What to Hang on Your New Walls: The 5 Golden Rules

Originally published in RedBook, March 22, 2022

When looking to acquire art works for your new home, there is often one big question: where exactly do I start?

Leading authorities in the field, Guy Jennings and Henry Little, share all you need to know.

1. Are you a decorator, collector or investor?

A key question to consider when acquiring art works for a new home. Most people are a mixture of all three, but it’s important to understand the nuances of each. Decorators might be content with works which lack art historical importance and whose financial value will deteriorate in the long term. Collectors will take a more research driven approach, looking to acquire works which embody an aesthetic position and demonstrate a degree of knowledge about art and the market. While investors might seek medium to long term returns at the expense of art historical merit or developing a personal aesthetic. There’s no reason these priorities should be mutually exclusive, however. With a sufficient degree of knowledge and the right advice, from an art advisor such as The Fine Art Group, it’s entirely plausible to source a group of works which accords beautifully with the architecture, is artistically consequential and will appreciate in value. Prepare to invest time if you want to do more than simply fill walls.

2. Look, listen, read.

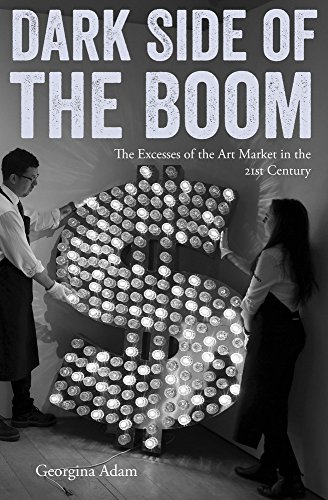

There really is no shortcut for learning, whether guided or independent. Visiting major museums will set a yardstick for determining quality in a marketplace which is notoriously cacophonous. Attend the major art fairs. Frieze and Frieze Masters in London or Art Basel can be dizzying at first, but offer an unparalleled view of the market in a compact viewing experience. If time permits, there are long lists of books intended to cater for the time poor and information hungry. Phaidon or Thames and Hudson are great places to start, for example. And there are excellent short reads about the market which elucidate the mechanics at play. We’d recommend Big Bucks: The Explosion of the Art Market in the 21st Century and Dark Side of the Boom: The Excesses of the Art Market in the 21st Century by art market doyenne Georgina Adam. Above all, become visually literate before committing substantial sums of money to an important acquisition. A small amount of effort to understand the market and what’s available will be richly rewarded.

3. Buy what you like, but pay attention.

Within reason, buy what you like and develop your own taste, but take your time to do so. Everyone’s taste evolves. As advisors we’re always thinking about what it would be like to resell an object we buy on behalf of a client if, for whatever reason, they no longer want to live with it. By following a few simple rules, and focusing on those artists who are well known with relatively liquid markets, you can hone and prune a collection as circumstances dictate. Collecting is most gratifying when personal preferences come to the fore, but these impulses should be considered and kept in check by an objective view of the acquisition: could it be immediately resold at cost if I needed to? This becomes especially pertinent when looking at younger artists. The most noise tends to be around those markets in a state of rapid ascension. While involvement might entice potential buyers with large returns, markets in such a rapid state of flux – where works go from selling for tens of thousands to multiple millions in a few short months – are to be avoided, or treated with the utmost caution. When spending significant sums to buy blue chip artists you’re buying into a collective consensus which has staying power for the future. While you may hear anecdotal evidence that casual purchasing can lead to high returns, this is the exception rather than rule, unless working with a specialist advisor like The Fine Art Group. It’s often better to buy a top tier print by an established artist than a unique work by an unknown, for example. Above all, be aware of fads and trends. Many artists might be flavour of the month now, but their market will evaporate in the medium term. Whenever someone recommends an artist or art work, stop and ask: who do they work for? Whose interests are they serving? If you instruct an art advisor you can be sure they are acting in your interests and no-one else’s.

4. Always negotiate.

Art dealers are a charming bunch who will talk you out of negotiating if they can. There are some conventions which dictate discussions about money, but really there are no rules and everything is up for negotiation. When buying work on the primary market – where the work is being sold for the first time by an artist’s representing gallery – the accepted norm is a 10% discount. You might be able to get shipping thrown in if you’re lucky. Pressing for more than this can lead to offence and you might do yourself a disservice, especially if the artist is highly sought after. When working with a living artist the dealer has a duty of care first and foremost to the artist and, in a sense, they are the gallery’s client, not you. When buying on the secondary market – when an object is traded for the second of subsequent time – the dealer typically has no motive other than profit. And they will price aggressively. With the right knowledge and expertise, you might be able to secure discounts up to 40% on the list price of an artwork. The art market thrives on knowledge asymmetry: our job is to make sure our clients know as much as the dealers. The same applies at auction. When preparing bid levels, be disciplined, set clear parameters and avoid losing control in the heat of the moment. No matter how much you love a work, you’ll find something else you love just as much if you look hard and long enough. In our experience there are few works you should overpay for.

5. Don’t ignore the boring stuff.

It can be tempting to brush aside considerations of tax and shipping when chasing a dream work, but these are ignored at your peril. If buying at auction, for instance, you need to consider a raft of additional costs which can quickly rack up including, but not limited to, buyer’s premium, VAT on the buyer’s premium, import VAT, artist’s resale rights, shipping and framing. Do your sums in advance and get an exhaustive picture of what a purchase will cost. Condition is also key. Unless a work is brand new, always ask for detailed condition reports and inspect a work in person. Always ask to see it off the wall or out of the frame. Frames are known to hide all manner of sins which should be avoided. Research, as far as possible, an object’s recent market history: how long has a dealer had the work? How many times has it been exhibited? Has it failed to sell at auction? As a (very) rough rule of thumb, good work shouldn’t hang around for too long. If a dealer’s had a piece for several years, ask yourself: why is that? And be aware that some media will be more vulnerable than others so you’ll need to think very carefully about where they’re hung. Photographs and works on paper, for example, should be kept out of direct sunlight at all costs. And please, whatever you do, pay to have works properly framed by a reputable framer! While this might feel expensive in the short term, the proper use of conservation grade materials is vital. And the right frame will make a work truly sing.