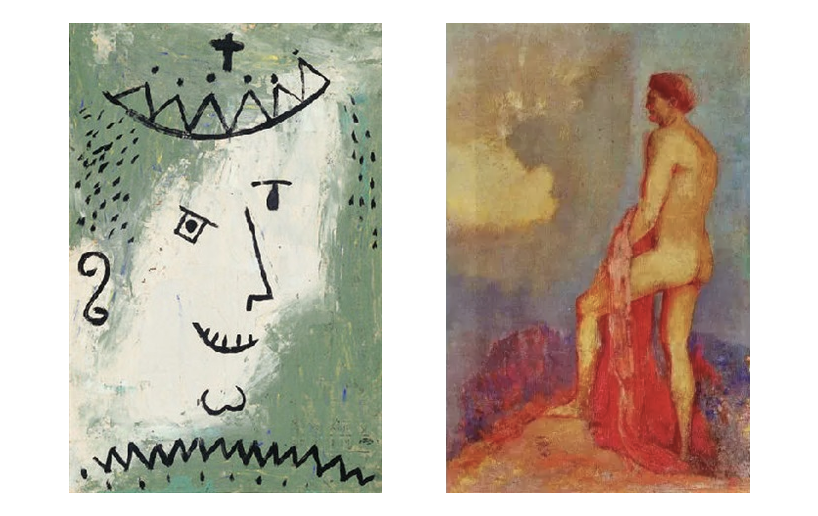

Freeman’s | Hindman to hold sale of the Collection of Sidney Rothberg on February 27 and 28

Almost 300 works will be on view to the public in Philadelphia, with similar highlights exhibiting in

Paris, New York, and Chicago, culminating in two single-owner sales on February 27 and 28,

with a percentage of proceeds going to support free programs helping to improve the lives of

cancer patients, survivors, and their caregivers.

CHICAGO PUBLIC EXHIBITION

Freeman’s | Hindman Chicago Gallery

1550 W Carroll Ave

Chicago, IL 60607

February 2nd to 8th

Monday to Friday, 10 AM to 5 PM

Weekends, 11 AM to 4 PM

PHILADELPHIA PUBLIC EXHIBITION

Freeman’s | Hindman Philadelphia Gallery

2400 Market Street

Philadelphia, PA 19103

February 16th to 26th

Monday to Friday, 10 AM to 4 PM

Weekends, 12 PM to 4 PM

BOOK A VIEWING APPOINTMENT

Please email Raphael Chatroux at rchatroux@freemansauction.com to book a viewing appointment.

“A lifelong Philadelphian, Mr. Rothberg was known for his expert eye and impeccable taste,” said Head of Sale Alasdair Nichol. “He regularly attended Freeman’s auction, so it is not only fitting, but also emotional, to see all these gems presented in the city he liked so much.”

The full auction preview will open in Philadelphia from February 16th until the auctions take place on February 27th and 28th. The online sale catalogue will go live from February 2nd. A portion of the proceeds from your acquisition will be donated to support free programs helping to improve the lives of cancer patients, survivors, and their caregivers.

SALE INFORMATION

Auction Preview: February 16th – February 26th

Sale Dates: February 27th – February 28th

Freeman’s | Hindman, 2400 Market Street,

Philadelphia, Pennsylvania 19103

Click here for more information:

Part I: Upcoming auction: What Do You See? The Collection of Sidney Rothberg, Part I | February 27, 2024 (freemansauction.com)

Part II: Upcoming auction: What Do You See? The Collection of Sidney Rothberg, Part II | February 28, 2024 (freemansauction.com)

Lots to be published on February 2nd, 2024.

RELATED ARTICLES

- Join Us for Creating a Legacy: The Collection of Sidney Rothberg

- Creating Charitable Impact with Passion Assets

OUR SERVICES

Whether you are an individual, family, foundation, or non-profit organization, The Fine Art Group can help make your charitable vision a reality.

Following the marquee sales of 20th/21st century art in New York, Philip Hoffman spoke to The New York Times regarding the state of the current art market.

