Written by Henry Little, Director, Art Advisory; Charlie Wood, Associate Director, Art Advisory; Grace England, Researcher

INTRODUCTION

The Asking Price #2 – December 9th, 2022

The Fine Art Group is pleased to present The Asking Price, a new monthly newsletter focused on the global art market.

Drawing upon world leading expertise, The Asking Price offers regular insight into the complex world of art dealers, art fairs and auction houses.

For our second edition:

- Charlie Wood provides the key conclusions from the mammoth round of New York auctions in November, including the billion dollar sale of the Paul Allen Collection (5 minute read)

- Grace England explores the history of Miami’s vibrant contemporary art scene following Art Basel Miami’s successful 20th edition (7 minute read)

NOVEMBER AUCTIONS IN REVIEW

BY CHARLIE WOOD (5 MINUTE READ)

Due to the behemoth Paul Allen collection coming to market, the New York November Marquee sales occurred over two weeks this year. Total evening auction sales of Impressionist, Modern, Post-War and Contemporary art (with some Old Masters) reached $2.38 billion (hammer price) against the total pre-sale estimate of $2.07 – $2.59 billion. Exceeding expectation, this is the highest total on record and likely to catapult 2022’s total auction turnover into its highest ever result.

THE PAUL ALLEN COLLECTION

The first week began with the evening sale (Part I) of the Paul Allen Collection, which resulted in a hammer total of $1.3 billion ($1.6 billion with premium), surpassing the presale estimate of $1.06 – $1.23 billion, with all proceeds going to undisclosed charities. There has been much discussion about the lack of bidding wars or drama during the sale. However, much of this is due to the high estimates that accompanied the works, estimates that no doubt were required to win the sale from competitors. These prices took the wind out of the sale room activity but should not take away from the success of the auction and the tremendous results.

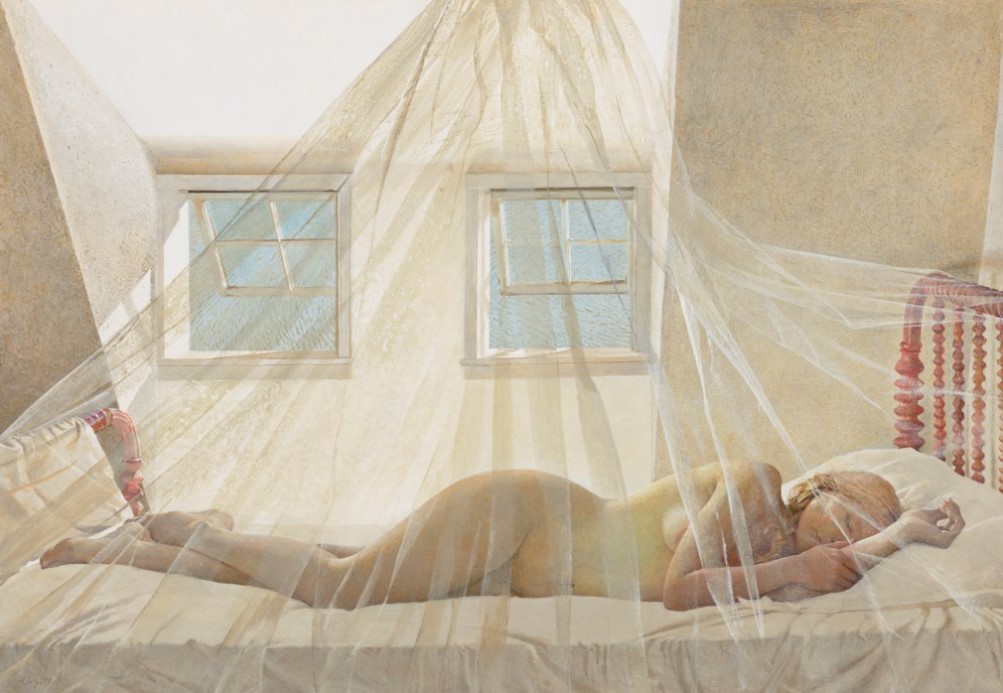

There was some spirited bidding on lots including Andrew Wyeth’s Day Dream (1980) which sold for a new record of $23.3 million (premium), more than seven times its high estimate, and Georgia O’Keeffe’s White Rose with Larkspur No. I (1927) which sold for $26.7 million (premium) above its $8 million high estimate. The whole sale set 20 new records for artists including Van Gogh, Klimt, Seurat, Jasper Johns and Lucien Freud.

All but one of the works sold (a Magritte was withdrawn as the sale began). Five lots sold for more than $100 million (premium), 15 others sold for over $20 million (premium) each. Of the 60 works offered, 39 were backed by third-party guarantees, but few of these works sold to their guarantors, a further demonstration of the wider demand for the material and pushing the results of the sale.

NEW YORK EVENING SALES

Despite Christie’s coming in with the highest total of the week due to Paul Allen, during the second week of sales Sotheby’s evening auctions appeared to have performed better than Christie’s overall. However, all the houses struggled, with several big withdrawals and reserve adjustments, meaning most sale totals were below expectations.

Sotheby’s began the second week with a single-owner sale of works from the collection of the late Whitney Museum president David Solinger. The 100% sold auction, remarkably with no guarantees, hammered at $116.4 million, towards the top end of the presale estimate of $86.7 – $118 million. Nearly half (11 out of 23) sold for hammer prices above their high estimates, with a new record for a de Kooning work on paper. Aside from this and Sotheby’s Now sale (also 100% sold), the remaining evening sales underperformed. Phillips’ sales total was $2.8 million below its anticipated total, Sotheby’s Modern and Contemporary sales together hammered $31 million below their pre-sale estimates. Christie’s 20th and 21st Century evening sales combined were $97.8 million below their expected hammer totals, their unsold $35 million de Kooning painting a large contributing factor.

Despite these totals, the average sell-through rate for these auctions was a very successful 94%. This is the result of tight sale management, lowering reserves and securing last minute third-party guarantees at conservative levels. Nevertheless, this confirms that most of these works did find buyers despite the market having spent $1.6 billion the week before. In addition, over $200 million was spent across all houses in the day sales, with an average sell-through rate of 84%. These sales, a high revenue stream area, with the houses not typically having to give away significant commercial terms compared to evening sale lots, are a good indicator of the stability of the market. As per past sale trends, the Post-War and Contemporary day sales continue to outperform the Impressionist and Modern category.

