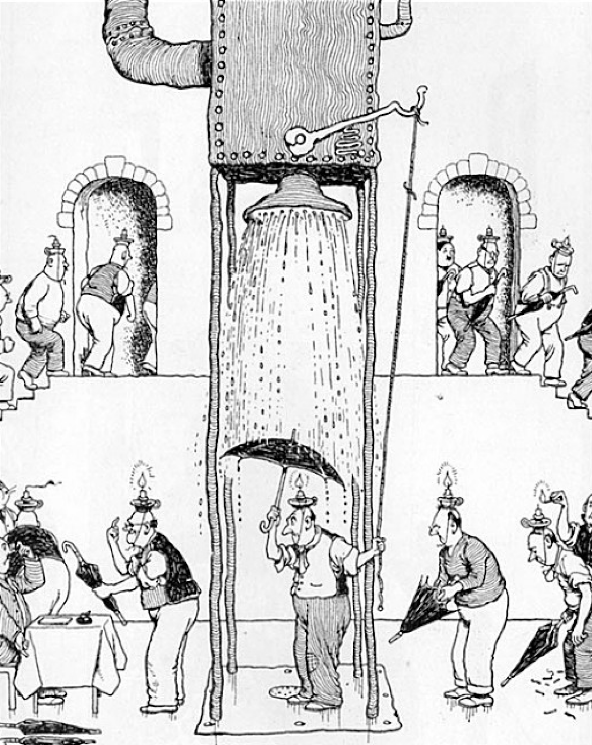

HOW PHILIP HOFFMAN BEGAN ART COLLECTING

In my early twenties my brother and I were captivated by the illustrator and satirist, William Heath Robinson. It was one of these absurd and charming drawings of an ad hoc contraption that became the first work I ever purchased. I think it was Robinson’s imagination that had me so intrigued. Today, the walls of my study are covered floor to ceiling with the original cartoons from the early 1900s.

A little later I began to collect antiquarian books. The obsession started when I was studying at York University; I used my student loan to buy an 18th century rare book on wine for £100 – thus complimenting my then and continuing interest in wine! A few years ago, when we renovated our home in London, I had a library specifically built to house my ever increasing antique and rare books collection. However, I will always value my first, and it has stood proudly in my library for over 40 years.

Since I started working in the art world, at least 30 years ago, my taste has slowly developed and changed and I’ve been heavily influenced by my wife, Nicky. It was Nicky who encouraged me to buy my first ‘real’ picture, a Bridget Riley at FIAC in Paris. I have always been interested in Modern British art, and I think Riley is one of the most revolutionary British painters of them all and I am looking forward to her upcoming retrospective this year.

ART AS COLLATERAL: SHIPPING & HANDLING

A young entrepreneurial collector working with The Fine Art Group’s advisory team to develop his contemporary art collection, was seeking a 2-year loan of $4 million against his collection. His long-term ambition is to found a private museum and display his collection to the public. However, with much of his capital invested in his expanding tech business, he was seeking to lever the capital reserved for his art acquisitions.

The Fine Art Group identified six contemporary artworks that were suitable collateral. Not only was the collateral spread across the collector’s international residences but it also included a delicate work on paper and a monumental sculpture. The Fine Art Group utilised the services of fine art shipper Gander & White to undertake collection, transport and storage of all artworks needed as collateral for funding of loan monies. Gander & White has a worldwide presence, with facilities in the UK, France and USA which enabled swift collection of collateral from the individual’s global residences. These works were packed and transported in bespoke crates crafted by Gander & White.

The pieces chosen as collateral varied in size, media, and complexity to transport. The large sculptural piece required a gantry to move. This work was successfully deinstalled by Gander & White and ultimately stored in one of the company’s state-of-the-art fine art facilities. These facilities contain environmentally-controlled private rooms ideal for storing such high-value works. The collateral also included a group of works on paper that required delicate and precise handling from beginning to end. These were transported to storage using a climate-controlled vehicle, where they were then placed in a secure and controlled environment. Both the collector and The Fine Art Group were confident that the artworks were in safe hands.

