New York Auctions November 2021

The New York November 2021 auctions saw a staggering $2.3 billion in sales, across two weeks of seven Evening sales and five Day sales, in a triumphant return to market heights not seen since before the pandemic.

Both Christie’s and Sotheby’s offerings were boosted by major single owner sales, The Cox Collection and The Macklowe Collection. Both sales were entirely guaranteed, and indeed irrevocable bids were omnipresent throughout all auctions, accounting for eighty-three percent of the total value of the evening sales, with reportedly stiff competition by third parties to buy out the house guarantees ahead of the sales. Taiwanese collector Pierre Chen, the seller of Peter Doig’s Swamped which set a new record for the artist at Christie’s, was supposedly a major backer of several of the top Macklowe lots, including the Rothko, De Kooning and Richter.

Christie’s, perhaps anticipating potential fatigue from the magnitude of the Macklowe Collection, opted to hold their sales a week earlier. Following their extraordinary results, it appears the strategy paid off. The Cox Collection, a group of twenty-five Impressionist and Post-Impressionist pictures from Texan collector Edwin Lochridge Cox, was a hundred percent sold with their sale total more than doubling the high end of the pre-sale estimate. Bidding was extraordinarily competitive on nearly every work, spanning customers in the room, online, and via specialists in Hong Kong and London. The sale ultimately proved incredibly important in restoring some much-needed confidence to the Impressionist and Modern market. Moreover, the success of low value lots that would traditionally be placed in a day sale, such as those by Gustave Loiseau, spoke to the benefits of marketing objects as part of a single owner sale.

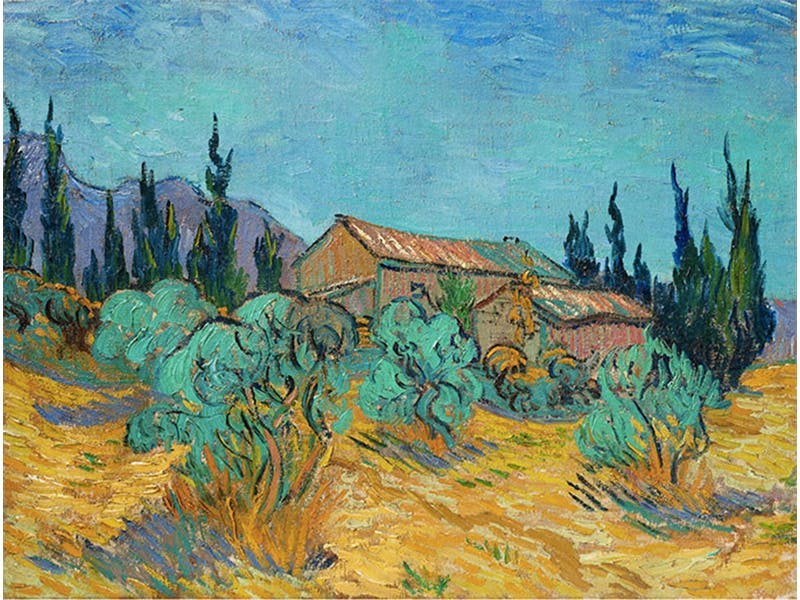

The Macklowe Collection, by contrast, consisted of thirty-five major Post-War and Contemporary works brought about by court order, as part of a bitter divorce between real-estate developer Harry Macklowe and his museum trustee ex-wife Linda. The remainder of the collection will be offered in May but the results of the first half were incredibly strong. The white glove sale, far exceeding the presale low estimate, totalled $676 million (premium) and was the highest total for a single collection in Sotheby’s history. The auction saw new records for Jackson Pollock and Agnes Martin, as well as the result for the highest priced artwork of the November sales. Rothko’s No. 7 (1951), sold for $82.5 million (premium) to an Asian client, the second highest price for the artist at auction. Vincent van Gogh’s, Cabanes de bois parmi les oliviers et cyprès (1889), from the Cox collection, was the second highest price paid over the two weeks, at $71.4 million (premium).

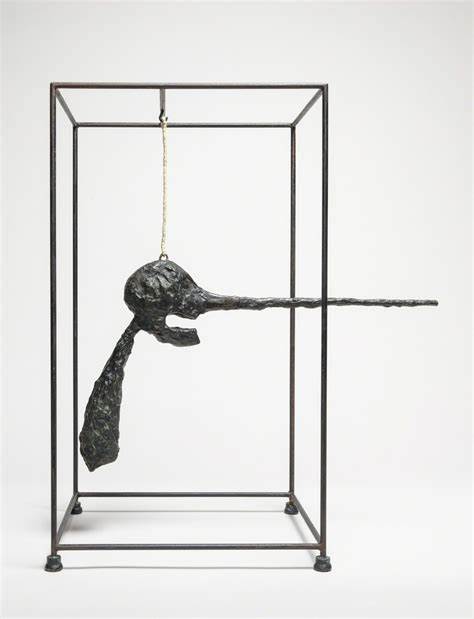

Another key headline from the Macklowe sale was the unexpected buyer of Giacometti’s Le Nez, unveiled as Justin Sun, the Chinese-born, thirty-one-year-old tech billionaire behind Web3 infrastructure company TRON. He plans to donate the sculpture (and two other recent auction acquisitions) to his APENFT Foundation, where it will be tokenized on the blockchain.