Despite this category remaining strongest, the market for some of the young artists in the newly coined ‘Ultra-Contemporary’ category, saw less frenzied demand than previous sale cycles, a development that had gently begun in the October London sales. Works by Maria Berrio, Lucy Bull and Salman Toor did all vastly exceed their estimates and saw lively bidding. By contrast, all but one of the offered Anna Weyant paintings sold for below her primary price levels of $600,000. Only one of the two Christina Quarles paintings hammered at the primary price level of about $1.2 million, the second painting hammering just above the low. Works by Amoako Boafo, Nicolas Party and Avery Singer also hammered below their low estimates. Yet the prices for many of these artists remain high for their age and career, more expensive than A+ works on paper (and even some paintings) by Impressionist and Modern Masters.

Moreover, these results should be viewed in the context of rising estimates and buyers becoming more selective as more works come to market. The differing results for the two Quarles pieces, for example, are to some extent reflective of the differing quality of the works. The successful outcome of the Sotheby’s Now sale that offers works from this category, hammering at $37.5 million against the low estimate of $32.4 million, also shows that this market segment still has considerable strength, even without the froth and unsustainable market heat.

The overall results reflect that the Paul Allen sale (and on a smaller scale, the Solinger sale) were a huge success, but the auctions that followed were markedly less so. This has led to some further suggestion that more challenging conditions may lie ahead for the art market. However, this viewpoint does not consider the wider picture, with $1.6 billion spent the week before, the buying power of collectors was perhaps waning by week two. This was a significant amount of material to ask the market to absorb. Moreover, the general totals and sell-through rates continue to display the resilience of the art market, against significant geopolitical disorder, rising inflation and fears of a recession that is currently affecting other markets to a greater degree.

These results also further demonstrate the importance of these single-owner collections in boosting overall volume and sales totals, as well as setting new records. More collections are anticipated to come to market in the coming years and these will continue to add vitality to a market that thrives off fresh material.

ART BASEL MIAMI BEACH: 20 YEARS

BY GRACE ENGLAND (7 MINUTE READ)

THE ‘MAGIC CITY’

This year marks 20 years since Art Basel came to the sunny shores of Miami, Florida, which has long been a haven for the wealthy to spend their winters and retire in a more forgiving climate. In the last two decades, however, the city’s cultural credentials have grown steadily. A 2018 study by UBS found Miami to be the second richest city in the U.S. and the third richest city globally when it comes to purchasing power. Today, the “Magic City” is home to dozens of art fairs, institutions, public art programs and private museums, including the Rubell, Margulies and de La Cruz collections. Each of these focuses primarily on American art and have vocally championed contemporary and emerging artists, opening their collections to the public in 1993, 1999 and 2009, respectively.

The correlation between the growth of private collections and the founding of public museums is strong, with the Museum of Contemporary Art in North Miami and the Institute of Contemporary Arts also opening in the mid-1990s. Above all, Art Basel is credited for the major expansion of the city’s art scene. Aside from a well-established collector base, the city’s location affords a dialogue with South American artists, galleries and collectors, as well as an appealingly warm climate in the traditionally off-season month of December.

THE BIRTH OF ART BASEL MIAMI

The arrival of Art Basel in Miami, and the subsequent expansion of its art scene, is largely attributed to two entities: the Miami-based collectors Norman and Irma Braman, and their long-term advisor and art world powerhouse, Jeffrey Deitch. Some of the earliest U.S. visitors to Art Basel in the 1980s, the Bramans introduced Deitch (who had first led them to Basel) to more Miami-based collectors who quickly turned into clients. This would connect Deitch to individuals who became pivotal in the creation of Art Basel Miami, namely Craig Robins (developer of the Miami Design District).

The reported “top buyer” at the time in Basel, Deitch developed close links with the fair’s chief, Lorenzo Rudolf, and director of communications, Sam Keller. When the fair looked to the U.S. for a new location, the Bramans proposed Miami Beach. The main selling points were the wealthy demographic with great buyer potential, the reasonable pre-holiday hotel rates before the Christmas festive season, and the excellent climate and glamorous lifestyle which would attract party-loving fairgoers.

With an initial delay due to 9/11, the fair officially opened in December 2002. From the start, the Miami Design District played a distinct role. With Craig Robins having begun to acquire property in the neighborhood during the 1990s, it has since become a community of designer shops, high-end restaurants, museums and fair spaces. Special exhibitions by the fair have taken place there almost every year since its opening, with the Institute of Contemporary Art and de La Cruz Collection both located within the Design District.

To this day, Deitch remains an integral partner in the fair’s activities. Since 2015 he has frequently collaborated with Gagosian on a satellite show during the fair’s run, with the latest show this year, 100 Years, featuring the likes of Theaster Gates, Damien Hirst and Rachel Whitehead, and taking place at the Buick Building in the Design District.

A FOCUS ON THE RUBELLS

Having begun collecting in New York in the mid-1960s after their marriage, Mera and Don Rubells’ collecting habits expanded after the death of Don Rubell’s brother, the infamous owner of Studio 54 nightclub, Steve Rubell. His significant inheritance allowed them to develop their collecting habits and invest in a number of hotels in South Florida. This began their historical relationship with Miami with the couple moving to the city from New York in 1998. Collecting emerging contemporary artists from the beginning (their initial budget for art buying in the mid-1960s was $25 a week), their collection now holds works by over 1,000 artists, including Jean-Michel Basquiat, Marlene Dumas, Oscar Murillo, Cindy Sherman and Kara Walker.

In 1993, they opened the Rubell Family Collection in the Wynwood neighborhood of Miami. An anomaly in the area at the time, they would kickstart a new trend for private collections and art-focused businesses and galleries opening in South Florida over the next decade. As of 2019, the collection is housed in the Allapattah neighborhood in the re-named Rubell Museum. Reportedly owning over 7,400 works, the Rubells also announced the opening of a second museum location in Washington, D.C., in October 2022. An important development, it demonstrates how far the Rubell influence has traveled outside of the West Coast to become a recognized institutional body.