Oliver Howell, European Managing Director at Gander & White, said of this project: “We were pleased to support The Fine Art Group in this international operation. The Fine Art Group offers an important service to art collectors and investors alike and it was a pleasure to once again work with a company who share our commitment to offering the best service to our respective clients”.

The collector also wished to show his works in multiple international museums and The Fine Art Group was pleased to facilitate this request, with the support of Gander & White, who work extensively with institutions. The Fine Art Group’s in-house legal team put in place all the necessary legal framework with the museums and the collectors, including establishing complex security structures, negotiating loan documentation, liaising with the museums, and organising insurance and logistics on the collector’s behalf. Gander & White worked with other agents belonging to the international fine art shipping network ICEFAT to carry out the shipping and installation of works in museums in Australia, Singapore and the UK.

This enabled the collector to realise his personal ambition of having his works exhibited for the public in major retrospective exhibitions globally. He continues to build his collection with the Fine Art Group’s advisory team purchasing emerging artists on the primary market, as well as some established blue-chip artists.

“It is important to me that our partnered service providers uphold the high-quality client service that we offer our clients. Gander & White enabled The Fine Art Group to facilitate every one of our clients’ needs as efficiently and professionally as possible.” – Freya Stewart

To learn more about Gander and White/The Fine Art Group you can subscribe to their newsletter here.

A TANGIBLE ASSET FIDUCIARY PROTECTS COLLECTORS

It was 4:00 am in Houston when my cell phone made that annoying “ping” alerting me to an incoming email. From a dazed and former deep sleep, I reached for my phone and saw that an “advisor” had sent me a painting apparently for sale that he thought I would be interested in for our clients. It had all the trappings of a scary deal: a work of art that was too good to be sending on an email, a price that was too high and did not reflect the market, and a source that I knew was hoping to make some quick money. I deleted the message, as I do every time.

That little email that jolted me from my peaceful sleep got me to thinking about what I wanted to share in the talk I was giving that morning in Houston to a group of highly intelligent business men and women who were interested in buying and selling with intelligence.

Tangible Asset Fiduciary. The term does not exist in the dictionary and you won’t study it when you are becoming an appraiser and certainly not when you are learning the skills as an art advisor. Hundreds of clients look to The Fine Art Group to serve as their tangible asset fiduciary when they decide to monetize their collections. A tangible asset fiduciary is a “fire wall” between the client and the auction house, dealer or art advisor. As a representative of the seller, our client, we ensure that the sale process works and that the work of art is with the best venue and all the steps for a successful sale are being met. Honestly, it is a mistake to try to go it alone when you are selling at auction.

It is imperative that each of the following steps are taken to ensure a good result at auction.

1. Find the right auction house. Kerry Jeffrey, our Director of Consignments, clearly articulated this point in her article on finding the right venue. To find the correct venue our team looks at how many works of art by that artist the auction house has sold successfully in the past. For example, we are currently evaluating the best venue for a significant sporting artist. We want to see how many works have sold in the last four years for this artist at each of the venues we are exploring for sale.

2. Negotiate the terms. It is important to understand that the auction business is expense heavy. Auction houses need to insure the works while in storage, they need to produce expensive catalogues, they need to pay for expensive real estate and they need to pay their expert staff. Therefore, due to the high cost of doing business, they will try to look to the seller to absorb some of those costs. The auction house can charge for photography fees, insurance fees, storage fees, shipping fees, buy in fees, sellers commission, and marketing fees. However, all of these fees can be waived if the collection has value.

3. Understand the nature of the sale. Deciding on the correct auction houses and negotiating the fees is just the first step in ensuring a successful outcome in a sale. Now comes the important part of the negotiation. You do not want your piece to be in a sale which is already top heavy with your artist. In addition, you want to make sure your work is not the last of the five-other works by the same artist.

4. Negotiate the marketing of your collection. If your work is of high quality or value, you should ensure that the work is featured in press, in a predominant place in the catalogue and in the internal auction marketing campaigns. A high price achieved at auction happens if people are aware of your work of art. High exposure is essential.

