Demystifying NFT’s: A Conversation with Vladislav Ginzburg, Founder and CEO of Blockparty

THURSDAY, MARCH 25, 2021 – 1PM EST / 10AM PST

With Christie’s monumental sale of Beeple’s The First 5000 Days – the market is abuzz with questions regarding NFT ownership. Tune in to The Fine Art Group’s exclusive conversation with the Founder and CEO of Blockparty, Vladislav Ginzburg about the future of NFT’s, the digital art movement and his views of their enormous market potential.

QUESTIONS TO CONSIDER

– What exactly does fungible mean?

– How do you secure a digital signature?

– How is ownership saved on blockchain ledgers?

– Are NFT’s a speculative bubble or a new funding model for art and entertainment?

ABOUT GINZBURG & BLOCKPARTY

Ginzburg leads the company’s building of a blockchain-agnostic platform for collectible NFTs among the art, music and sports genres. Blockparty launched their MVP in August 2020 with a number of mainstream oriented drops, including first digital artworks by Ryan Keeley, Harif Guzman and MadSteez, the first 3lau/Slime Sunday drop, Adventure Club, and others. The platform is re-releasing in March with an integration to mint onto the FLOW blockchain. Earlier, Ginzburg was Chief

Further Reading

- The Scoop: The Next Generation Collector #14

- Reintroducing The Scoop: The Next Generation Collector

- The Scoop: A Bi-Weekly NFT & Digital Art Newsletter #12

“A lot of our clients are entrepreneurs, and they use leverage across their businesses and personally,” said Freya Stewart, CEO of art finance at The Fine Art Group. “They have a lot of valuable capital tied up in their art collections and they want to release that capital for other uses.”

Following a surge in loan requests due to the pandemic, Freya Stewart discusses the appeals of leverage to entrepreneurial collectors who are using their artworks as both loan collateral and an investment product.

To read more of Freya’s comments in this CNBC article, please click here.

Debunking Common Appraisal Myths

Read article published by Mary Pontillo, “Tips for Obtaining a Fine Art/Collectibles Appraisal”.

Pontillo’s article covers basics of the process like cost of appraisal, Appraiser certifications, and the information your appraisal should include.

Check out the article here on the LinkedIn.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

Further Reading

- El Niño 2023: Are Your Art & Collectibles Protected?

- Watch Art, Cars & Collectibles: How to Mitigate Risk Before a Disaster Hits

- Why Appraising Valuables is Important & How to Find a Qualified Appraiser

The Fine Art Group are proud to announce that our Founder & CEO Philip Hoffman has been selected as a Top Recommended Art Adviser in the 2020 edition of Spear’s 500.

As a leading wealth management authority, their annual publication is an essential guide to the market’s best private client advisers, and we are thrilled to be recommended to their UHNW and financial services community.

To learn more about Philip Hoffman and The Fine Art Group in the 2020 Spear’s 500 rankings, please click here.

Value of Advice: Wealth Transfer Strategies for Art & other Passion Assets

THURSDAY, FEBRUARY 11, 2021 – 2PM EST / 11AM PST

Wealth transference and tax strategy is a hot topic of conversation in 2021 particularly when discussing passion assets such as art, jewelry, wine, cars and other valuable collections.

Please join us for a webinar discussing these issues and others related to wealth preservation and tax efficient strategies.

QUESTIONS TO CONSIDER

- Should passion assets be transferred in an LLC or a trust?

- If the collector has philanthropic objectives, should a charitable trust be created or should the object(s) be donated directly to an institution?

- When is a rental leaseback situation preferred? What are the rules governing fractional gifts of art?

- Can passion assets be discounted? If so, when does this occur? When and how do you transfer passion assets out of your name?

EVENT DATE

- Thursday, February 11, 2021 – 2pm EST / 11am PST

EVENT LENGTH

- 1 hour

FORMAT

- Live interactive webinar

“Gathering people together at art fairs created so many discussions and opportunities. We need that oxygen.”

Following the news that Art Basel is to be postponed once again, Managing Director Guy Jennings discusses the recent absence of art fairs and the snowball effect this has on gallerists and auction houses.

To read more of Guy’s comments on this piece by The New York Times, please click here.

