In this article, we look at the importance of legal and valuation advice in connection with the acquisition, ownership, and disposal of art and other valuable chattels by sale, gift, or estate tax planning.

THE ART MARKET

Two things are certain about the art market. The first is that art buyers and collectors are increasingly acquiring art and collectibles from an investment viewpoint.

The second is the increasingly heard complaint that the art market is not properly regulated, leading to a lack of transparency and access to authoritative sources of advice.

ART BUYERS & COLLECTORS

The 2015 European Art Fair Report (TEFAF), considered to be the authority on auctions, art fairs, and market trends, recorded the highest ever total value for sales in the art market in 2014. It reckoned the global art market totalled more than €51 billion ($53.9 billion U.S.), surpassing the annual sales figure for the 2007 pre-recession high of €48 billion ($51 billion).

The Report noted that the most popular acquisition in 2014 of the High Net Worth Individual was jewelry, gems and watches (29%), while antiques and collectibles ranked second (21%) with art representing 17% of sales.

The British art market, which accounts for 22% of the global market, is highly regulated, both at an EU and national level.

As at February 2015, it was estimated that there were 167 applicable laws and regulations affecting the market, including the Artist’s Resale Right Regulations, the Dealing in Cultural Objects (Offenses) Act, regulations under the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES), and the Auctions (Bidding Agreements) Act, to name but a few.

However, there are a number of significant issues that are specific to the art market, which still require addressing:

- no industry regulator

- conflicts of interest giving rise to confusion over commission charges

- lack of transparency over true ownership which can create title issues

- distortion of competition which can arise from auction house guarantees or similar activities and which can amount to insider dealing

- third party valuation and appraisal is not regulated in the UK and many other countries

Other related issues are money laundering, tax evasion, corruption and fraud.

Improvements could be made by more effective enforcement of existing regulations, particularly in the areas of competition and criminal law. An important contribution too can be made by the purchaser, who is always better advised to deal with members of appropriate professional organizations.

The same caveat should apply when seeking professional valuation or sales advice. Advice by an independent third-party professional adviser can provide both assurances as well as help achieve the most satisfactory financial outcome. While membership of a professional body is not an absolute guarantee of competence and honesty, it goes some way to establish credentials and may be helpful if something goes wrong.

THE ROLE OF THE LAWYER

In the context of owning, acquiring or disposing of art, there are three areas where a lawyer may be required to contribute.

REGULATION OF GENERAL APPLICATION

The first is the purchase or sale of a work of art (or jewelry, cars, guns, antique furniture), is subject to the usual range of property transaction legislation, such as that regulating the sale of goods, consumer contract, trade description, intellectual property, etc.

There could be a number of circumstances where it would be advisable for a lawyer to draft or review any contractual arrangements prior to purchase or disposal. It may also be advisable to have other ownership arrangement checked, such as contracts for transport, insurance or agreements for loans to museums or exhibitions.

ART SPECIFIC REGULATION

Secondly, there is a range of art-specific legislation where legal advice would be highly advisable. Examples of this are the already mentioned CITES regulations to prevent international trade from threatening species.

Appropriate exemption certificates may have to be obtained even when the purposes of transport are not for sale. There is a lot of uncertainty in the application of CITES regulations and seeking legal advice may forestall trouble or seizure of valued items.

Another trap for the uninitiated and where legal guidance may be important is in connection with the Artist’s Resale Right known as ‘Droit de Suite’.

‘Droit de Suite’ is a royalty payable to a qualifying artist or the artist’s heirs each time a work is re-sold during the artist’s lifetime and for a period up to 70 years following the artist’s death, sellers need to be aware of this and should seek legal advice if it is an issue.

A new British copyright law comes into effect in 2020, which will restrict design rights on mass-produced items to 25 years. This may threaten the viability of museums, publishers and art-related businesses to work with artists and estates on reproduction rights. The changes are retroactive; meaning some cases where image rights have expired will be revived and the new legislation will make copyright breach a criminal, rather than a civil offense.

TAX RELATED ASPECTS

Artwork has become an important aspect of estate planning and administration because it can affect the estate’s overall value, resulting in substantial estate or inheritance taxes

The freeze of the Nil Rate Band has contributed to a significant rise in the total of IHT revenue for HMRC with rising house prices, asset prices and inflation, pushing more estates into IHT.