5. Estimates are the Secret Sauce to a Successful Sale. I know it seems illogical to place estimates that appear to be below the “value” of the work. However, in order for auctions to work you need a minimum of two people to want the work of art. Preferably you want 10 people who want your work and you want them to be bidding on line, standing in the auction room and calling on the phone. If you place lower estimates on the pieces, you have a much better chance at a higher return. The psychology of auction require emotion.

6. Don’t forget the guarantee. If you have a very significant work of art, you may benefit from an auction guarantee. It is not always in your financial interest, but it can provide you with a safety net.

7. Insure your collection when it is in transport. The biggest losses tend to occur when your art work leaves your house and is transported to the auction house. You want to ensure you have a true insurance value on the pieces so that in case of loss you are made whole again with a check that represents the value of the piece. Don’t trust the shippers to have appropriate insurance. If your artworks are currently with a “direct insurer” and you have valuable paintings, jewelry or collectables, consider working with a risk advisor who will place you with the best insurer for your needs. The Fine Art Group can help you find a professional insurance broker.

8. Reserves. The reserve is the lowest number in which you are willing to sell your work. The reserves are not known to the public but should be set as close to the sale date as possible. There is a lot of information that comes into the auction house very close to the sale which will provide insight into buyer interest in the piece. It is important that you make sure your reserve is low enough that an auctioneer has the ability to start low to get people excited about bidding on the piece.

9. Placement in the Auction Show Room. Make sure that when the exhibition is up for viewers of the sale, that your work is displayed in a dominant position in the sale room and has good light.

10. Avoid having the work of art go unsold. An unsold work of art is not good for its resale value. If you abide by the first 9 steps, you should have a successful sale and avoid getting the object back.

Don’t do it alone. Allow your tangible asset fiduciary to bring their expertise to the successful sale of your work of art or collection.

IMPRESSIONIST & MODERN WORKS ON PAPER

Lot 221

Léonard Tsuguharu Foujita (1886-1968)

Les danseuses

signed ‘Foujita’ in Japanese and ‘T. Foujita’ (lower right)

Watercolour and pen and ink on paper

12 7/8 x 18 ¾ in.

1920

Estimate: £50,000-£80,000

Sold: £106,250 (with Buyer’s Premium)

IMPRESSIONIST & MODERN ART DAY SALE

Lot 405

Moïse Kisling (1891-1953)

L’Albergo

signed ‘Kisling’ (lower left)

Oil on canvas

28 7/8 x 21 1/4 in.

1922

Estimate: £50,000– £80,000

Sold: £62,500 (with Buyer’s Premium)