OUTSIDE OF ART BASEL

As the longstanding mainstay of Miami’s contemporary art ecology, Art Basel is now surrounded by a plethora of other art and design fairs across Fort Lauderdale and Miami Beach during this pivotal week in December. Design Miami launched in 2005 under Craig Robins as a way to both incorporate design galleries into the fair week and further develop the Design District. Others have joined too, including NADA (New Art Dealers Alliance) in 2002, and Untitled in 2012, both focusing on emerging art. Not forgetting of course Art Miami, Miami’s longest running anchor fair which preceded Basel, having launched in 1989. Originally following Art Basel Miami in January, it now runs in parallel and comprises a wider empire, incorporating other fairs in Miami and New York such as CONTEXT, Aqua Art Miami, Art Wynwood, Palm Beach Modern + Contemporary, and Art New York.

Miami art week has become known for a more ebullient atmosphere, possibly the consequence of its more informal appeal compared to the original Art Basel. This took an early form in performance art and began under Jeffrey Deitch. Deitch Projects first launched its performance program in the house (and pool) of collector George Lindemann at the first Art Basel Miami in 2002. Deitch continued with this performance program (his last in 2014 included pop singer Miley Cyrus) until he switched to an exhibition collaboration with Gagosian in 2015. The performance strain of Miami art week has, however, continued to thrive. In 2022, South African artist William Kentridge, fresh from a concurrent career retrospective at the Royal Academy of Arts in London, performed a work at the Adrienne Arsht Center for the Performing Arts.

In 2021, with the arrival of NFTs and huge growth of the digital art scene, Miami was quick to participate in the market frenzy. Art Basel Miami partnered with blockchain Tezos to invite guests to mint their own NFT, NFT superstar Beeple was spotted making the rounds at the fair, and NFT platforms and NFT selling galleries such as SuperRare, Pace Verso and Nagel Draxler were granted booths. A momentous moment, with Art Basel Miami arguably the first mainstream fair to fully incorporate and promote NFTs, it took advantage of the recent emigration of many fintech companies to low-tax South Florida, as well as introducing Miami’s wealthy collectors to another sector of art collecting.

While the NFT world has suffered considerable setbacks in 2022 with the crash of the crypto market, inflation and general market distress, tech-enabled art platforms continue to expand in Miami, with a key example being Aorist, a climate-conscious NFT marketplace launched during 2021’s Miami art week with an immersive, aquatic-themed installation by Refik Anadol.

THE ULTIMATE SUNSHINE APPEAL

Miami art week has become a vital keystone event in the art market calendar. Art Basel, and the subsequent growth of Miami’s contemporary art scene, has resulted in a collector hub, fueled by the establishment of native commercial galleries such as David Castillo, Fredric Snitzer and Emerson Dorsh.

Attractive from the beginning for its location, climate and wealthy demographic, since inception Art Basel Miami has become the most celebrity laden of the annual fairs (competing only with Frieze LA). Leonardo DiCaprio, Sylvester Stallone and Barbara Streisand are all big-time collectors and regular visitors. It is certainly the most carnivalesque of the Basel fairs. The artwork on offer, extravagant events and overall atmosphere are far less formal than traditional art fairs – a combination, perhaps, of pre-Christmas anticipation, local wealth and sunshine. At a time of year when the art world fades into hibernation for the holiday season, and art market centres London and New York cool, literally and figuratively, Miami offers warmth and energy to close out the year.

EXHIBITIONS NOT TO MISS

LONDON

Barbican – Carolee Schneemann, Body Politics

Barbican Centre, Silk Street, London, EC2Y 8DS

Until 8th January 2023

Lisson Gallery – Richard Long, Drinking the Rivers of Dartmoor

27 Bell Street, London, NW1 5BY

Until 21st January 2023

Ben Hunter – Rodin, Moore, Whiteread, Keith-Roach

44 Duke Street St James’, London SW1Y 6DD

Until 27th January 2023

Gagosian – Lucian Freud, Francis Bacon, Frank Auerbach, Michael Andrews

20 Grosvenor Hill, London, W1K 3QD

Until 28th January 2023

Tate Britain – Lynette Yiadom-Boakye, Fly in League with the Night

Millbank, London, SW1P 4RG

Until 26th February 2023

NEW YORK

Mnuchin Gallery – Lynne Drexler, The First Decade

45 East 78 Street, New York, NY 10075

Until 17th December 2022

Gagosian – Anselm Kiefer, Exodus

555 West 24th Street, New York, NY 10011

Until 23rd December 2022

Green Naftali – Jacqueline Humphries

508 West 26th Street, New York, NY 10001

Until 14th January 2023

Mendes Wood DM – Antonio Obá

47 Walker Street, New York, NY 10013

Until 21st January 2023

Guggenheim – Alex Katz, Gathering

1071 Fifth Avenue, New York, NY 10128

Until 20th February 2023

TOP ART MARKET STORIES THIS MONTH

- Art Basel in Miami Beach sales report: Dealers Brace for Gloomier Times Ahead

- At Art Basel Miami Beach, a Tale of Two Markets: Lean at the Top, But Robust on the Lower End

- ‘Art Basel has to keep changing’: after 20 years, what is next for the fair juggernaut?

- Hong Kong’s autumn auctions for modern and contemporary art saw a 38% drop from last year—but why?

- A Hack Has Revealed What Many Long Suspected: The Owners of Auction Houses Are Also Some of Their Best Customers

- Paul Allen’s Masterpiece-Filled Collection Sells for $1.5 Billion at Christie’s, the Biggest Sale in Art-Market History

- Despite Shanghai fairs Art021 and West Bund shutting early due to Covid concerns, dealers report decent sales

LOOKING AHEAD

After a busy autumn season with no COVID-19 related disruptions the market will quieten until early February when Frieze Los Angeles opens for the first time at Santa Monica Airport with more than 120 exhibitors.

Meanwhile Art Basel Hong Kong, opening late March 2023, is will open for the first time without strict quarantine restrictions in place.

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Written by Henry Little, Director, Art Advisory; Charlie Wood, Associate Director, Art Advisory; Grace England, Researcher

INTRODUCTION

The Asking Price #1 – November 3rd, 2022

The Fine Art Group is pleased to present The Asking Price, a new monthly newsletter focused on the global art market.

Drawing upon world leading expertise, The Asking Price offers regular insight into the complex world of art dealers, art fairs and auction houses.