Legal advice should be sought on various steps to reduce an unnecessary tax including:

- lifetime gifts

- gifts with reservation of benefit

- Chattel Rental Schemes

- acceptance in lieu of IHT

- The Cultural Gifts Scheme

- Private treaty sales of a heritage item to a national museum or gallery.

Trusts, or alternatives such as a family investment company or family general partnership, often play an important part in preserving chattels from generation to generation and clearly the setting up of such an arrangement is the province of the lawyer. Again continuing legal advice during the lifetime of the trust will be important.

THE ROLE OF THE VALUER

Being aware of the correct and current values of art, jewelry and other valuable objects is of critical importance.

To meet the required criteria, a specialist valuer will be essential in setting out the arguments for the transfer of an object under an acceptance in lieu arrangement, the Cultural Gift Scheme or through sale by private treaty.

The valuer’s knowledge of market values will assist the lawyer in guiding trustees over assessing tax liabilities or on the disposal of assets for diversification purposes or raising income to meet anticipated tax liabilities.

Advice from an experienced, established and independent valuation business can offer confidence in the acquisition of new works or the sale of items.

Such assistance could also include negotiating auction house or gallery commission rates or arranging sale by private treaty.

Valuation and art advice services are the “glue” that connects the professional advice offered by lawyers, accountants, and wealth managers and the art professionals.

OUR SERVICES

Understanding value is the cornerstone to effectively managing a collection – and at The Fine Art Group, it is this understanding that enables us to work as trusted fiduciaries for our clients, and their objects. We are experienced providing appraisals for a wide range of purposes, and are also specialists in unique and complicated appraisal scenarios.

Andrew Wyeth’s ‘The Lobster Man’ sold for $103,000 at Freeman’s of Philadelphia in June 2011. Wyeth produced the watercolour of a fisherman clutching his steaming thermos at the behest of the American Artists in New York, with a view to it being used for a Maxwell House Coffee advert. The painting never made it to the billboards and a descendent of our client had acquired it directly from the artist in the 1940s. The work of Wyeth, one of the most revered US artists of the last century, has consistently achieved good results at auction.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

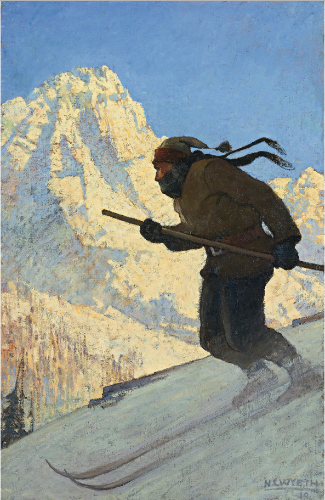

On our advice, ‘The Skier’ (The Ski Runner) by N.C. Wyeth (1882-1945), was consigned for sale at Sotheby’s New York in November 2014 where it sold for $1,205,000.

This much-exhibited picture – illustrated on the cover of the February 1911 edition of The Popular Magazine – had previously been owned by both the artist’s wife and his daughter. It is thought this painting was based on photographs of the artist’s brother Stimson (known as Babe).

“I have just completed, and shipped, on the same train with Babe,” Wyeth wrote, “a cover for the Popular. The most striking and strongest I have done in a long time. The Ski Runner is its title.” It had been bought by our client from a Pennsylvania family in 1998.

N.C. Wyeth

The Skier

Oil on canvas

41 5/8 by 27 1/8 in.