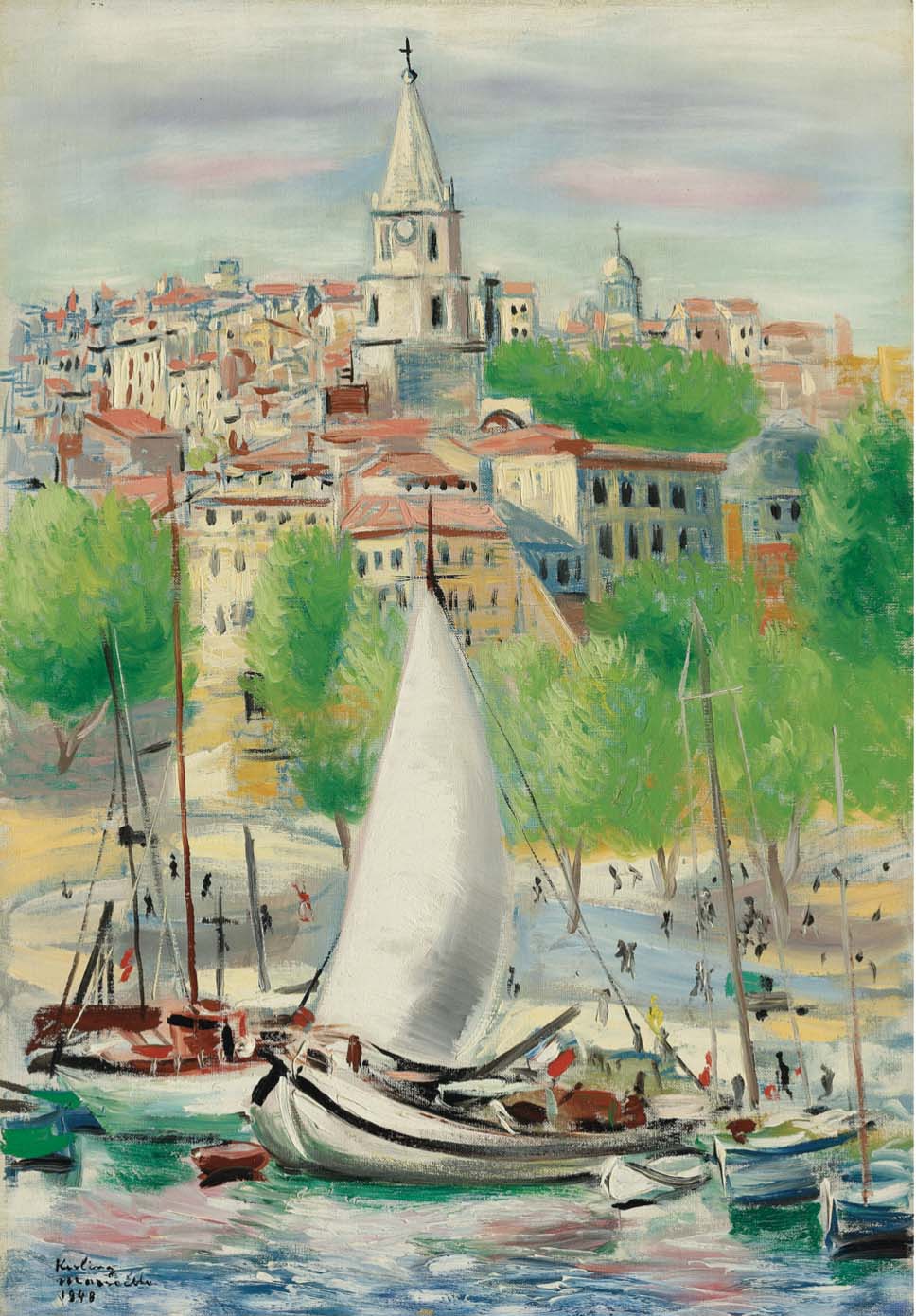

Lot 406

Moïse Kisling (1891-1953)

Marseille

signed, dated and inscribed ‘Kisling Marseille 1948’ (lower left)

Oil on canvas

21 3/4 x 14 7/8 in.

1948

Estimate: £40,000–£60,000

Sold: £75,000 (with Buyer’s Premium)

Lot 412

Marc Chagall (1887-1985)

Enceinte du mur de Jerusalem

stamped with the signature ‘Marc Chagall’ (lower right)

Oil on canvas

15 x 12 1/4 in.

1931

Estimate: £80,000– £100,000

Sold: £162,500 (with Buyer’s Premium)