Cryptocurrencies and NFTs continued to be a major presence in this round of sales. The NFT recording setting artist Beeple (in a move not seen since Damien Hirst’s primary market sale with Sotheby’s in 2008), created HUMAN ONE specifically for Christie’s, the artist’s first physical artwork (accompanied by a NFT). Christie’s paid the artist a house guarantee for the right to consign the work. Nearly doubling its $15 million estimate, the work sold for $29 million (premium) to crypto Swiss financier Ryan Zurrer.

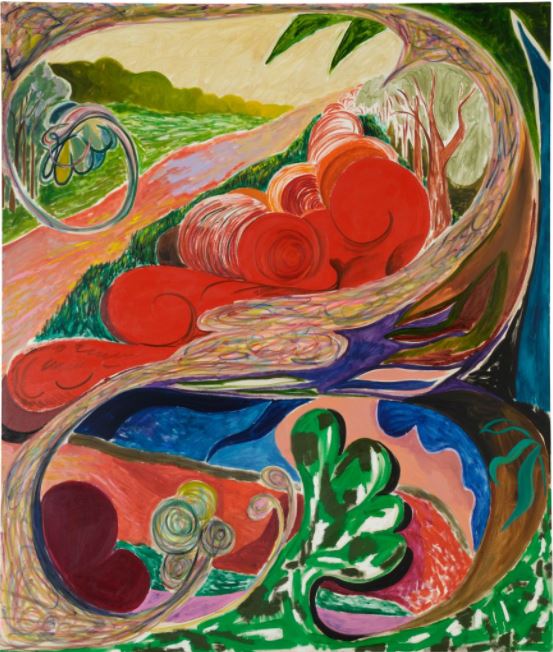

As part of the ever-shifting sales categories, Sotheby’s offered an additional evening sale entitled ‘The Now’ which focussed on art executed in the last twenty years. This sale marked the first time the auction house accepted bids in cryptocurrency for a live auction, with auctioneer Oliver Barker, navigating between bids in the millions of U.S. dollars (USD) and in thousands of Ether (ETH). That sale saw eleven records for primarily ‘wet paintings’ by artists including Lisa Brice, Maria Nerrio, Toyin Ojih Odutola, Hernan Bas, Stanley Whitney, Christina Quarles, Jordan Casteel, and Lukas Duwenhögger. The feel of ‘The Now’ sale was very much in brand alignment with Phillips who have traditionally shown strength in this area, with Sotheby’s clearly looking to compete for further market share in a category proving increasingly lucrative.

The Phillips evening sale, with similarly hot ultra-contemporary works which have come to define their auctions, saw consistent bidding wars, affording the house their highest evening sale total ever at $139 million (premium). It was perhaps this sale which most accurately encapsulated the character of the art market over the last six months: frothy bidding for young figurative painters and more muted demand for the traditional auction stalwarts. Shara Hughes broke her previous auction record of $1.2 million, made just last month in London, with the sale of Inside Outside (2018) for $1.5 million (premium). Other records were made for Jadé Fadojutimi and Ewa Juszkiewicz. With the only two unsold lots by Willem de Kooning and Wassily Kandinsky. The underwhelming result for their top lot, a Francis Bacon which hammered at $33 million on a single bid, below its $35 million low estimate, appeared to further illustrate the divide.

Other disappointments during the sales included Basquiat’s Made in Japan II which went unsold at Sotheby’s against an estimate of $12 – 18 million. Christie’s also offered a major Basquiat in their 21st Century evening sale: The Guilt of Gold Teeth sold on just one bid to the guarantor for $37 million hammer, below the low estimate of $40 million. Both signs that the Basquiat market is perhaps top heavy following several high-profile results. However, the successful results of the Macklowe and Cox sales served to highlight that the global market is not currently making a choice about genres, it’s simply becoming more selective about traditional artists and the price levels they typically command. When the best examples hit the auction block appetite remains strong, as illustrated by artist records outside the major single owner sales, with new top prices for Pierre Soulages and Frida Kahlo, both from Sotheby’s Modern Evening sale. In conclusion, the November sales marked a very strong end to a year that started off shaky, but these results were deservedly achieved for exceptionally strong material. Had it not been bolstered by two historic single owner collections the week would have likely felt calmer.

Image 1: Courtesy of Christie’s; Image 2: Courtesy of Sotheby’s; Image 3: Courtesy of Sotheby’s; Image 4: Courtesy of Phillips