SUCCESSFUL SALE OF JEWELRY ADVISORY CLIENT COLLECTION

We are pleased to have assisted a client in successfully selling their impressive jewelry collection in the Sotheby’s Magnificent Jewels Sale.

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 29

Fancy Vivid Orange Diamond and Diamond Ring

Estimate: $1,000,000-$1,500,000

Sold: $1,895,500

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 30

Fancy Red Diamond and Diamond Pendant-Necklace

Estimate: $2,500,000-$3,500,000

Sold: $3,166,000

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 191

Padparadscha Sapphire and Diamond Ring

Estimate: $180,000-$220,000

Sold: $226,800

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 192

Suna Sapphire and Diamond Necklace and Pair of Earrings

Estimate: $100,000-$150,000

Sold: $126,000

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 184

Emerald and Diamond Ring

Estimate: $75,000-$100,000

Sold: $163,800

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 185

Oscar Heyman & Brothers

Emerald and Diamond Ring

Estimate: $50,000-$70,000

Sold: $151,200

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 183

Oscar Heyman & Brothers

Emerald, Black Opal and Diamond

Estimate: $50,000-$70,000

Sold: $88,200

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 178

Oscar Heyman & Brothers

Black Opal, Diamond, Ruby and Sapphire ‘Clover’ Necklace

Estimate: $50,000-$70,000

Sold: $100,800

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 176

Oscar Heyman & Brothers

Black Opal, Diamond, Ruby and Sapphire

Estimate: $10,000-$15,000

Sold: $17,640

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 177

Oscar Heyman & Brothers

Black Opal, Diamond, Ruby and Sapphire Bracelet

Estimate: $30,000-$50,000

Sold: $52,920

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 16

Van Cleef & Arpels

Diamond and Pearl Lapel-Watch

Estimate: $25,000-$35,000

Sold: $37,800

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 187

Oscar Heyman & Brothers

Diamond, Colored Diamond and Ruby Brooch

Estimate: $35,000-$45,000

Sold: $88,200

Sotheby’s

December 9, 2020 – Magnificent Jewels

Lot 186

Oscar Heyman & Brothers

Pair of Sapphire and Diamond Pendant-Earclips

Estimate: $40,000-$60,000

Sold: $69,300

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

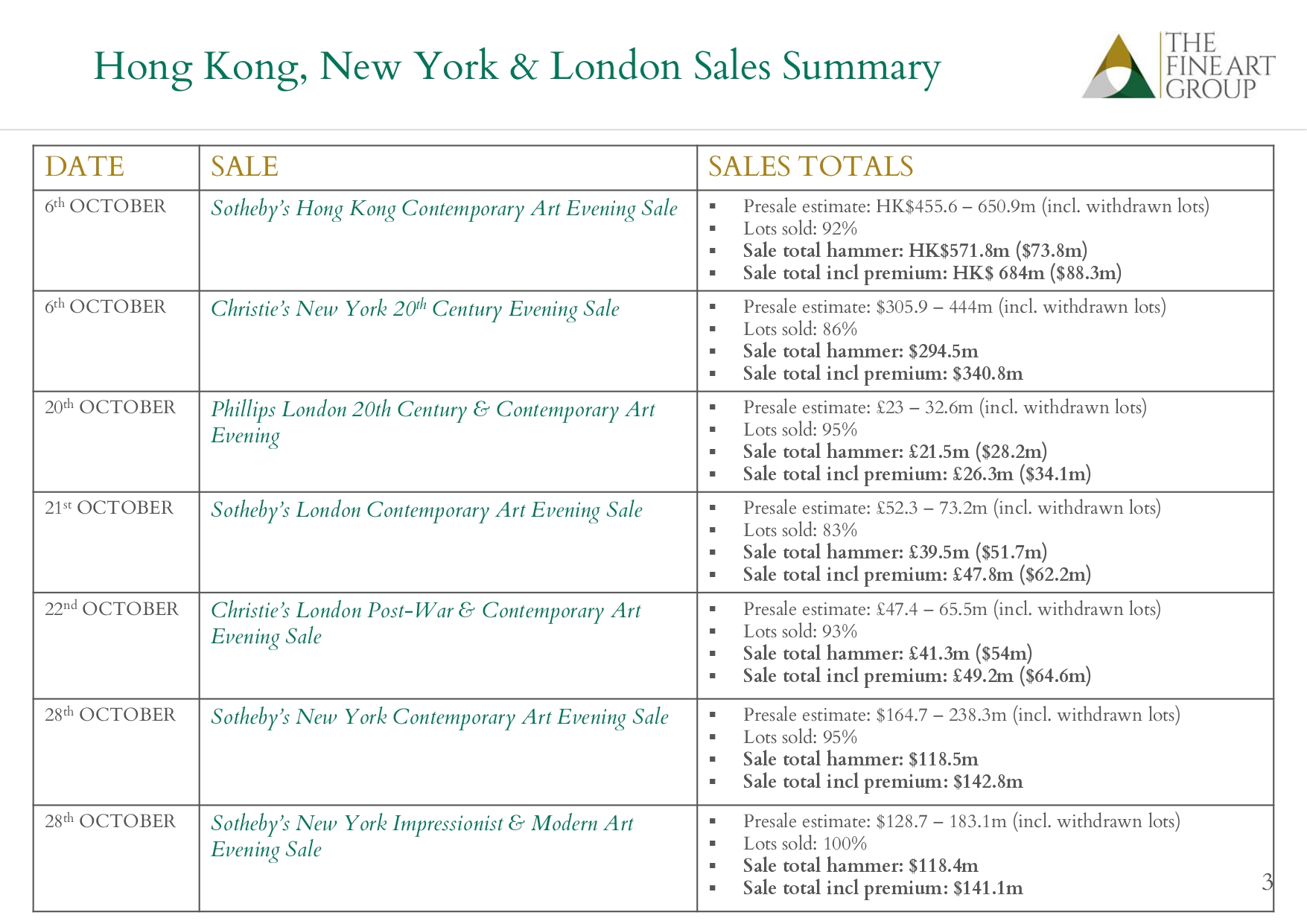

With the year drawing to an end, the auction houses recently rallied for one last push with five major evening sales held between New York and Hong Kong across Phillips, Sotheby’s and Christie’s over the first two weeks in December. Representing what would have been the usual November slot, these sales were pushed back to December. However, despite Sotheby’s opting to move their ‘November sale’ forward to October, they curiously bookended this period with yet another evening auction, this time mixing Impressionist & Modern and Post-War & Contemporary lots, a tactic in line with Christie’s recent approach.