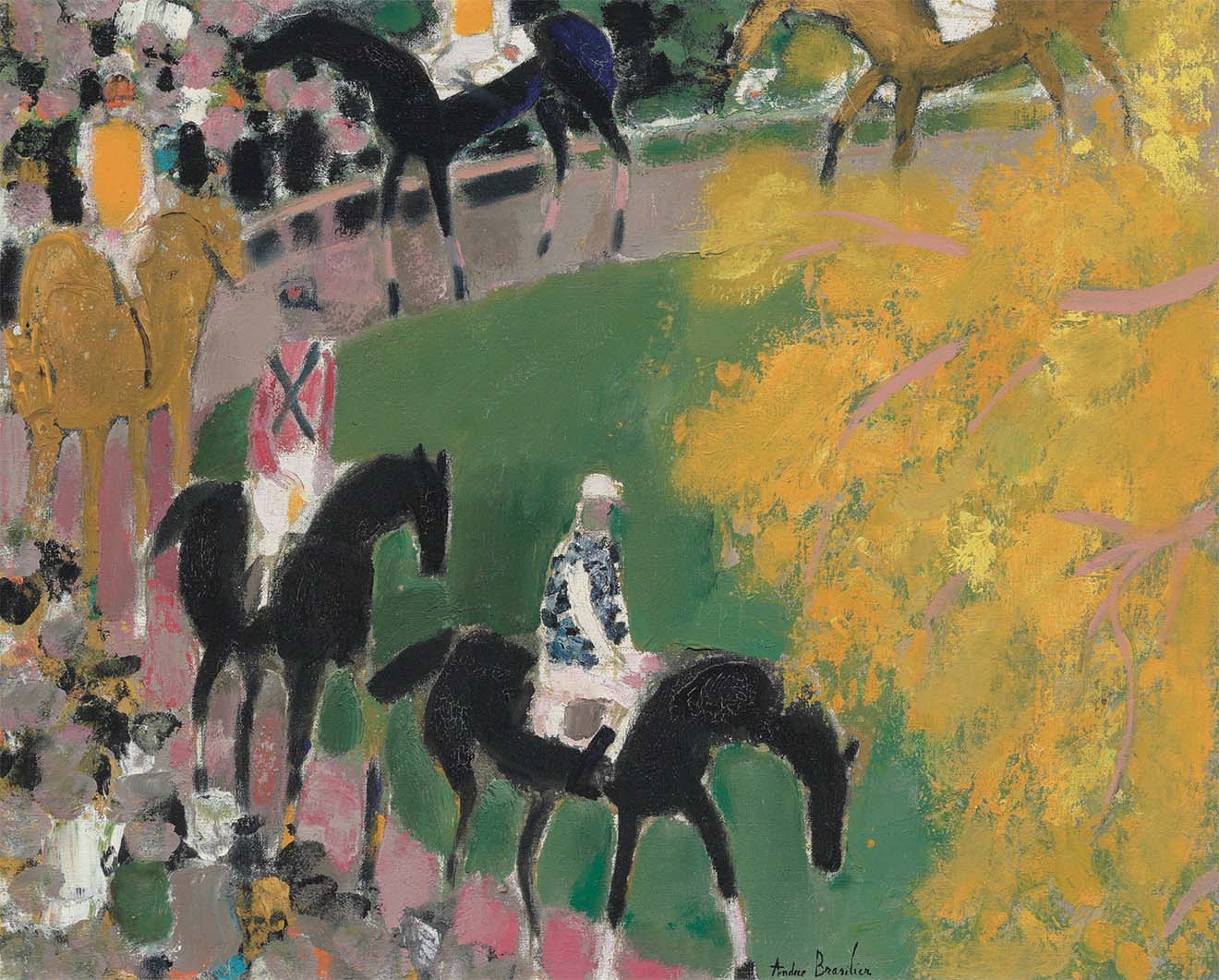

Lot 509

André Brasilier (B. 1929)

Le paddock

signed ‘André Brasilier’ (lower centre)

Oil on canvas

23 3/4 x 28 3/4 in.

1960

Estimate: £35,000–£55,000

Sold: £43,750 (with Buyer’s Premium)

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

UPCOMING EXHIBITION

The UC Berkeley Art Museum and Pacific Film Archive will be exhibiting a recent Hans Hofmann work that The Fine Art Group sold on behalf of a client last year. The work shall be included in the upcoming exhibition Hans Hofmann: The Nature of Abstraction from February 27–July 21, 2019.

Hans Hofmann

Cataclysm (Homage to Howard Putzel)

1945

Oil and casein on board

51 3/4 x 48 in.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

PART IV OF OUR SERIES: ARE YOU A TANGIBLE ASSET FIDUCIARY?

Baby boomers are the wealthiest generation in American history and they’re about to pass down their wealth over the next few decades. A portion of this wealth is in the form of tangible assets that reflect the passions, interests and legacies of the individuals and families who owned them. However, are the heirs interested in acquiring the art, jewelry, wine, furniture and other objects that their parents and grandparents have collected over the years?

Consumer tastes have changed and the younger generation may not be interested in acquiring their parents or grandparents’ treasures. So what can a family do with these objects?