For our inaugural edition:

- Henry Little interviews Matthew Travers, Director of Piano Nobile in London, discussing the gallery’s comprehensive survey of Frank Auerbach portraits (7 minute read)

- Grace England covers British painter Glenn Brown’s new private museum, The Brown Collection, exploring the wider trend of self-funded artist museums (6 minute read)

- Charlie Wood provides incisive analysis of the Frieze week auction sales, highlighting some of the most important sales and developments (5 minute read)

INTERVIEW WITH MATTHEW TRAVERS

BY HENRY LITTLE (7 MINUTE READ)

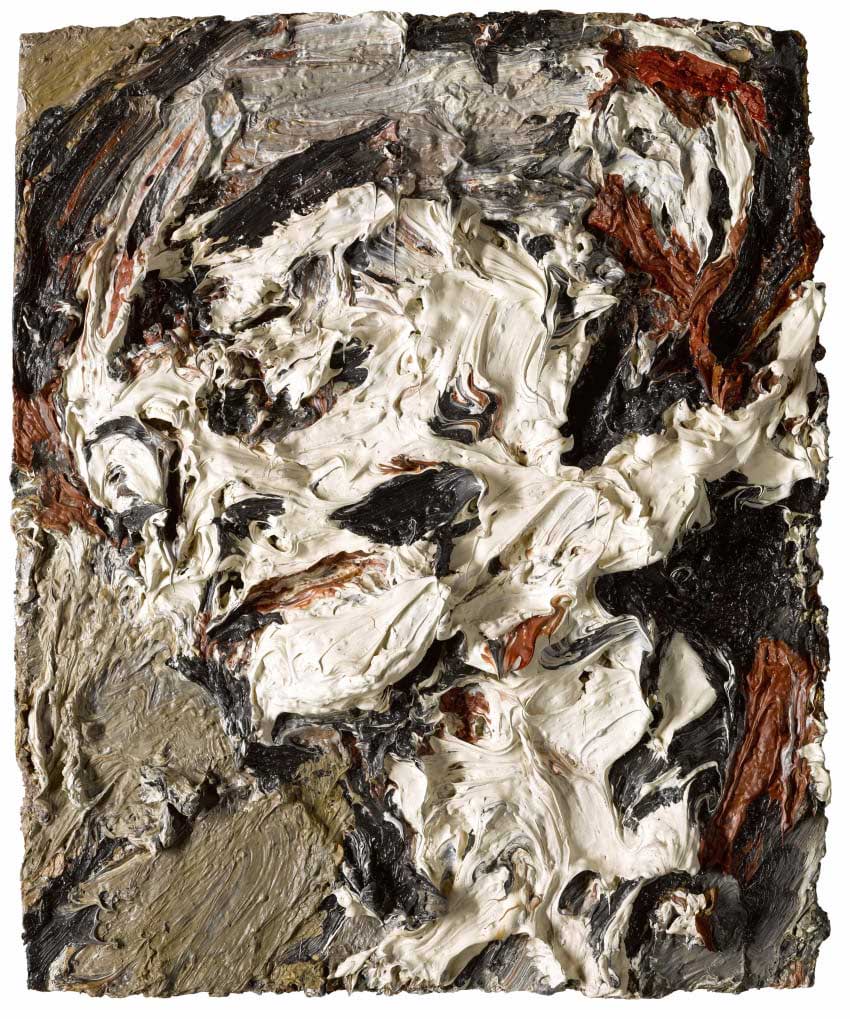

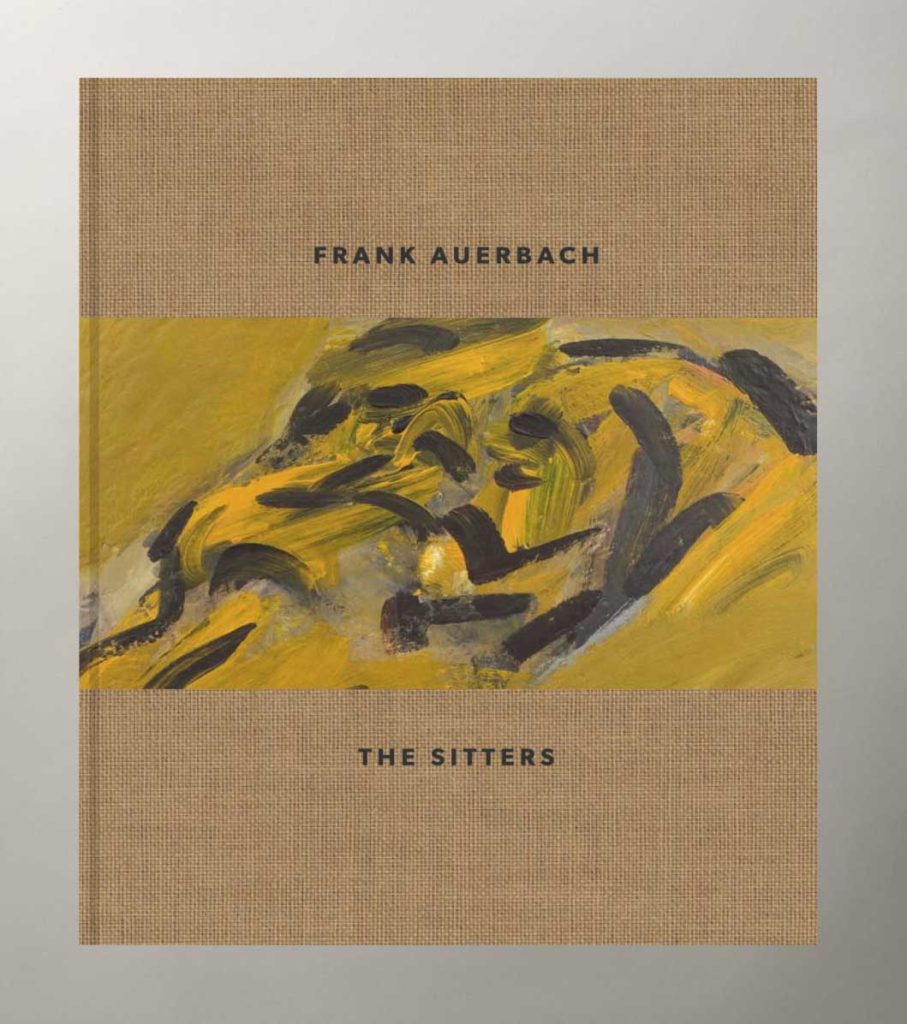

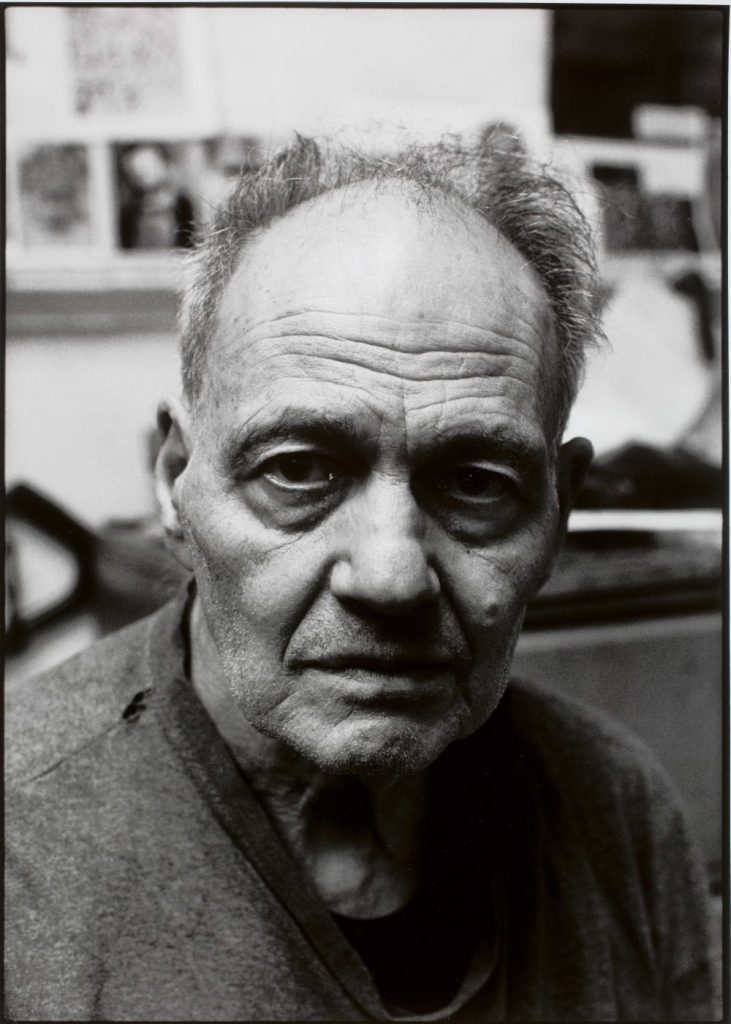

Known for their distinguished taste, Piano Nobile specializes in 20th Century British art. Until Dec. 16, the gallery hosts Frank Auerbach: The Sitters, a wide-ranging survey of the celebrated nonagenarian painter’s portrait heads from 1956 to 2020.

We spoke to Matthew Travers, Director at Piano Nobile, about the process of preparing such an important exhibition, writing catalogues and the nuances of the artist’s market.

Henry Little: You’re currently hosting a major survey of Frank Auerbach’s portrait heads, offering a survey of the artist’s work from 1956 to 2020. Could you describe the process of developing and mounting an exhibition like this? With so many important works there must be a long lead time for such a considered presentation.

Matthew Travers: We love presenting this type of exhibition, particularly for artists whose work we handle regularly. It’s important to find a moment to celebrate the artist because that has two purposes. One, to be able to enjoy them and see them together, and the other, to allow our audience, if they know the work very well, to understand it better. For an audience that doesn’t know it so well, we can introduce them to the work in a deeper way.

Even for someone like Frank Auerbach, to see a concise, consecutive body of work is not necessarily that easy unless there’s a major museum retrospective, so that was the thinking behind it. We’ve been thinking about shows like this for a long time, and we isolated the idea that we wanted to present a show of the portrait heads. For me, they’re some of his greatest works. They’ve got an amazing intensity and power. Of course, the landscapes are incredible, large and beautiful things, and that could be another exhibition entirely. But it was really the heads that we wanted to start with. It’s always about a 12-month lead time from fixing a date to gathering the works and getting the catalogue together. From a press point of view, timing is very important.

Then it’s a case of acquiring works for gallery stock, which we do all the time, and building up a base of works we know we can structure the show around, but then also leaning on the generosity of lenders, and being able to pull a major group of works together. It would be impossible to go into the market and pull together 40 major Frank Auerbachs from across his career that tell a story and are tightly curated. So, it’s very much down to the generosity of owners, whether it be existing clients we sold to or talking to people who have works.