AN INTERESTING AUCTION SEASON

With 14 live sales across the major houses—Christie’s, Sotheby’s, and Phillips—the November season saw many challenges. “While in art market terms it was a success, in business terms it was an expensive investment,” said Philip Hoffman.

Click here to read the full article in the New York Times.

Full Article.

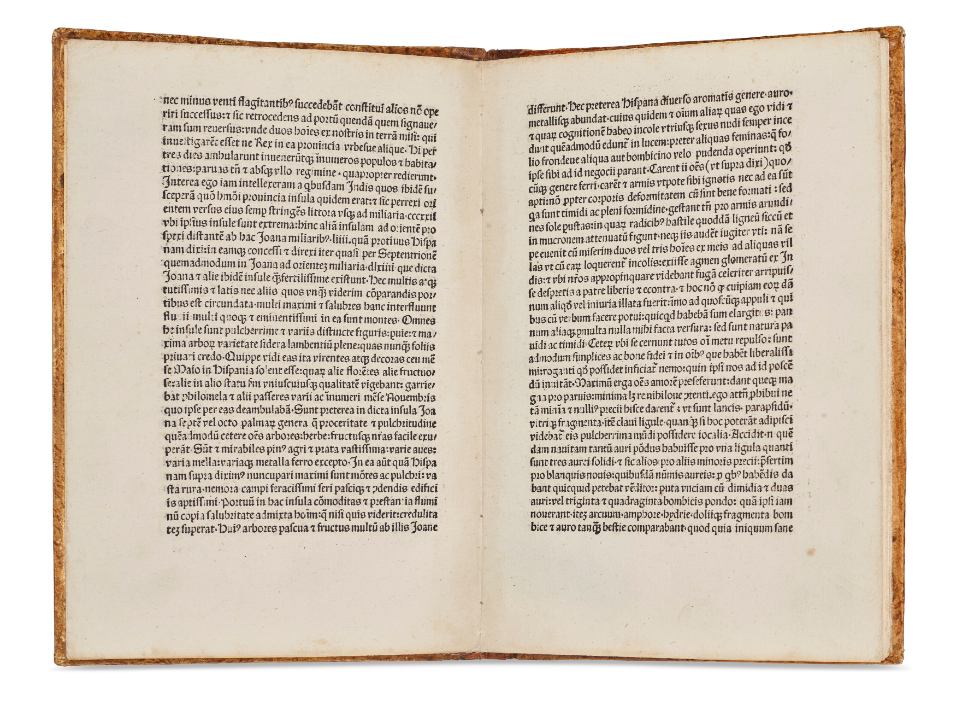

The Fine Art Group is pleased to announce the acquisition of the Epistola de insulis nuper inventis on behalf of a private client from Christie’s sale of Fine Printed Books and Manuscripts including Americana on October 19, 2023 for $3.9m.

The document is the earliest obtainable edition of the letter to King Ferdinand and Queen Isabella of Spain sent by Christopher Columbus from on board the Nina and provides the first descriptions of the Americas by a modern European explorer in 1493. Originally written in Spanish, the letter was translated into Latin by Leander di Cosco and its printing is attributed to Stephen Plannck, a publisher associated with the Papal chancery in Rome.

Christopher Columbus

1493

Christie’s

October 19th, 2023

Lot 308

ESTIMATE: $1,000,000 – $1,500,000

PURCHASE PRICE: $3,922,000

Following its translation into Latin, this document spread the news of Columbus’ transatlantic voyage and sparked one of the first ever media frenzies in Europe. Its publication forever altered peoples’ perception of their world and changed the course of world history forever. Copies of the Epistola de insulis nuper inventis are extremely rare, with few known copies existing outside of institutional libraries. Before coming to auction, the present example resided in the collection of a private Swiss library for nearly a century.

Kerry-Lee Jeffrey, Senior Director, The Fine Art Group, said ‘‘We are thrilled to announce the acquisition of this important document on behalf of our client. This outstanding acquisition will be the cornerstone of a collection that explores the sweeping narrative of the United States of America through important documents.’’