Estimate: $250,000-$350,000

Sold: $1,205,000

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

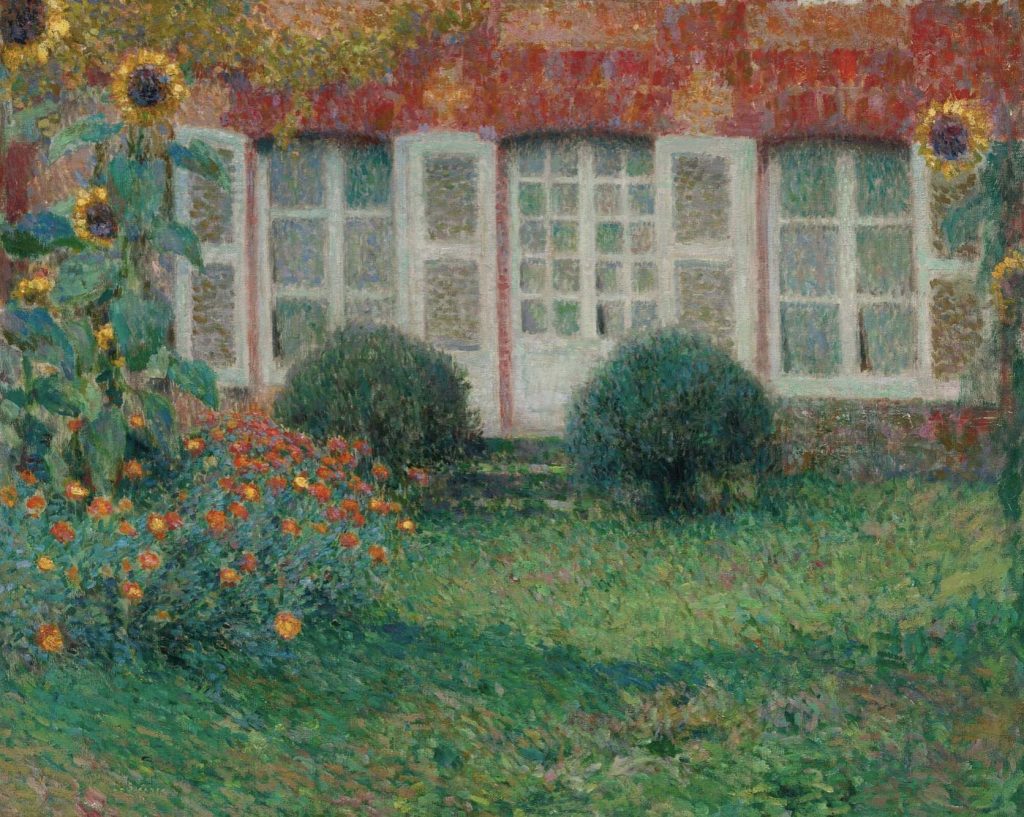

Sotheby’s sells Les Soleils by Henri Le Sidaner (1862–1939) on behalf of a client on November 5, 2015.

Henry Le Sidaner (1862-1839)

Les Soleils

Signed Le Sidaner (lower left)

Oil on canvas

26 by 31 7/8 in.

1909

Estimate: $300,000-$500,000

Sold: $370,000

PROVENANCE

Sale: Christie’s, London, June 28, 1988, lot 157

Sale: Christie’s, New York, May 9, 2000, lot 159

Private Collection

Acquired from the above

EXHIBITED

Paris, Galeries Georges Petit, Société nouvelle, 1909, no. 81

Estimate $300,000 — 500,000 USD

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Alexander Calder

Dissolving Spiral

Gouache and ink on paper

26 5/8 by 40 1/8 in.

1963

Estimate: $25,000-$35,000

Sold: $100,000 (Hammer with Buyer’s Premium)

PROVENANCE

Perls Galleries, New York

Winifred Breuning, New York

Acquired by the present owner from the above

NOTE

Executed in 1963, this work is registered in the archives of the Calder Foundation, New York, under application number A07462.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

With deep rounded sides rising to a flared rim, this stembowl is supported on a tall slightly spreading hollow foot, decorated in anhua on the interior with a ruyi in the center and a offers a pair of dragons chasing a ‘flaming pearl’ around the sides. The exterior is plain and covered overall with an even creamy-white glaze.

Christie’s

Sale 2872

Lot 814

White-Glazed Ming Dynasty Stem Bowl

Ming Dynasty, Early 15th Century

Height: 4 3/4 in.

Estimate: $20,000-$30,000

Sold: $87,500

PROVENANCE

Christie’s New York, 23rd March 1995, lot 94.

Sotheby’s Hong Kong, 29th October 2001, lot 560.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Prices for the best untreated coloured gemstones have been exceptionally strong this year. Consigned for sale in New York on behalf of a client from Baltimore, this platinum, gold, fancy vivid yellow diamond and diamond ring with a central stone weighing 7.35 carats, sold for $281,000 (Hammer Price with Buyer’s Premium).

Estimate $200,000-300,000

Sold: $281,000 (Hammer with Buyer’s Premium)

RELATED CONTENT

- Selling Jewelry & Watch Collections

- Watch TFG’s New York Luxury Week 2023 Webinar

- Sales Agency Services: Maximizing Value and Efficiency through Comprehensive Sales Strategies

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

CARTIER’S TEMPLE BROOCHES

Cartier’s temple brooches, first introduced at the famed Exposition Internationale des Arts Décoratifs et Industriels Modernes in 1925, rank among the firm’s most iconic designs.