The Hong Kong sales showed remarkable strength and considerable depth of bidding when compared to the New York segments. Christie’s Hong Kong first held a fifty-eight lot Modern & Contemporary sale and a standalone one lot Sanyu sale. With all but one lot selling, the sale surpassed its presale estimate by 20% bringing in $132 million. This was followed a few hours later by the 20th Century department holding a ‘global sale’ starting in Hong Kong then moving on to New York, in a relay style similar to what we saw in July, totalling $119.3 million solidly within their presale estimations.

This appeared a risky gambit with major works by several artists such as Zao Wou-Ki, George Condo, Yoshitomo Nara included in both the Modern & Contemporary and One Sale Hong Kong segment. However, this overlapping of content did not seem to slow the appetite one bit, the One Sale Hong Kong was 100% sold. As Christie’s moved to their New York segment, bidding from Hong Kong continued long into the evening, including a Renoir painting towards the end of the sale which meant Asian bidders were active at 11.45 pm local time. More surprising, a sculpture by Hans Arp sold to a Hong Kong bidder in the room for $2.4 million including premium, as Georgina Hilton bid virtually for the collector with Adrian Meyer in New York.

Phillips Hong Kong opted to hold their sale in partnership with Poly Auctions, one of mainland China’s biggest auction houses. The strategy paid off with only two unsold lots, the sale surpassed its presale estimate by around $10 million. Poly crucially expanded the bidding to mainland China which helped increase competition with Phillip’s Hong Kong bidders and ultimately pushed the price on several lots. Buyers leapt bidding increments by as much as HK$5 and HK$6 million at times. Most notably, a major 1995 painting by Yoshitomo Nara, initially chased by seven bidders, was fought over by Nick Hilton with Phillips Hong Kong and Blair with Poly Beijing, resulting in the work doubling the low estimate and selling for $13.3 million. It eventually sold to the same phone buyer that won the Matthew Wong and set the second highest price for the artist. Interestingly the partnership with Poly also led to more online bidding than we had seen in a while, clients from Singapore, Taiwan, Samoa and Korea, all underbid online for several of the top lots.

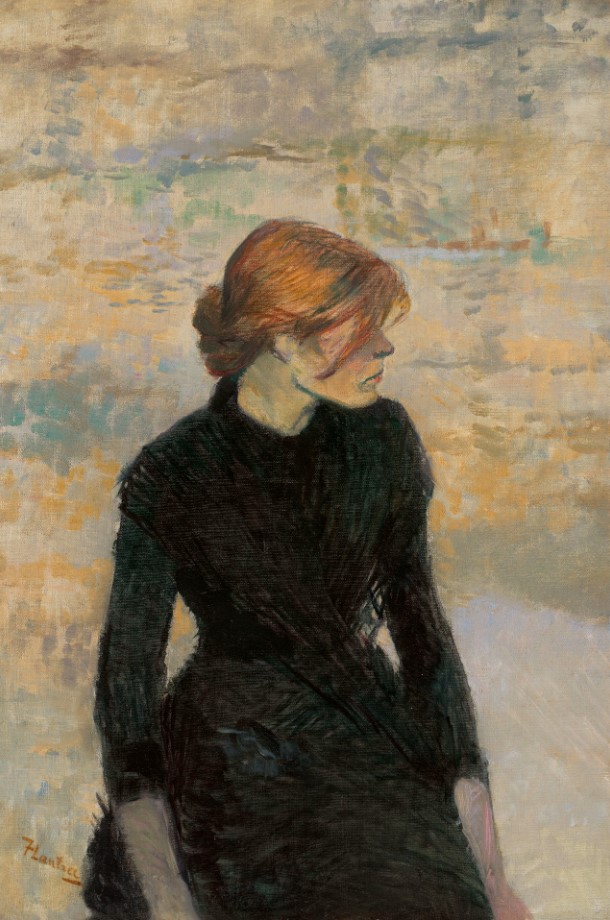

It was a very different feel during Christie’s New York One Sale segment which had five unsold lots compared to zero from the Hong Kong section and more than half of their lots sold on or below the low estimate. Their Post-War & Contemporary day sale also failed to reach the low end of its presale estimate. Intriguingly, the star evening sale lot was not a Contemporary work but a Toulouse-Lautrec, which had belonged to automotive head Henry Ford II. This attracted at least five bidders, all in New York, before selling well above estimate for $9 million including premium. 43% of the sale was guaranteed by value as the success of the sales continues to be assisted by financial backing.