Explore the Epistola de insulis nuper inventis here.

Related Content:

- Watch: How To Maximize Value When Selling Collections Webinar

- Philanthropic Strategy at Work: The Jack Davis Collection

- 10 Art Exhibits Collectors Should Visit Before 2024

Our Services

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

The first round of 2022’s marquee evening sales took place in London last week with significant results. Sales totals from all three houses reached just over £400 million ($525 million), above 2019 pre-pandemic levels for the same period.

The ongoing crisis in Ukraine created an understandably strained atmosphere for all houses but the auctions continued with consummate professionalism. Phillips, owned by the Russian company The Mercury Group, especially came under fire, despite having no financial links to any of the sanctions imposed on Russian businesses. In response, Phillips donated all vendor’s commissions and buyer’s premium from their evening sale, totalling £5.8 million ($7.7 million), to the Ukrainian Red Cross Society. Christie’s made an announcement later in the week that they too would make a significant donation to the Red Cross efforts in Ukraine.

The top prices of the week were for Franz Marc’s recently restituted painting The Foxes (Die Füchse) (1913) which sold for a record £42.6 million ($56.8 million) premium. There was also a new record for René Magritte at Sotheby’s; L’empire des lumières (1961) sold for £59.4 million ($79.4 million) premium, almost tripling the artist’s previous record. Both works carried a guarantee, as did most top priced lots in the sales, including Francis Bacon’s Triptych (1986-87), which sold at Christie’s to the guarantor for £38.5 million ($51.2 million) premium. Guarantees accounted for about 64% of the overall sales total across the houses, with the total low estimates of guaranteed lots around £257 million ($337 million). This resulted in £249 million ($327 million) in guaranteed actual sales, signalling how crucial guarantees are in the current business, in terms of winning consignments as well as ensuring a high sell through rates for the overall sales figures.