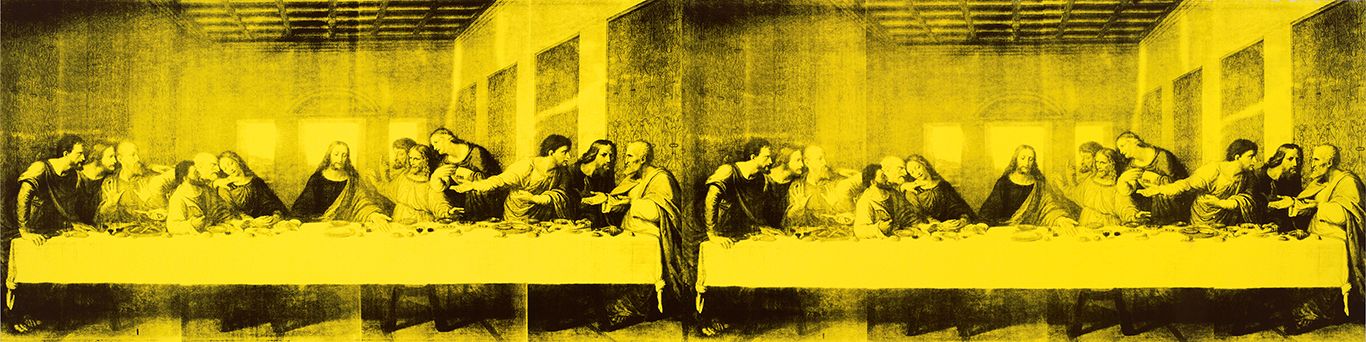

The art trade on both sides of the Atlantic has been abuzz with sales from permanent collections at public institutions, otherwise known as deaccessioning. Most prominent in the recent debate about associated ethics is the Baltimore Museum of Art (BMA). The institution offered major works – by Brice Marden (3, 1987 – 88), Clyfford Still (1957-G, 1957) and Andy Warhol (The Last Supper, 1986) – for sale at Sotheby’s in October 2020 with a combined estimate of 65 million USD. Just hours before the Marden and Still paintings were due to hit the block (the Warhol was to be offered privately), the museum withdrew both from the auction in response to a growing maelstrom of negative criticism, internal and external.

The BMA was technically operating within the bounds of newly loosened regulation from the Association of Art Museum Directors (AAMD) in America: a targeted, finite response to the ongoing pandemic which has, to all extents and purposes, obliterated gate receipts from museum balance sheets. Funds from the sale would be directed towards ongoing running costs (even though the museum was not in financial distress), ‘care of the collection’ and, crucially, new acquisitions to diversify the collection of a major museum rooted in a city with a 65% black population. The museum director had even secured public consensus from the executive director of the AAMD before proceeding with the proposed deaccessions.

Operating within the rules, with admirable objectives, the plan was still deemed controversial enough to attract bitter criticism from all sectors of the art world and, further, controversial enough to spook the institution into withdrawing the works from public sale. Why?

Long seen as one of the unassailable taboos in the UK museum sector, and generally handled with judicious caution in America, two key factors have contributed to a temporary loosening of the strict ethical codes surrounding the practice. The first is the decimation of visitor numbers to museums due to the global pandemic. The second is a growing sense of urgency, especially in American cities with black majority populations, to develop public collections which reflect the diversity of society at large.

Permanent collections housed by museums, often accumulated over decades or even centuries through a patchwork of philanthropic gifts, bequests or acquisitions, are generally intended to be just that. Caroline Douglas, Director of the Contemporary Art Society (CAS), an organisation that acquires work on behalf of their partner museums in the UK, explains: ‘Museums are the forever proposition – that’s why artists want to be in them.’ Gifts to museums, whether from an individual or an organisation such as the CAS, are usually given with the explicit proviso that such works must remain part of the collection in perpetuity.

In both America and the UK, professional membership organisations publish guidelines of best practice for their member institutions. While rules vary, there are a few broad points of consensus. Until the global pandemic, one of the most common restrictions was that works could not be sold to keep the lights on. Deaccessions – sales from the permanent collections – might be allowed where works fell outside an institution’s ‘core collection’ and with the rigorously enforced purpose of funding new acquisitions. In other words, funds raised must be reinvested back into the collection.

There is subsequently a dual aspect to the question of deaccessions: why is the work being sold? And what will the funds be spent on? Having a defensible answer for one part of this equation isn’t enough. Institutions must make a clear case for the acceptability of a sale, and there are subsequent restrictions – both written and unwritten – pertaining to the use of sale proceeds.