It’s amazing how generous people are prepared to be, and the understanding is that a show like this is only a good thing for everybody. It adds great provenance to a work, it’s wonderful to see it published in a new publication, and it celebrates a painter and develops the world’s understanding of him. These things make people very happy to loan. Often people hear we’re doing a show and voluntarily offer things to us; some great works came to us that way for this exhibition. We often borrow from museums as well; that’s sometimes a longer process. You need a good lead time to achieve that, at least 12 or sometimes 24 months.

One of the great USPs of this show is that all the works come from private collections so they’re works you wouldn’t generally see. I think that’s a wonderful thing to do: to bring a body of work together that not only speaks of the artist and his development throughout his career, but also brings fresh work into the public eye that hasn’t been seen for decades publicly. Visitors can look at them in a relaxed, quiet environment, where they can get up close to works, study them and not be distracted by the larger spaces of a public museum or large gallery space. Smaller works, domestic-size works, life-size works, as in Frank Auerbach heads, can always feel very powerful, but are made to feel rather small in huge spaces.

Showing them in smaller rooms speaks very much to the way they were painted, whether it’s particularly for London school, whether it’s Kossoff or Bacon. Bacon’s studio was tiny. Freud worked in domestic spaces. These works were made in London rooms, in London spaces, in the proportions of London houses; therefore, to show them in that type of space only enhances them and the viewing experience.

HL: What purpose do such exhibitions fulfill for the gallery? How do they help build your reputation for specialist expertise?

MT: We have a clear focus on London School painting. Many works come in and out behind the scenes that the world never sees, so to take a moment to celebrate this painter is exciting. From our point of view, it helps a wider public see the breadth and body of work that we’ve handled over the last few years and, of course, works are for sale. It helps a wider public understand what the gallery is up to. Roughly a third of the show is for sale. For an artist such as Auerbach, works appear sporadically in isolation, in the auction sales, at an art fair or in a gallery. But coming to an exhibition with works available from the early 1960s, all the way through to a recent work by Frank from 2020 is special.

To have that choice gives collectors an amazing opportunity to think about buying Auerbach, to compare a body of available work. It’s important to isolate what makes collectors tick and understand which area of the artist’s work appeals to them.