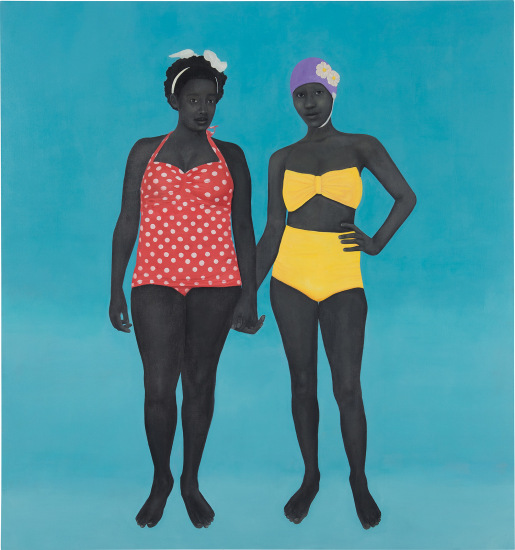

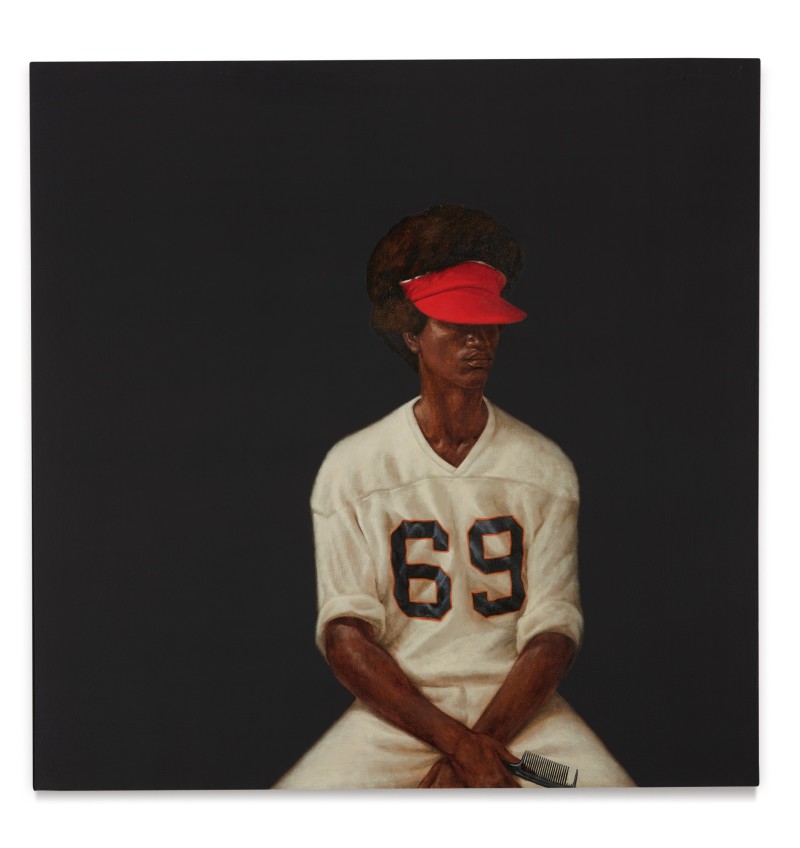

Throughout the sales a number of artist records were achieved. At Phillips both in Hong Kong & New York new records were set for Matthew Wong, Bernard Frize, Lucas Arruda, Emily Mae Smith, Vaughn Spann, Jadé Fadojutimi, Kehinde Wiley, Mickalene Thomas and Amy Sherald. Several artist records were achieved with Christie’s as well, including Salman Toor (surpassing the record Phillips set earlier that day) Georges Mathieu, Nicholas Party, Joyce Pensato, Dana Schutz, Amoako Boafo and Shara Hughes, amongst others (interestingly both the Boafo and Hughes were acquired by the same collector). And Sotheby’s reached a new record for Barkley L. Hendricks. The notable theme running through this list of records being major success for black artists and less well established artists, as ever increasing speculative buying rages on.

Phillips New York sale had significant weight in this area which contributed to the success of their evening sale, in disparity with the Christie’s New York and Sotheby’s sales being predominantly focussed on the traditional canon. Phillips achieved an extraordinary price for Amy Sherald, only the second work to come to auction the painting sold for $4.3 million with premium against an estimate of $150,000 – 200,000. Contrastingly, the top priced lots by evening sale regulars such as Jean-Michel Basquiat, Donald Judd and Clyfford Still saw more muted bidding. But their top lot by David Hockney did see the artist’s highest price for a landscape, selling to Cheyenne Westphal’s client for $41.1 million including premium.