The risk of eroding donor confidence in the entire museum sector underpins much of the regulation at play. Not only are museums usually charities or non-profits with beneficial tax codes, they are also typically built on the generosity of private citizens and the state. Selling works from the collection – given on the explicit or implied understanding that they would remain the collection forever – is therefore seen as a grave betrayal of the trust placed in them by donors. It subsequently threatens to dismantle faith in the very mechanisms and structures which maintain museums as viable economic entities in the first place.

There is another great risk with museum deaccessions. Tastes change, fashions come and go. The world evolves. While some artists may appear utterly irrelevant to the present moment, they may come to be seen as pivotal by later generations. And what might appear frivolous and inconsequential in one historical era might be understood as prescient and vital by museum audiences of the next. There also remains – most pertinently in the case of the BMA, but generally for museums in Western Europe and America – the question of representation and the art historical canon.

It’s clear to today’s audiences that the ‘approved’ art historical account of the post-colonial age needs expansion, revision and rewriting. But it’s also impossible for anyone to know what the cultural consciousness of the future might deem important. The mission of the museum is, therefore, inherently conservative: to hold, intact, collections intended for the public good. The prevailing taste which forms a public collection is likewise, in and of itself, a historical artefact.

Similarly, selling the work of living artists can have a profoundly negative impact on their market and career trajectory. While museum acquisitions are the gold standard of validation for an artist, sale of their work from a museum, logically, can have the opposite effect. Essentially suggesting that an artist is, in the eyes of the museum (the custodians and narrators of art history) no longer of consequence. To make such a dramatic, public and negative statement about an artist’s work goes entirely contrary to what is widely understood as the Hippocratic Oath of museums vis-à-vis the wellbeing of the artistic community it serves.

2020 has shown everyone – inside and outside the art world – that systems, structures and rules that previously seemed immutable are in fact entirely contingent. Many public institutions have survived this year with furlough schemes, goodwill and inventive short term strategies. But they can’t live on vapours alone. The Victoria & Albert Museum, for example, received 15% of its usual traffic in August. Such precipitous drops in visitor numbers are untenable. Museums need donations yes, but most importantly they need an audience, gate receipts, successful gift shops and humming cafes. Another long stretch into 2021 without this revenue will bring financial distress, just as public borrowing hits record highs in the UK and the glamourous social events which generously lubricate the cogs of private philanthropy remain strictly off limits. We can therefore only foresee more – not less – works coming to market from the museum sector next year. Outcry or no outcry, reality must bite sooner or later. The debate continues.

Image 1: Image credit Sotheby’s; Image 2: Image credit Baltimore Museum of Art; Image 3: Image credit Amir Hamja/Bloomberg via Getty Images; Image 4: Image credit Katherine Hardy/The Art Newspaper; Image 5: Image credit Baltimore Museum of Art

Further Reading

- Collection Management

- When the Kids Don’t Want it: Converting Your Passion Assets into Charitable Impact

Managing the Legacy of the High-Profile Client

THURSDAY, JANUARY 7, 10AM PST / 1PM EST

Whether a client is a major sports figure, a celebrity, a politician or a founder of a notable company, it is inevitable that over their lifetime he or she will accumulate objects and documents of significance.

This webinar will focus on developing a strategy for managing their legacies and archives.

TOPICS DISCUSSED

- How do you value and manage archival material associated with

a high profile client? - Are there tax opportunities and strategies what would benefit a high profile client’s legacy?

- How do you develop a long term collections management strategy for the memorabilia and archival materials associated with the high profile client?

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

Further Reading

- High-Profile Client Collections & Sudden Wealth Syndrome

- Helping the High-Profile Client Buy & Sell Smart

- Helping the High-Profile Client Buy Luxury Assets

THE LURE OF THE LUXURY ASSET: HELPING THE HIGH-PROFILE CLIENT BUY LUXURY ASSETS WITH INTELLIGENCE

THURSDAY, DECEMBER 17, 2021 – 10AM PST / 1PM EST

Whether it is buying sports or rock memorabilia, collecting fine wines, investing in collector cars, or acquiring artworks for the home, there are rules for acquiring tangible assets intelligently.

The Fine Art Group is pleased to bring together an expert panel in Part 2 of our latest webinar series. It will provide insight into these markets and collecting categories.