Art and collectibles can have a tremendous amount of value so your client with these types of assets may consider using these items to further their philanthropic interests. Historically most people have donated cash to their favorite charities. Instead of writing checks, some clients may consider converting their tangible assets such as art, jewelry, wine and other valuable collectibles into a philanthropic opportunity. Using tangible assets in a strategic philanthropy initiative presents families with the chance to work collectively to create a unifying legacy.

What is tangible personal property or passion assets?

Tangible gifts of personal property are defined as personal property other than land or buildings. Items that are included in this category are vintage cars, jewelry, artwork, wine, memorabilia, rare books, furniture, stamp and coin collections, and other types of valuable personal objects.

If your client is contemplating a donation of tangible personal property to charity, it is important to be aware of the complex tax issues it can present, which will need to be carefully evaluated by a tax professional in order to maximize your client’s gift and the possible tax deduction.

Below are a few issues to consider:

- Has the client owned the donated object for at least one year?

- Will the donated object be used by the charity in its tax-exempt function (related use)?

- Has the Charity agreed to keep the object for at least three years?

- Is the client a collector or investor? If the client is an artist or dealer, consult a tax advisor to understand the different IRS tax allowable deductions.

- Has the client obtained a qualified appraisal for the donated object?

- What is Related Use?

According to the IRS tax code, in order for a donor of tangible personal property to be able to take full advantage of a tax benefit, the charity must use the object in a manner that is related to its exempt purpose. Examples would be a painting that is added to the collection of an art museum and a tall case clock created by a regional clock maker given to a historical society.

CASE STUDY #1

A client has owned a painting for the past 12 years that was originally purchased for $50,000. The client has three heirs of whom none are interested in the painting. The Fine Art Group recommended that the client approach an art museum that is very interested in accepting the painting as a donation. In addition, the painting has appreciated over time and has a current fair market value of $125,000. Since the art museum is planning to keep the painting, the donor should be able to deduct the full $125,000 value of the painting.

If the donor wants to give the same painting to an unrelated charitable organization, the client should consult with their tax advisor. The client may only be able to deduct the $50,000 cost basis. It is the donor’s responsibility to establish “related use,” so the donor should secure from the charity a letter stating the charity’s intent to use the property for a purpose related to its mission.

However a gift of artwork doesn’t necessarily have to be given to a museum to be considered for a related use. For example, gifts of artworks to a religious organization could be considered for a related use if the object would have religious and cultural significance. Similarly, gifts of artworks to a hospital may be for a related use if their display in common and patient rooms contributes to a healing environment.

When is an appraisal needed?

Contributions of art, jewelry, wine and other tangible assets worth more than $5,000 require the donor to obtain a qualified appraisal from a “qualified” appraiser. The qualified appraiser must be independent of the donor (the appraiser can’t be anyone related to the donor nor have been involved with a former sales transaction with the donor) For instance, if a client purchased a rare historical document from an auction house with the intent to eventually donate the item to a museum, then the donation appraisal can not be completed by the auction house where the object was purchased.

Once the appraisal is completed, the IRS Form 8283 must be completed and filed with the donor’s income tax return. This form includes a summary of the appraisal, signature of the appraiser, a signature of the charity and a statement from the appraiser that he/she is qualified to complete the valuation. Any item valued for fair market in excess of $50,000 is automatically referred to the Art Advisory Panel for review.

What are other philanthropic options for tangible assets?

Charitable giving has never only been motivated by tax deductions. Even without the full tax advantage, clients still consider donating to passionate causes by converting their valuable objects into liquidity for a cause they really believe in.

For example, a wine collector may want to sell 800 bottles of wine from the collection that had been assembled over three decades and allocate the proceeds to a charity that the collector supports.

CASE STUDY #2

Mr. and Mrs. Jones collected contemporary art, Tiffany lamps, rare books and antique coins. Their four children and the seven grandchildren were not interested in inheriting any of these items. However when Mrs. Jones fell ill, the multigenerational family wanted to create a legacy in her honor. The family decided to monetize the collections and create a scholarship fund in Mrs. Jones name at her alma mater. The family worked with a Tangible Asset Fiduciary, such as The Fine Art Group to negotiate the costs associated with monetization process and to determine the best venue for sale for each of the asset class.