Sotheby’s only had two lots by ‘emerging’ artists and this affected the level of activity in their sale. Before the sale even began, they withdrew five lots with a combined low estimate of $10.1 million which perhaps attests to whether the new mixed category strategy paid off. For the remaining lots in the sale bidding was subdued bar for the expected Hendricks, Wong and remarkable Calder, their top selling lot of the evening. Some last-minute guarantees were put in place at half of the low estimate for works by Van Dongen and Achipenko. This benefitted their sell through rate but affected the bottom line.

Overall, Hong Kong showed considerably more vigour than New York, clearly the Asian economy has weathered recent events better than the US. However, Phillips New York’s results were encouraging, indeed it was the house’s highest ever evening sale total in that category. Evidently the market is currently buoyed by young artists and a sale tailored to this current demand is what’s required to see active bidding. Restrictions over seeing works in person continue to fuel this, the due diligence requirements for a 1950s Ab-Ex painting remain very different to a recent primary market piece, as well as the obvious economic factors. Volume continues to be another feature, the bulk of ‘marquee’ evening sales over the last few months is affecting demand. With the promise of yet another ‘major’ sale around each corner what is to stop collectors holding out and waiting to see what the market offers down the line. Hopefully, the break between now and the next round of London sales will bring much needed respite.

It will be interesting to see how the auction houses approach the next six months given the recent dramatically changed schedule. However, generally the overall strength in the performance over the past nine months has been impressive given the circumstances.

Image 1: Image courtesy Christie’s; Image 2: Image courtesy Christie’s; Image 3: Image courtesy Phillips; Image 4: Image courtesy Christie’s; Image 5: Image courtesy Christie’s; Image 6: Image courtesy Phillips; Image 7: Image courtesy Sotheby’s; Image 8: Image courtesy Sotheby’s

Further Reading

- The Asking Price: Understanding Value 1

- The Asking Price: Understanding Value 2

- Looking Forward: Ten Art Market Predictions for 2023

Helping the High-Profile Client Buy Luxury Assets with Intelligence

THURSDAY, DECEMBER 17, 2021 – 10AM PST / 1PM EST

Whether it is buying sports or rock memorabilia, collecting fine pieces, investing in collector cars, or acquiring artworks for the home, there are rules for acquiring tangible assets intelligently.

The Fine Art Group is pleased to bring together an expert panel in Part 2 of our latest webinar series. It will provide insight into these markets and collecting categories.

TOPICS DISCUSSED

- What specific attributes make the piece valuable?

- What is the best venue for acquisition?

- What is the best process for acquisition?

- When is it time to sell, where do you go and what do you do?

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

Further Reading

- High-Profile Client Collections & Sudden Wealth Syndrome

- Helping the High-Profile Client Buy & Sell Smart

The Fine Art Group’s new Sports & Entertainment Specialty Practice and Director Shane David Hall have been featured in the Atlanta Business Chronicle Sports Biz Notebook.

To read the article and learn more about The Fine Art Group’s Sports & Entertainment Specialty Practice please access the link below.

Read the article.

With fame and fortune, many celebrities, sports figures, and entrepreneurs have experienced an influx of wealth and begin to buy art, jewelry, cars, wine and memorabilia. When the money begins to flow, it is common that a high-profile buyer experiences vulnerability.

It is essential that structures are put into place to protect the high-profile client from being taken advantage of.

In Part 1 of our latest webinar series, we will provide specific tools and case studies to assist in protecting the high-profile client.

Join Us Thursday, December 3rd, 10 am PST / 1 pm EST.

TOPICS TO BE DISCUSSED

- How do you buy luxury assets with intelligence and at the right price and in the right venue?

- How to avoid the lure of the “hot for a hot second” artist?

- How do you sell collections to obtain the highest revenue?

- How do you insure, store and ship collections correctly?

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

Further Reading

- High-Profile Client Collections & Sudden Wealth Syndrome

- Helping the High-Profile Client Buy Luxury Assets

Hello from Charlotte, N.C.!

Instant wealth and fame at a young age offers great opportunity. But adding the expertise of an art advisor gives those with sudden early success the enhanced prospect to pursue a sound and wise investment strategy in tangible assets.

This crucial need for the suddenly wealthy crystalized for us when our senior jewelry appraiser and I met with a newly contracted professional athlete, his business manager and risk manager to discuss and implement a plan of action when acquiring unique and unusual luxury timepieces. Throughout 2019 and 2020 this client made a substantial investment in what can be a robust and volatile collecting market, often working directly with dealers and without sound guidance from experts in terms of investment. In one instance before working with us, this client acquired an 18-karat yellow-gold Rolex Daytona set with diamonds and sapphires for $70,000 – a big purchase for a young man who overnight went from less than $20,000 a year to over $5 million a year!

In the late spring of 2020, a trusted friend and insurance broker called me to ask if we could establish appropriate retail replacement values for this growing collection. Our appraisal process began like any other: confirming available dates, scheduling onsite appointments, completing inspection and beginning valuation research. However, during this process we learned that our client had significantly overpaid for a watch that regularly retails for $25,000. A delicate conversation followed in which our team discussed the details of the luxury timepiece market and how to avoid overpaying in the future.