The early work has a hugely important presence within his career, people love it, and traditionally the values have been highest there. But he’s an amazingly consistent painter. I would argue his entire oeuvre is exceptional and within that, it’s natural to have preferences. Some collectors prefer the 1980s, 1990s or the 2000s over the darker, heavier, more angst ridden 1950s and 1960s paintings. That’s personal preference and there’s no right or wrong. To look at all aspects of that and have works within that, that are available, is a big part of the exhibition for us and offering that service to clients and collectors.

HL: Why did you think now was the right time to stage such a meticulously curated show?

MT: When presenting a tightly curated show such as this, timing is important. There have been many shows of Frank’s work in the past, whether large or small, which are more general retrospectives. But he comes out of the wider London School and ultimately the post-war period is about the depiction of the human form, finding new ways of depicting the human form in a post-war world. Surprising as it may sound, we believe this is the first-ever show dedicated to Auerbach’s portrait heads.

That’s why we settled on it and were intent on keeping the curation tight, with a concise body of work from the 1950s through 2020. We have presented paintings and drawings from every decade of the artist’s career that chart changes in sitters from the early works. E.O.W., Gerda Boehm, to Catherine Lampert, the most recent sitter being William Feaver, who has been sitting for over 30 years. Julia Auerbach has been the longest standing sitter, with works from 1960, and his most prominent muse in recent years.

We have, therefore, been quite selective and have not just shown a group of works we can easily secure. Producing something that makes sense, that is not overly weighted in one place and not others, is key to it, and also stands the test of time.

HL: Can you explain how you piece together your exhibition catalogues, the role they play and what you think about when writing texts for such publications?

MT: The catalogues play a huge role in the exhibition. The exhibition is transitory and is here for a couple of months. But then it is gone, and the works go back out into the world. Publishing is a very important aspect of what the gallery does. Every time we produce a catalogue, it is more than just a record of the exhibition. It becomes a reference point for us and collectors.

We wish to produce something that is a meaningful addition to the artist’s literature and ultimately which supports, enriches and promotes the artists in which we’re interested. This catalogue has a previously unpublished interview with the artist and Martin Gayford. We republished an important text by Michael Podro, a great friend of Auerbach. Michael was a wonderful art historian and writer on Auerbach’s work. So many important writings on artists in their lifetime were published in obscure places. Our catalogue is now the most accessible place to find this essay and it still rings true today, even though he wrote it 50 years ago.

Another aspect of the catalogue is to provide a comprehensive record of Frank’s sitters, as this is the focus of the show. We thought it constructive to compile a full list with information on each of them, roughly 40 in total. It also builds a timeline. The earliest sitters were Leon Kossoff and Stella West. In the 1970s and 1980s, there were several short-term sitters. But then, as with the early works, the later works are refined back down to half a dozen regular sitters, who have been sitting for 30 or 40 years.

The sitters would have regular appointments in the studio once a week, often for two-hour sessions, where Frank would paint them. The work would then be pulled out a week later, scraped down and repainted. Sometimes 20 or 30 sittings, which could mean 20 or 30 weeks of sittings, if not longer, for a work to be produced. This is an incredible regimen, enforced by the artist, which is a true partnership with the sitter.

HL: How does Frank’s exhibition fit within the gallery’s wider program?

MT: We specialize in 20th century British art, positioned in the wider context of American and European artists. Britain certainly wasn’t working in isolation. The gallery mounted a show in 2020 titled Drawn to Paper: Degas to Rego, looking at Parisian School painters. We often handle the work of Giacometti or Degas, occasionally Picasso or Léger, because these artists did have an important effect on British painting, like Dalí and British Surrealism. Another aspect of this specialism is British figurative painting from Sickert until today. An important part of that history, that lineage, is post-war London painting, the School of London as Kitaj dubbed it.

It felt like the right moment to mount this exhibition. It could have been something we did in a few years’ time, but it was wonderful to have Frank’s involvement. So it’s part of our wider positioning of celebrating London School painting.

HL: What are the greatest pleasures of bringing together such a historic group of works?

MT: To live with them and study them only adds to one’s expertise on the artist, and one’s assurance when advising and buying in the future. Especially understanding why works are great, what aspects one is looking for in different periods, and what one might look for from a condition point of view. This is incredibly informative and enjoyable, bringing a deep satisfaction in realizing a compelling group of paintings.

HL: Can you elaborate on the concurrent presentation of Nicola Bensley’s photographs, Frank Auerbach: A Morning in the Studio, and how they complement the wider exhibition?

MT: For any exhibition, it’s always a dream to find unpublished photographs of the artist that have never been seen. In this case, we spoke to Nicola, a great photographer. She went to visit Auerbach in 2015 for a morning, making works in natural daylight from black and white 35-mm film. She took several iconic images of Auerbach at the age of 87, looking like he could be a man in his fifties.

This is testament to the power and strength of the man. Not just of the mind, but physically. Oil paint is heavy and hard to manipulate, particularly when scraping it off.

HL: Can you provide indicative price ranges for available works in the exhibition?

MT: Auerbach’s works are highly sought after. The show ranges from £250,000 for a 1980s or 1990s charcoal, to multiple millions for earlier heads. Recently, the artist’s Head of JYM (1984-85) sold at Sotheby’s for a record public price of £5.65 million (including premium). His market has grown organically and is therefore incredibly robust. The new catalogue raisonné now runs to 2022, providing greater clarity on extant work. These are beautiful, rare things and they will only become more sought after with time.

We find our clients for Auerbach are totally global, whether it’s from the US, East Asia, Europe, Middle East and Africa, South Africa, or South America. They are all over the world and he touches on something very broad, very human, which has a totally international appeal and will continue to do so.

Two works, which sum up the exhibition for me, are from totally different periods. Sixty years apart, they are both for sale: the early charcoal from 1960 of Julia, Auerbach’s wife, and the last work we are showing, Reclining Head of Julia, from 2020. To see his longest standing sitter, Julia, 60 years apart, has a powerful resonance. Together, they demonstrate a trajectory which is ultimately redemptive of a young man dealing with the horrors inflicted by the Second World War, losing his parents and being uprooted from his place of birth, Berlin, and moving to England. In this beautiful late work of his wife Julia, she is afflicted with all the pains of old age but there is a kind of peace to it.