There are many advantages that come with the use of a planned giving vehicle. Nevertheless, should a client decide to donate tangible objects to an institution, donor-advised fund, opportunity zone or foundation, a tax specialist should be consulted to determine the best option.

In conclusion, the field of strategic philanthropy is more sophisticated and complex than ever. More individuals are implementing a philanthropic strategy using collections of wine, art, jewelry and other tangible assets to help make a greater impact in the lives of others. Anyone that regularly writes checks to their favorite organizations and causes can develop a more strategic approach to giving by considering using tangible assets. Nonetheless, the philanthropic process involving these objects begins with understanding what your client owns and understanding the value.

OUR SERVICES

Whether you are an individual, family, foundation, or non-profit organization, The Fine Art Group can help make your charitable vision a reality.

MASTER PAINTINGS EVENING SALE

Our Advisory team sells 3 works from one client’s collection. All were a part of the single owner sale, The Gilded Age Revisited: Property from a Distinguished American Collection.

All shining examples of the tangible benefit to working with an advisor who places work appropriately in the marketplace and creates tailored marketing around a collection to ensure the best possible outcome at sale.

Lot 52

Angelika Kauffmann, R.A

Portrait of Three Children, Almost Certainly Lady Georgiana Spencer, Later Dutchess of Devonshire, Lady nenrietta Spencer and George Viscount Althorp

Estimate: $600,000–$800,000

*Sold: $915,000 (world record setting sale)

Lot 69

Claude-Joseph Vernet

A Mediterranean Port at Sunset, with a Fisherman in the Foreground and a Couple at Left Walking Along the Rocky Coast

Estimate: $300,000–$500,000

Sold: $639,000

Lot 68

Jan Brueghel the Elder

A Wooded Landscape with Peasants Crossing the River

Estimate: $500,000–$700,000

Sold: $555,000

RÉGENCE STYLE GILT-BRONZE-MOUNTED EBONIZED CENTER TABLE

Estimate: $4,000-$6,000

Sold: $24,000

Lot 780

Eugen Von Blaas

A Maiden with a Basket of Roses

Oil on panel

Estimate: $200,000-$300,000

Sold: $500,000

Lot 771

William Bouguereau

Pâquerettes

Oil on canvas

Estimate: $$00,000-600,000

Sold: $960,000

Lot 753

Louis XV Ormolu Cartel Clock

Estimate: $10,000-$15,000

Sold: $42,000

19th CENTURY EUROPEAN ART

Lot 411

Virginie Demont-Breton

Femme de Pêcheur Venant de Baigner Ses Enfants

Estimate: $100,000–$150,000

Sold: $543,000 (world record setting sale)

Virginie Demont-Breton Auction History

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

THE FINE ART GROUP: LEADING ART FINANCE PROVIDER

With the acquisition of Falcon Fine Art’s art-secured loan book, The Fine Art Group further cements its position as a leading art finance provider. It marks the first significant consolidation of specialist art lenders in a maturing and growing art financing market.

“We are delighted with the acquisition of Falcon Fine Art. This inaugural art-financing business consolidation strengthens our long-term commitment to being the leading art finance provider to collectors and owners of high value art globally. This is an exciting time for our business as demand for our art financing product increases – we look forward to continuing to deliver the best art lending service to our clients.”

– Freya Stewart, CEO of The Fine Art Group’s Art Lending business

The Fine Art Group founded its art-secured lending practice three years ago to provide specialist art-secured financing to collectors and owners of high-quality art and jewelry, under the leadership of Freya Stewart. Having established a strong track record in the art lending space, with a commitment to provide financial solutions for a growing global client base, The Fine Art Group was the natural buyer for Falcon Fine Art.

Kamel Alzarka, the Chairman of Falcon Group, said: “This sale makes perfect sense, as we continue to focus on the growth and expansion of our core business, providing solutions for our large corporate clients.”