This made me pause and realize that most appraisers and art advisors are accustomed to opining on a range of tangible assets, such as jewelry, luxury accessories, rare automobiles and similar asset classes for private clients. However, there exists another segment of high net-worth individuals whose youth, wealth and celebrity regularly bring new challenges to their financial advisors and business managers. These individuals are often household names, from actors and celebrities to models or government officials – all people who have attained fame and wealth but have neither the time nor expertise to manage the range of investment-quality tangible assets that exist within their collections.

Although the enormous cash influx realized by many of these high-profile clients is properly protected by a team of business managers, wealth managers, accountants and attorneys, suitable guidance from an experienced art advisor who understands the challenges of the tangible asset market is missing. As a result, seemingly common purchases like a fine Swiss timepiece, a luxury handbag or a work of art from an emerging artist can become unstable investments.

SUDDEN WEALTH SYNDROME

Sudden Wealth Syndrome, a term coined by psychologist Stephen Goldbart to describe the stress, guilt, and social isolation that often accompanies a large windfall, often strikes first-round NFL draft picks, overnight IPO millionaires and actors plucked from obscurity. Sudden wealth can overwhelm those who have made it big and encourage overspending coupled with poor decisions when making a significant purchase. The result can be financial ruin. Goldbart and his associates at the Money, Meaning & Choices Institute say that much like the four stages of grief, there are four stages people go through when coming to terms with their new wealth:

- Honeymoon: Like the beginning of a romantic relationship, people who come into money feel powerful and invulnerable. Many go on spending sprees, buying things and making risky investments which often lead to disastrous results.

- Wealth Acceptance: A realization that there are unknown factors associated with wealth and the need to set limits.

- Identity Consolidation: During this stage, people accept that they are now rich but realize that their money does not define who they are.

- Stewardship: In the final phase, people reach a mature resolution of what their money means to them and have established a plan for what to do with their money in terms of personal, family and philanthropic missions.

These cash windfalls are a nice problem to have; however, there are numerous stories detailing the recently wealthy burning though their money in just a few short years, ending up with a collection of expensive toys and objects that hold little return on investment. There are important pitfalls to avoid particularly when managing investment quality tangible assets – the first step being to assemble the right team of experts.

A QUALIFIED ART ADVISOR OFFERS PROTECTION

All newly minted high-profile clients should be encouraged to hire and consult with an art advisor. In fact, it is paramount that the client hires an art advisory firm with a vast range of specialists, experts and conservators who can consult and bring significant insight to any asset class including expert purchase negotiations on the client’s behalf. This team can provide expert advice and analysis on the acquisition of a new asset whether it is a piece of jewelry, sports memorabilia or something more traditional such as a first-edition manuscript. Additionally, an art advisory firm can provide an unbiased opinion on the quality of the investment as well as the condition of the object, steering the client to more solid footing in terms of the client’s overall investment portfolio and potential long-term gains.

Secondly, avoid the dealer dilemma! While a traditional retail setting such as a gallery, fine art show or fine jewelry salon can be an interesting arena to acquire unique and unusual tangible assets, there is a built-in bias on the dealer’s behalf. The seller’s goal is to garner the highest amount possible for any object marketed or sold. Additionally, while a collector’s discount can often be negotiated, the seller has the upper hand because the seller’s understanding of the market is greater. In many cases, and particularly with our watch-collecting client, we see specific instances where high-profile clients are taken advantage of even with negotiated discounts, simply due to the fact that there is money to spend and impulse to buy without sound financial guidance.

In this circumstance, it is important for high-profile clients to have knowledgeable professionals advocating on their behalf in order to avoid additional pitfalls to acquisition, such as authenticity, fakes and forgeries, clear title and condition issues.

When acquiring high value tangible assets, the most important factor beyond understanding value is due diligence. Before payment is made, the potential owner should have a complete grasp of the item’s condition, including previous conservation or restoration. A solid and transparent provenance should also be available to the buyer and his or her team, thus providing a clear knowledge of authenticity and title which alleviates concern surrounding fakes and forgeries. Without proper due diligence, a $250,000 purchase can depreciate to $1,000 in the blink of an eye!

Finally, when working with an art advisory firm, many of the unseen details of acquisition are instantly handled by an experienced team and vetted third-party sources solving unforeseen concerns such as framing, conservation, repair, shipping, fine art storage and other needs associated with ownership of high value tangible assets. It is important for a high-profile client to “not go it alone” because doing so could have unwanted ramifications. For instance, storing a high value painting or print in an untested storage facility could mean significant financial losses if this facility does not meet appropriate standards. Further, if a work requires conservation or repair, an art advisory firm is able to facilitate the proper way forward. In many cases, if an owner does not hire the appropriate conservator, which is often designated by the artist or maker’s estate, foundations and/or other top experts, then a significant loss in value is imminent.

The art market is often considered by many to be the last great unregulated segment of the financial market and can often make for a treacherous experience for new collectors without the proper guidance.