THE RISE OF THE ARTIST MUSEUM

BY GRACE ENGLAND (6 MINUTE READ)

THE GLENN BROWN COLLECTION

Among the hundreds of events, private views and shows which launched during Frieze Week (as well as the fair itself), British artist Glenn Brown opened his own self-funded museum, The Brown Collection. Tucked away in a mews off Marylebone High Street, Brown says he hopes the collection will introduce his work to a larger audience and provide visitors with a haven to sit, read and relax. Announced a month ago, The Brown Collection will initially exhibit the artist’s own work, with plans over time to bring in pieces from other artists in Brown’s personal collection.

A mix of sculptures, paintings and drawings from Brown’s oeuvre, the collection is housed in Bentwick Mews, a property the artist purchased six years ago. Having originally planned to use the house for a studio office, Brown instead made the decision to restore and convert the building into an archive and exhibition space frustrated, he said, by the fact that “people couldn’t see my work in London.” Indeed, while Brown is widely collected and included in major public collections throughout the UK, including the Tate, British Museum and Arts Council, he has not had a major institutional show in Britain for some years, his last large-scale retrospective taking place at Tate Liverpool in 2009 (later touring to museums in Turin and Budapest).

Bemoaning the rotation of commercial shows as too slow (especially given the transnational nature of Brown’s market), Brown has opened this new venture close to The Wallace Collection, a museum housing many masterpieces which have inspired his own practice (a must-see is his version of Fragonard’s Blue Boy). While Brown’s work is sought after on both the public and private market, the Brown Collection’s impressive capacity is largely due to a tendency by the artist to retain as much of his own work as possible. The artist is also known to buy back some of his earlier, more historic pieces.

Glenn Brown is the latest example of a growing number of artists who have founded and self-funded museums of their own work. While many single-artist foundations have been established posthumously (with examples including The Frida Kahlo Museum in Mexico City, Musée Picasso in Málaga and Paris, and Musée Courbet in Ornans) a select few have been founded by the artists themselves in their lifetimes.

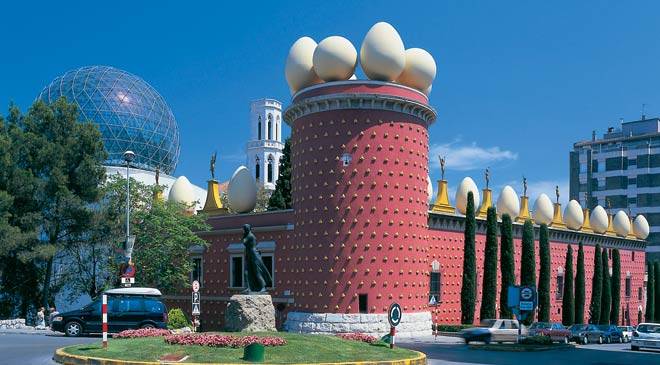

One of the most impressive (and bizarre) “artist-museums” is the Dali Theatre and Museum in Dali’s hometown of Figueres, Spain. Conceived in the 1960s by Dali and the Mayor of Figueres, Dali took over the ruins of the town’s municipal theatre in the 1970s, a building of sentimental value where Dali had held the first ever exhibition of his work. The Dali Theatre-Museum officially opened in 1974 and, as well as housing over 1,000 works by Dali, is considered a Surrealist masterpiece, with every aspect of the architecture and interior designed by Dali himself. These include some suitably wacky features, including the Mae West Room, an installation when viewed from a certain angle forms the ‘face’ of the famous actress. The artist’s burial crypt sits at the center of the museum.

Establishing a legacy, and having control over that legacy, seems to be the crux of the artist-museum. Yayoi Kusama, currently the world’s most expensive living female artist, opened her own museum in her home city of Tokyo in 2017. Operated as the principal project of her foundation, its aim (according to the museum director) is to offer “visitors a chance to learn about the courageous battles that Kusama has fought as an avant-garde artist, allowing them to experience and feel the sincerity of her ideas.” As an artist who faced a great deal of sexism and xenophobia early in her career, and who has battled mental health problems for most of her adult life, establishing her own controlled and curated space seems to have been the paramount motivation.

A fear of mortality is also a key factor when artists decide to transition from creative to curator. British artist Tracey Emin recently underwent an intense battle with bladder cancer and the disease came close to claiming her life. In September 2021, after undergoing extensive surgery, Emin announced that she would turn her Margate studio into a museum after her death. Partly inspired by a visit to Marfa, Texas, where she saw the Donald Judd Foundation building, Emin decided she wanted a place to house her extensive archive of works, photographs and essays, as well as her own collection of “other people’s art.”

In January 2022, Emin announced the establishment of a museum and art school. Launched in October 2022, TKE Studios provides 30 affordable artist studios, as well as an 18-month artist residency funded by the Tracey Emin Foundation. A former mortuary, which sits near the 30,000-square-foot converted bathhouse, the property will also serve as a small museum for Emin’s enormous archive of 30,000 photographs and some 2,500 works on paper.

The growing popularity of the artist-museum is perhaps the latest step for contemporary artists choosing to exercise greater autonomy over their image. At a time when the artist’s public persona is increasingly scrutinized, with cancel culture, social media and gallery hierarchies having the power to make or break an artist, the artist-museum allows artists to regain some control over how they might be perceived.

Indeed, foundations which have chosen to establish single-artist museums posthumously have often been met by the dilemmas of inheritance struggles, legal disputes and family conflict. The most prominent example is the Picasso Family which has endured numerous disputes for decades. Most recently, plans for a new Picasso Museum in Aix-en-Provenance were abandoned in September 2020 after three-year negotiations between the town council and Picasso’s stepdaughter Catherine Hutin-Blay collapsed.

By choosing to establish open collections in their lifetimes, prominent public-facing artists like Brown, Emin and Kusama can avoid some of the misrepresentations of legacy and the dispersal of personal collections which can often follow death. Reflecting on the creation of her new artist studios, residency and museum, Emin remarked: “When I was ill, I thought I was going to die. A part of me asked, what’s it all about? What am I here for? What am I doing? I knew I could do so much more, but I wasn’t sure what it was. And then the whole thing made perfect sense. If we can get one person here that becomes a really good, amazing artist, I’ve done my job.”

From the sentimental to the truly fantastical, no matter what form it takes, the artist-museum has emerged as a powerful phenomenon.