*Calendar invites will be sent to registrants emails.

TOPICS DISCUSSED

- What specific attributes make the piece valuable?

- What is the best venue for acquisition?

- What is the best process for acquisition?

- When is it time to sell, where do you go and what do you do?

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

Further Reading

- High-Profile Client Collections & Sudden Wealth Syndrome

- Helping the High-Profile Client Buy & Sell Smart

- Helping the High-Profile Client Buy Luxury Assets

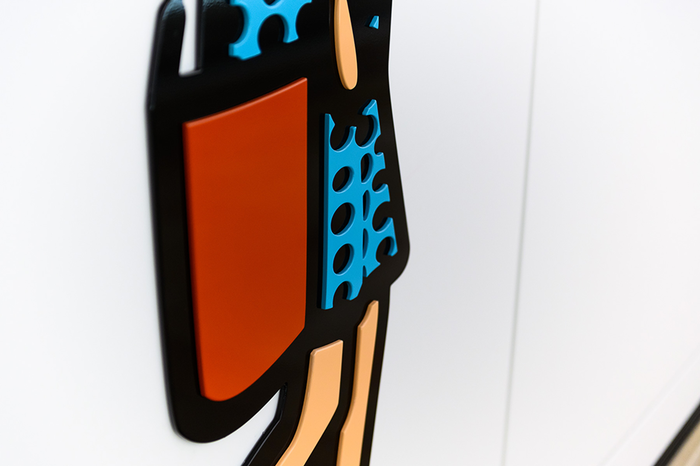

JULIAN OPIE SITE-SPECIFIC COMMISSIONS

The Fine Art Group is delighted to announce the completion of two major new, site-specific commissions by Julian Opie for Swire Properties in Hong Kong.

Parade. (2020) depicts sixty-two colourful and dynamic characters from all walks of life as they go about their daily business. The multi-layered and dimensional metal figures are finished in glossy varnish, accompanying passers-by in their journey through the pedestrian link between the Mall, Three Pacific Place and Starstreet Precinct.

Located along the walkway between the Island Shangri-La, Hong Kong and Conrad Hong Kong, Running 3. (2020) occupies a dramatic position along a prominent raised walkway. Conceived as a continuous frieze of thirteen life-sized figures in black vinyl, Running 3. embodies the dynamic of central Hong Kong.

Opie’s distinctive formal language is instantly recognisable and reflects his artistic preoccupation with the idea of representation and the means by which images are perceived and understood. Always exploring different techniques both contemporary and ancient, Opie plays with ways of seeing through reinterpreting the vocabulary of everyday life; his reductive style evokes both a visual and spatial experience of the world around us. Drawing influence from classical portraiture, Egyptian hieroglyphs and Japanese woodblock prints, as well as public signage, information boards and traffic signs, the artist connects the clean visual language of modern life with the fundamentals of art history.

The artist has commented on observing busy city crowds:

“A constant flow in both directions. Each person a mass of decisions and style and attributes with a destination and only a fleeting moment in front of me but combined, they create a constant flowing crowd. Each random person would be great to draw, better than I could ever invent.

I draw using a graphic program that allows me to bend thick lines over the photograph and fill the gaps with flat colour. A gang of characters emerges, caught in mid stride, going about their business with bags or phones or cold drinks. Their random, momentary decisions became frozen into a set piece, a logo and symbol drawn in the most emphatic and generalised way I could manage while sticking to the details of what I saw. Symbols and hieroglyphs, images and road signs perform similar tasks of turning objects and people into a language that is specific enough to describe but general enough to be read. These words can be combined to form sentences just as the people combine to form crowds. Walkways and pavements turn pedestrians into lines of text, read left to right.”

The series of figures, created for Pacific Place by British artist Julian Opie, is the latest addition to Swire Properties’ permanent art collection, as part of the Company’s long-time support of the arts and place-making. Inspired by and designed to engage with its community – the workers, shoppers of Pacific Place and people of Hong Kong Parade. and Running 3. is a noteworthy highlight for the Pacific Place community and beyond.

Find out more about the project here.

Visit www.julianopie.com to find out more about the artist and his works.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Image 1: Image courtesy Julian Opie; Image 2: Image courtesy Pacific Place; Image 3: Image courtesy Julian Opie; Image 4: Image courtesy Pacific Place; Image 5: Image courtesy Julian Opie