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

FURTHER READING

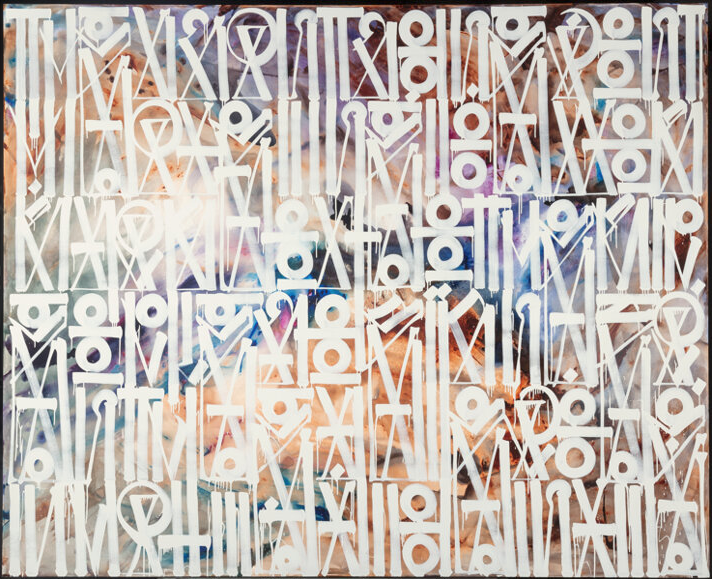

A client has put this impressive work by contemporary street artist Retna for auction. The work They Can’t Come is one of the largest pieces of Retna’s to go to sale.

Heritage Auctions

Urban Art Signature Auction

Lot 66039

RETNA (B. 1979)

They Can’t Come

2015

Acrylic on canvas

96 x 120 inches (243.8 x 304.8 cm)

Signed, dated, and titled in ink to verso

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Following the success of our previous Virtual Breakfast Briefing back in July, this season’s Breakfast Briefing continues the trend of the virtual replacing the traditional IRL events, normally held at Christie’s, Sotheby’s, or Phillips around the world.

Senior Director Morgan Long and Managing Director Guy Jennings sat in virtual conversation with Philip Hoffman, discussing the recent auction sale results, and debating the movements and currents of the art market over the past few months.

The art world is an unregulated and opaque market with significant private and public transactions. Advisors guide collectors and investors, ensuring they do not overpay while offering discipline and market analytics. This model doesn’t necessarily exist when acquiring jewelry. Retail prices are often higher than the intrinsic value of the material and stones, and clients are shocked to discover their fair market value.

Jewelry connoisseurs understand the three c’s (cut, clarity, and carat) but are unaware of additional factors influencing value. Color saturation is important, and its interpretation and identification change as the market evolves. When diamonds are mounted, color can be enhanced by the mount or foil backing. Additionally, the mount or cut of the stone can hide flaws. This isn’t always disclosed when acquired through a dealer or designer, and accompanying certificates give the client a false sense of security.

It is imperative to work with a knowledgeable advisor such as The Fine Art Group’s Advisory Team when acquiring jewelry and loose stones. The following article discusses the myths surrounding red diamonds, highlighting the importance of seeking experienced advisory when navigating the jewelry market, as independent advisors can bring discipline, market analytics and due diligence to collecting.

The Diamond Investment & Intelligence Centre (DICE), Published August 9, 2020

RED DIAMONDS: UNDERSTANDING THEIR RARITY

Red diamonds are not the rarest color in the world! Now we can review the myths…

There are other colors that are rarer such as violet, purple and orange. So why are people under the impression that red diamonds are the rarest? There are so many individuals in the world that claim they know how many red diamonds exist. Some auction houses claim that there are only 29 red diamonds in existence. That is false. Some dealers claim that there are only 30 red diamonds in the world, which is also false. Even some geological websites claim that red diamonds are the rarest colors, which is also false. Do red diamonds even exist? if so, how many do exist? and if they don’t exist, then why does the GIA (Gemological Institute of America) certifies them as such?

What are the various theories? What is the truth about red diamonds? How many exist? These are all very good questions, and it is time to address them all properly.

RED DIAMONDS THEORY #1

The Argyle mine in Australia produces 90% of all pink and red diamonds.

It is believed that the majority (90% as stated) of all pink and red diamonds are mined in the Argyle mine. This theory can be easily verified. There are official documents (mostly Kimberly Process) that can trace back the majority of rough diamonds to mines and therefore we can use this method as a way to verify. Some red diamonds were found in India decades ago from the Golconda region which was also famous for its blue diamonds. This can also be verified as the GIA can easily determine the origin of such diamonds. If we go back less than 40 years, we will find that the Argyle mine has indeed produced the vast majority of pink and red diamonds; just follow the money and sales…

RED DIAMONDS THEORY #2

There are only 29 or 30 red diamonds in existence.

That is completely false. I am personally aware of at least 100 red diamonds in existence, and I am sure that some of the top fancy color diamond dealers that trade in red diamonds are aware of a few more…There is a single collection that has 51 red diamonds in it, from as large as a 4.59 carat red diamond to a 0.24 carat red diamond. With a total weight of just above 50 carats. There is another large collection of 25 red diamonds.

A very well-known dealer, who also produced a rare diamond cross with 11 red diamonds in it, has many other red diamonds in his personal collection. There is an online dealer (which has the largest diamond collection offered on the internet) that has more than 25 red diamonds listed. Let’s not forget that there are many other red diamonds owned by private individuals that have been acquired over the years that we are not aware of.