FRIEZE WEEK 2022 ROUND UP

BY CHARLIE WOOD (5 MINUTE READ)

AUCTIONS ANALYSIS

The Frieze Week London auctions opened to a backdrop of jitters surrounding uncertainty around UK government policy and the falling pound. Overall, however, the sales were a success for all the major houses, selling squarely within or above their presale estimates. Sotheby’s lead the total at £96 million ($107 million), the highest result for its October sales in seven years. Christie’s followed with £72.5 million ($82.2 million), which beat its 2021 Frieze total, and Phillips was at £18.7 million ($20.9 million).

All of them achieved strong sell-through rates ranging from 94-100%, but the sales were tightly managed with several withdrawals from each house ahead of time, helping to ensure strong final statistics.

There was much speculation regarding a potential increase of international buyers piling in due to the falling pound, and while there was significant international bidding, data released by the houses reflected broadly similar levels to last year. American and Asian bidding continues to be hugely important to the results of these sales and they remain firmly scheduled to conveniently capture both time zones, despite disrupting schedules for those also at Frieze.

Christie’s evening sale demonstrated significant Asian bidding: one paddle bid on over 10 lots and was a huge support to the sale. Likewise, Sotheby’s had strong levels of American bidding which drove the prices for several top lots, notably Gerhard Richter’s “first abstract painting” 192 Farben (1966) which sold for £18.3 million premium ($20.5 million) against an estimate of £13 – 18 million.

Young contemporary artists continue to show market strength. Phillips, always strongest in this area, ensured its sale was much more focussed towards this category with fewer Impressionist & Modern lots offered this season despite previously venturing into these collecting categories. Several artists making their auction debut, including Julian Pace and Rebecca Ness, significantly outperformed their estimates.

High prices were also achieved for Flora Yukhnovich and Caroline Walker, but there was notably calmer bidding for other artists in this category, including Jadé Fadojutimi, Christina Quarles and Shara Hughes. Not necessarily reflective of waning demand, estimates for many of these artists have now significantly increased, therefore, hammer prices are falling closer to their pre-sale expectations rather than vastly outreaching them as per previous sale cycles.

There were strong results for several blue-chip paintings throughout the week. David Hockney’s unusual landscape Early Morning Saint-Maxime (1968 – 69) vastly exceeded expectations at Christie’s, selling for £20.8 million premium ($23.7 million), double its high estimate. Richter’s cloud painting, Study for Clouds (Green-blue) (1971), also performed well at Christie’s with a result of £11.17 million premium ($12.7 million). Bidding was notably thinner, often with just two buyers battling it out, suggesting that demand at the very top level could be tightening. Two top-priced Banksy works fell significantly below expectations as price levels have, perhaps, reached an unsustainable level.

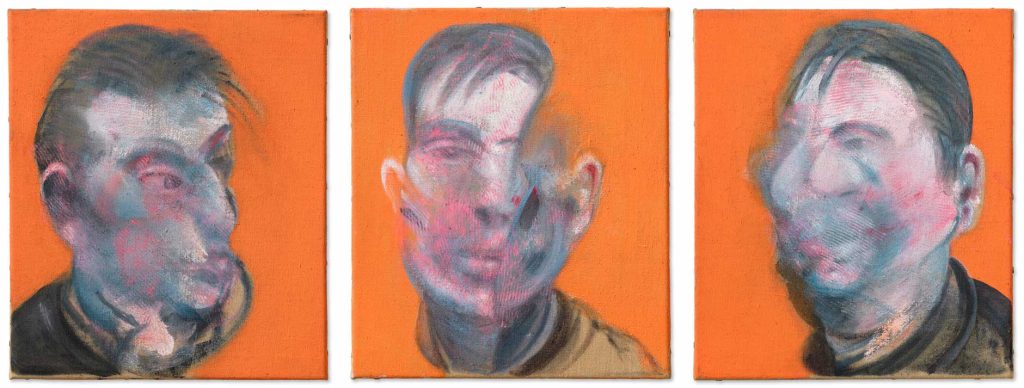

Top-priced works sold nonetheless; several key trade buyers made opportunistic purchases. The Nahmads acquired Christie’s Francis Bacon Painting 1990 (1990) below estimate; it hammered at £5,950,000 ($6.6 million) below a £7 million low estimate. At such a sensible price the piece was undeniably an attractive option for inventory.

Notable auction records for the week include a new record for a Tracey Emin painting set at Christie’s: Like a Cloud of Blood (2022) sold for £2.3 million premium ($2.6 million) against a £700,000 high estimate. New records were set at Phillips for Michaela Yearwood-Dan and Robert Nava. Sotheby’s set artist records for Louise Giovanelli, Charlene von Heyl, Kiki Kogelnik, Julien Nguyen, Caroline Walker and, most significantly, Frank Auerbach for his 1984 – 1985 Head of J.Y.M, achieving a new record of £5.6 million premium ($6.3 million).

5 EXHIBITIONS NOT TO MISS IN LONDON

Maximillian William – Somaya Critchlow, Afternoon’s Darkness

47 Mortimer Street, London, W1W 8HJ

Until 19th November 2022

Thomas Dane – Cecily Brown, Studio Pictures

3 Duke Street, London SW1Y 6BN

Until 17th December 2022

The Approach – Caitlin Keogh, Running Doggerel

1st Floor, 47 Approach Road, London, E2 9LY

Until 17th December 2022

Hayward Gallery – Strange Clay: Ceramics in Contemporary Art

Belvedere Road, London, SE1 8XX

Until 8th January 2023

Tate Modern – Cezanne

Bankside, London, SE1 9TG

Until 12th March 2023

TOP ART MARKET STORIES THIS MONTH

- Artists take to Instagram to criticize Gilbert & George’s claims that museums are now ‘woke’ and only focus on Black and women artists

- Frieze Opens to a Flood of Hungry Collectors, Calming Fears That Competition From Art Basel’s New Paris Fair Would Tank Attendance

- Paris+ par Art Basel’s VIP opening: galleries report good sales, the right people and a clear step up from Fiac

- Damien Hirst – The Currency: Is setting fire to millions of pounds worth of art a good idea?

- Opening Paul Allen’s Treasure Chest

LOOKING AHEAD

The highest value single owner sale to come to auction, the sale includes notable works by Botticelli, Canaletto, Cezanne, Lucian Freud, David Hockney, Gustav Klimt and Georges Seurat, spanning 500 years of art history.

All proceeds from the sale will be donated to charity.

FURTHER READING

- The Asking Price: Understanding Value 2

- Market Update: How the Art Market Joined the Digital Age

- Jan Prasens on Talking Galleries Panel Focus: Art Finance Debunked

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.