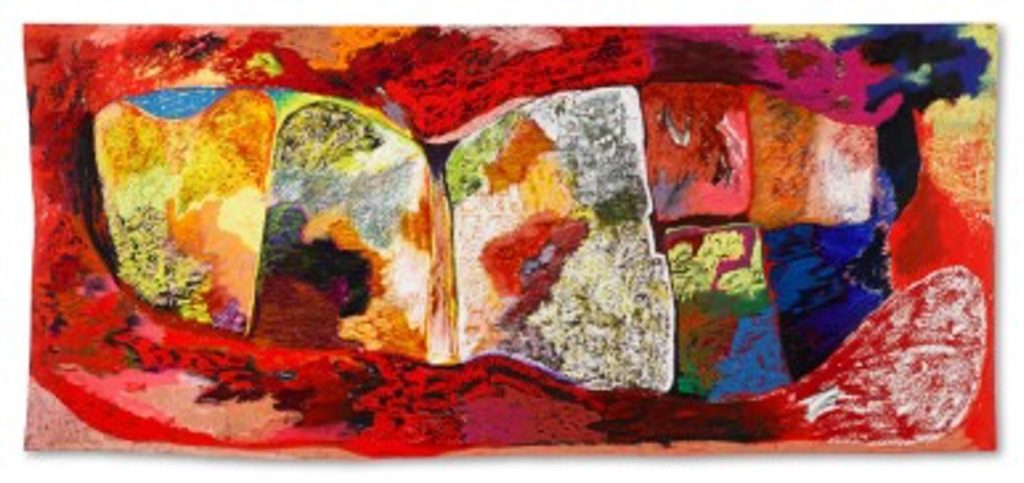

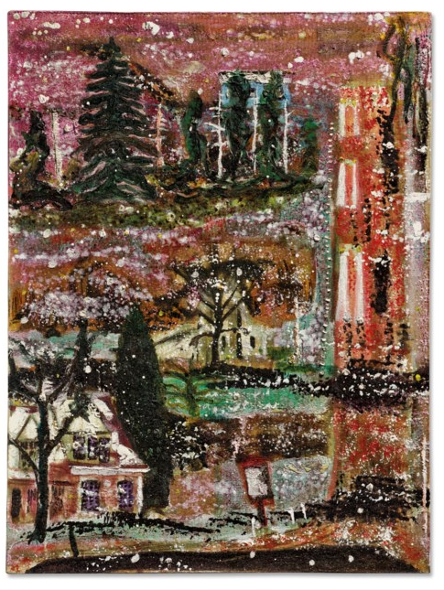

A slew of auction records were achieved for works from the newly coined ‘ultra-contemporary’ category, with new record prices set for Issy Wood, Shara Hughes, Flora Yukhnovich and Hilary Pecis, among others. This became the fastest growing auction category of 2021 and looks set to continue a strong trajectory for 2022. Two sales predominantly offered works from this category: Christie’s Shanghai Evening sale and Sotheby’s New Now Evening sale. 70% and 55% of their lots respectively sold above estimate, compared to around 25-30% in the Modern and Contemporary sales. The result for Rachel Jones who had her debut at Sotheby’s, selling for £617,400 ($828,600) premium against an estimate of just £50,000 – 70,000, felt particularly illustrative of the momentum in this area of the market.

Despite some very strong performances, a few disappointing results indicated that with secondary market supply increasing for some of these ‘hot’ artists, buyers are becoming somewhat selective about the lots they chase, as well as perhaps a waning appetite for the new price levels of these popular names. Amoako Boafo had four works at auction during the week, two of which sold on or below their low estimate. A work by one of the breakout stars of 2021, Salman Toor, was withdrawn from the Christie’s day sale, another in the Phillips day sale sold for one bid above the low estimate. While in no way does this indicate a slowing down of these artist’s markets (the works by Boafo that did sell well are now the second and third highest prices at auction) it suggests increasing selectivity as well as a possible plateau in terms of price points for these names that have on many occasions in the past twelve months far exceeded their estimates.

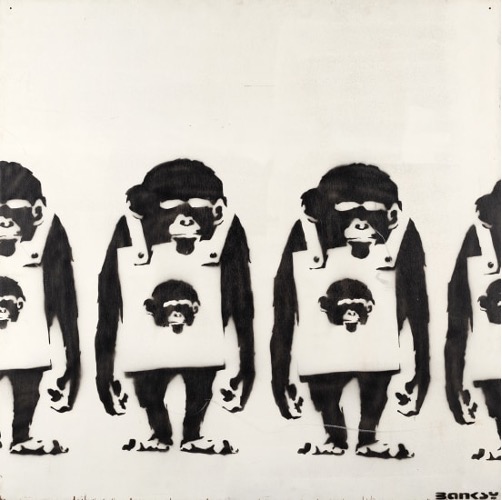

Another noticeable shift was a softening in demand for works by Banksy. With a total of ten works on offer across Phillips, Sotheby’s and Christie’s, at various price points, buyers could be discerning with the works they bid on. Together the works had a presale estimate of £14 – 21 million ($18 – 26 million) and the hammer total was just £7.5 million ($9.8 million). Four top priced pieces either went unsold or were withdrawn, significantly affecting the artist’s sales total for the week.

Despite the noticeable contrast in bidding between the ultra-contemporary and post-war and modern categories, this is not reflective of the latter’s slowing market. Their estimates represent very different price points, and, in some instances, several the highly priced lots were accompanied by estimates at the mid to top end of the artist’s market, which accordingly limits the amount of action and live bidding in the room. A number of these lots sold on one or two bids. Works that the market felt were under-priced, for example Peter Doig’s Some Houses on Iron Hill (1992), estimated at £600,000 – 800,000, were chased by buyers, with the work selling for £2.4 million ($3.3 million) premium.

Ultimately, despite the various categories performing at different levels, major auction records were achieved in both the modern and next generation contemporary segments. The exceptional sell through rates of all the auctions, ranging from 88% to 95%, is further testament to the overall strength of the market which proved resilient during a difficult week.