RED DIAMONDS THEORY #3

Are red diamonds real? The answer is yes, but only relatively recent.

The best-known gemological laboratory is the GIA based in New York and Carlsbad, with many more satellite labs around the world. Before the 1970’s color diamonds were such a rarity that they were discarded by the trade. The GIA started certifying red diamonds only recently (as recent as the 80’s). Prior to that they were all certified as pink diamonds, and in fact, if we look at the pink diamond color chart by the GIA, we will find that at the bottom right corner, there is an area called Fancy Red.

That is the reason that the red color has only 4 categories; Fancy Brownish Red, Fancy Orangy Red, Fancy Red and Fancy Purplish Red. You will not find a single GIA certificate that certifies a red diamond as Intense Red or Vivid Red. The most desired color is Fancy Purplish Red. It has a more lively color than a pure Fancy Red color, and therefore more attractive to the eye. A pure Fancy Red diamond has a more dull color.

RED DIAMONDS THEORY #4

The current largest certified red diamond is the 5.11 carat Moussaieff Red diamond. It has a flawless clarity. There are 2 more known certified red diamonds in the 5 carat size, there is a 4.59 carat red diamond and then the weight scale goes down to the 2.00-3.00 carat area with a 2.71, a 2.29 carat, a 2.26, a 2.11 carat, a 2.09, a 2.06 carat, a 2.03 and a 2.00 (to my knowledge). Then we go down into the 1.00-1.99 weight area with many more.

I heard that there is a 3 carat red diamond that exist, but I have not seen the certificate to confirm it myself. The vast majority of red diamonds are below the 0.50 carat mark. It is extremely rare to find red diamonds with clarities better than SI1. The vast majority are SI1 and below down to an I3 (or half cert). Rarely we see a VS2 or better such as the 2.11 Argyle Everglow. Such a combination makes a Red diamond extremely rare and very much desired by investors and collectors.

RED DIAMONDS THEORY #5

There are not many red diamonds sold in auctions.

It is true that since 1987 when the 0.95 carat round brilliant Hancock Red Diamond was sold for whopping $880k (a newsworthy sum at the time), there have been only 22 red diamonds (or 25 if we count multi red diamond jewelry pieces) that have been offered and sold at auction. The question is why not more red diamonds have been offered (like blue and pink diamonds)? The answer is simple. The vast majority of people, including dealers, do not really understand red diamonds and therefore prefer not to deal with them, unless they have a client that specifically asks for one.

Another famous red diamond that sold at auction, which also holds the current record price per carat for any red diamond sold at auction, is the 2.09 carat, Fancy Red, Heart Shape, with SI2 clarity. It was sold by Moussaieff. It was sold in November 2014 at a Christie’s auction in Hong Kong for over $2.4 million per carat. This 2.09 is the perfect example proving the Red Diamonds Theory #3. This 2.09 carat red diamond was an Argyle tender diamond which was certified as a pink diamond when it was offered.

CONCLUSION

This article summarizes the information and theories about red diamonds and their rarity. Are red diamonds rare? Yes. Are red diamonds the rarest color on earth? No. Violet and purple are; both in terms of quantities as well as in sizes. There are no pure violet and purple diamonds in the 5 carat size like red, not even a single diamond.

When buying a red diamond, one has to work with a trusted advisor that will not have a conflict of interest. The advisor will point out those red diamonds that may have a brown tint or an orange tint to it which should be avoided. The advisor will also help in properly valuing such a diamond and will also help acquire such a rarity.

Read this article at The Diamond Investment & Intelligence Centre (DICE).

What happens when the title event of Frieze week is a no show? It’s complicated. The fairs themselves – Frieze London, Frieze Masters, an already postponed Photo London – mostly moved online, although 1:54 optimistically went ahead with an IRL event at Somerset House.

Some Frieze week absences are welcome – the tired feet, gallery dinner malaise, bushels of Gail’s Bakery receipts – but, unsurprisingly, without the usual international traffic in town, the mood was and remains calm, steady, muted. Without marquee auctions accompanying the week – the biggest sales to coincide with Frieze week were Christie’s mixed offerings in New York and Sotheby’s successful contemporary sale in Hong Kong – the heat of blue chip commerce has been deferred in London to later this month.

The online iterations of Frieze and Frieze Masters, finely tuned technologically and stronger than most, generally contributed to the growing consensus that we’ve passed peak online viewing room. Bigger galleries reported meaningful sales, but there were few surprises. No fair passes without Hauser & Wirth pointedly announcing sales of at least several objects for several million each, yet there seemed to be little mention of reported sales from Frieze Masters.

While operating at a less frenetic pace there is nonetheless considerable depth to the museum and gallery schedule in London. The closest the week came to the usual fair buzz was a few hours on the afternoons of Thursday 8th and Friday 9th October on Cork Street. Blue chips Lisson and Sadie Coles have opened temporary spaces on the street, both until the end of October. While South Africa’s Goodman Gallery is a relatively new but permanent addition to the new Cork Street development which has stood empty for more than eighteen months. Outsize at the north end of the street is the new venture Saatchi Yates. Nearly three years in the making, the business is run by Phoebe Saatchi (daughter of Charles) and her husband Arthur Yates. The opening show – a young artist, Pascal Sender – is reportedly close to selling out, with large works priced at 50,000 – 60,000 GBP.