This platinum and diamond example was sold for the benefit of our client, the Carbaugh Family Charitable Lead Trust, established by Charlotte and Miller in the spirit of philanthropy they so admired in their mother.

“The giving and receiving of jewellery creates a special memory and is a blessing,” explains Miller, “Our hope is that the Trust will also act as a blessing, reaching out to the needs of our communities and beyond.”

Of architectural inspiration, the temple’s dome set with a half moon-shaped diamond weighing approximately .75 carat is accented by trapezoidal- shaped diamonds weighing approximately 1.40 carats and baguette diamonds weighing approximately 2.10 carats. It is further decorated with smaller variously-cut diamonds weighing approximately .90 carat, and signed Cartier, Made in France, numbered 02577 and 7569, with French assay and partial maker’s marks; circa 1930.

The diminutive size of Cartier’s temple brooches —sweetly at odds with the structures they represent—accentuates their exquisite construction, rendered meticulously and exclusively in diamonds and platinum. The brooches take on a variety of configurations within the relatively strict codex of the temple form, from Japanese pagodas to neo-classical temples d’amour, to the occasional Taj Mahal. Each example invited the designer to challenge the gem-cutter who, in turn, entrusted the gem- setter to assemble these petits tours de force of jewellery making. The form also lent itself perfectly to the incorporation of one of Cartier’s greatest innovations, the baguette cut, introduced in 1912. These small diamond rectangles created the columns and capitals that support the brooch’s superstructure: rhomboid lintels leading to half- moon domes terminating in lozenge-shaped finials. By the 1930s, this battery of cutting styles became a cornerstone of contemporary jewellery design, making the temple brooch a miniature codex for the Art Deco period.

Sold at Sotheby’s New York in December 2013, it made $100,000 – a record sum for a jewel of this type.

FURTHER READING

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory, Sales Agency, and Philanthropic Strategy teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

A fine Chinese chalcedony snuff bottle with carved cameos of an elderly man and child mounted with a pink tourmaline lid was attributed to the school of Zhiting in the Suzhou region of China. From the collection of the late Mrs. John Dilks of Philadelphia, it was acquired from prestigious London snuff bottle dealer Robert Hall. The quality of the carving, the attribution, as well as the provenance of being vetted by a dealer such as Robert Hall led to the strong sales result of $31,250, five times the auction estimate.

Suzhou, School of Zhiting,

18th/19th Century

Height with lid: 2 3/4 in.

Estimate: $5,000-$8,000

Sold: $31,250

PROVENANCE

Property of the late Mrs. John Dilks of Philadelphia, originally purchased from Robert Hall of London

RELATED CONTENT

- Selling Jewelry & Watch Collections

- 10 Reasons to Work with an Advisor for a Successful Sales Process

- Visit The Fine Art Group’s Webinar Library

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Wolfgang Paalen (1907-1959)

Les Cosmogenes

signed lower right

Oil on canvas

96 x 93 in.

1944

PROVENANCE

Robert Anthoine, New York

EXHIBITED

Mexico City, Galería de Arte Mexicano, Wolfgang Paalen, February 22-March 3, 1945

New York, Art of This Century, Wolfgang Paalen, April 17-May 12, 1945

San Francisco, San Francisco Museum of Modern Art, Dynaton, 1951

Mexico City, Museo de Arte Moderno, INBA, Homenaje a Wolfgang Paalen, el precursor, 1967, p. 48, illustrated

Paris, Galerie Viland et Galanis, Domaine de Paalen, 1970, no. 11

Basel, Galerie Schreiner, Creation: Wolfgang Paalen und Gordon Onslow Ford, 1978

Los Angeles, Los Angeles County Museum of Art, The Spiritual in Art 1887-1987, 1987

Gemeentemuseum den Haag, 1988

Stifung Ludwig Wien, Museum Moderner Kunst, Wolfgang Paalen, Zwischen Surrealismus und Abstraktion, 1993, p. 231, illustrated

Mexico City, Museo de Arte Carrilo Gil, Wolfgang Paalen Retrospectiva, June 27-September 18, 1994

San Francisco, Wendi Norris Gallery, Philosopher of the Possible, Wolfgang Paalen, February 6-March 29, 2014, no. 5, p. 29, illustrated in color; also illustrated in color on the cover

RELATED CONTENT

- From auctions to acquisitions, read how our unparalleled market insights and results-driven strategies have delivered for our clients.

- Let Us be your Auction Sale Advocate

- Protect Your Investments While Divesting Tangible Assets

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.