Typically the time of year for grand openings, there are further new spaces in the city. Dealer Ben Hunter has taken on White Cube’s first space at 44 Duke Street, opening with a sell-out show of paintings by Sarah Ball. Soon to open on Margaret Street, Fitzrovia is Workplace Gallery – headquartered in Gateshead – with a solo presentation by young painter Louise Giovanelli. Other galleries opened temporary off-sites in the centre of town – most notably Rome’s Galleria Lorcan O’Neill in Mayfair, Project Native Informant in Soho and Edel Assanti at St Cyprian’s Church in Baker Street.

Long in the making is the opening of Cromwell Place, a much talked about development of several South Kensington town houses into a commercial arts ‘hub’, with gallery spaces for hire, offices, club rooms and professional storage. Conceived several years ago as a response to the increasingly peripatetic nature of the art market and the focus on particular, seasonal moments in the city, the operation has nonetheless opened with a mixed offering of current occupants, most notably Lehmann Maupin – who appear to be longer term residents than others – and Edinburgh’s Ingleby Gallery.

Commercial shows in town remain strong, with or without the fair. Dana Schutz at Thomas Dane is a relative ‘must see’ (until 19 December 2020), as is Howard Hodgkin at Hazlitt Holland-Hibbert (until 11 December 2020) and John Stezaker at Luxembourg & Co. (until 5 December 2020). Other presentations of note include Christina Quarles at Pilar Corrias (until 21 November 2020) and a historicising group presentation, Nude at Olivier Malingue (until 11 December 2020).

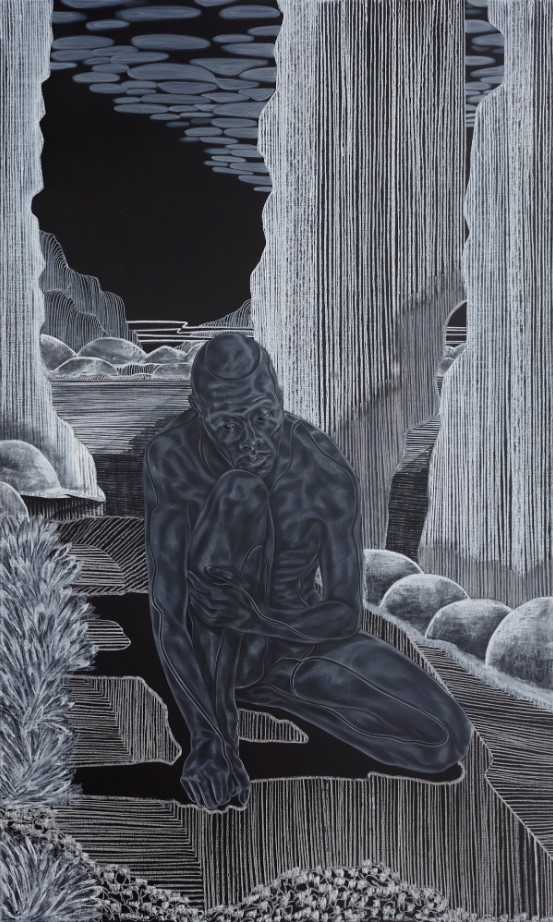

The autumn season also sees strong institutional presentations recently opened or soon to open. Critics and the commentariat have significant praise for Toyin Ojih Odutola’s solo exhibition at the Barbican (until 24 January 2021), and group shows including The Botanical Mind: Art, Mysticism and The Cosmic Tree at Camden Arts Centre (until 23 December 2020) and Not Without My Ghosts: The Artist as Medium at the Drawing Room (until 1 November 2020). Bruce Nauman’s retrospective at Tate Modern, the artist’s first major show in London for twenty years, presents one of conceptual art’s most provocative proponents in depth (until 21 February 2021).

Soon to open, and hotly anticipated, are the solo surveys of Lynette Yiadom-Boake (18 November – 9 May 2021, Tate Britain) and Zanele Muholi (5 November – 7 March 2021, Tate Modern). We’re also excited to see Tracey Emin / Edvard Munch at the Royal Academy of Arts (15 November – 28 February 2021). And, continuing the yBa theme, Damien Hirst’s self-mounted early career survey at the Newport Street Gallery (until 7 March 2021).

The woes facing the museum sector – Tate especially – are myriad. And staff at leading institutions, including the Royal Academy of Arts, have been vocal in their criticism of the organisation’s financial priorities following announcements of large redundancies and cost cutting. Commercial galleries are likewise working harder than usual to turn the wheels of commerce without the heat, buzz and noise of the art fair circuit. So the current outlook for the London arts scene is one of great resilience, yes, but also enormous flux. While a little stilted compared to other years, the exhibition schedule in London should remind us of its place – come what may in January 2021 with our departure from the European Union – as one of the world’s most important ecosystems for modern and contemporary art.

Image 1: Image courtesy The Art Newspaper; Image 2: Image courtsey Novaloca; Image 3: Image courtesy Cromwell Place; Image 4: Image courtesy Hazlitt Holland-Hibbert; Image 5: Image courtsey Barbican; Image 6: Image courtesy artnet news