Originally published in RedBook, March 22, 2022

When looking to acquire art works for your new home, there is often one big question: where exactly do I start?

Leading authorities in the field, Guy Jennings and Henry Little, share all you need to know.

1. Are you a decorator, collector or investor?

A key question to consider when acquiring art works for a new home. Most people are a mixture of all three, but it’s important to understand the nuances of each. Decorators might be content with works which lack art historical importance and whose financial value will deteriorate in the long term. Collectors will take a more research driven approach, looking to acquire works which embody an aesthetic position and demonstrate a degree of knowledge about art and the market. While investors might seek medium to long term returns at the expense of art historical merit or developing a personal aesthetic. There’s no reason these priorities should be mutually exclusive, however. With a sufficient degree of knowledge and the right advice, from an art advisor such as The Fine Art Group, it’s entirely plausible to source a group of works which accords beautifully with the architecture, is artistically consequential and will appreciate in value. Prepare to invest time if you want to do more than simply fill walls.

2. Look, listen, read.

There really is no shortcut for learning, whether guided or independent. Visiting major museums will set a yardstick for determining quality in a marketplace which is notoriously cacophonous. Attend the major art fairs. Frieze and Frieze Masters in London or Art Basel can be dizzying at first, but offer an unparalleled view of the market in a compact viewing experience. If time permits, there are long lists of books intended to cater for the time poor and information hungry. Phaidon or Thames and Hudson are great places to start, for example. And there are excellent short reads about the market which elucidate the mechanics at play. We’d recommend Big Bucks: The Explosion of the Art Market in the 21st Century and Dark Side of the Boom: The Excesses of the Art Market in the 21st Century by art market doyenne Georgina Adam. Above all, become visually literate before committing substantial sums of money to an important acquisition. A small amount of effort to understand the market and what’s available will be richly rewarded.

3. Buy what you like, but pay attention.

Within reason, buy what you like and develop your own taste, but take your time to do so. Everyone’s taste evolves. As advisors we’re always thinking about what it would be like to resell an object we buy on behalf of a client if, for whatever reason, they no longer want to live with it. By following a few simple rules, and focusing on those artists who are well known with relatively liquid markets, you can hone and prune a collection as circumstances dictate. Collecting is most gratifying when personal preferences come to the fore, but these impulses should be considered and kept in check by an objective view of the acquisition: could it be immediately resold at cost if I needed to? This becomes especially pertinent when looking at younger artists. The most noise tends to be around those markets in a state of rapid ascension. While involvement might entice potential buyers with large returns, markets in such a rapid state of flux – where works go from selling for tens of thousands to multiple millions in a few short months – are to be avoided, or treated with the utmost caution. When spending significant sums to buy blue chip artists you’re buying into a collective consensus which has staying power for the future. While you may hear anecdotal evidence that casual purchasing can lead to high returns, this is the exception rather than rule, unless working with a specialist advisor like The Fine Art Group. It’s often better to buy a top tier print by an established artist than a unique work by an unknown, for example. Above all, be aware of fads and trends. Many artists might be flavour of the month now, but their market will evaporate in the medium term. Whenever someone recommends an artist or art work, stop and ask: who do they work for? Whose interests are they serving? If you instruct an art advisor you can be sure they are acting in your interests and no-one else’s.

4. Always negotiate.

Art dealers are a charming bunch who will talk you out of negotiating if they can. There are some conventions which dictate discussions about money, but really there are no rules and everything is up for negotiation. When buying work on the primary market – where the work is being sold for the first time by an artist’s representing gallery – the accepted norm is a 10% discount. You might be able to get shipping thrown in if you’re lucky. Pressing for more than this can lead to offence and you might do yourself a disservice, especially if the artist is highly sought after. When working with a living artist the dealer has a duty of care first and foremost to the artist and, in a sense, they are the gallery’s client, not you. When buying on the secondary market – when an object is traded for the second of subsequent time – the dealer typically has no motive other than profit. And they will price aggressively. With the right knowledge and expertise, you might be able to secure discounts up to 40% on the list price of an artwork. The art market thrives on knowledge asymmetry: our job is to make sure our clients know as much as the dealers. The same applies at auction. When preparing bid levels, be disciplined, set clear parameters and avoid losing control in the heat of the moment. No matter how much you love a work, you’ll find something else you love just as much if you look hard and long enough. In our experience there are few works you should overpay for.

5. Don’t ignore the boring stuff.

It can be tempting to brush aside considerations of tax and shipping when chasing a dream work, but these are ignored at your peril. If buying at auction, for instance, you need to consider a raft of additional costs which can quickly rack up including, but not limited to, buyer’s premium, VAT on the buyer’s premium, import VAT, artist’s resale rights, shipping and framing. Do your sums in advance and get an exhaustive picture of what a purchase will cost. Condition is also key. Unless a work is brand new, always ask for detailed condition reports and inspect a work in person. Always ask to see it off the wall or out of the frame. Frames are known to hide all manner of sins which should be avoided. Research, as far as possible, an object’s recent market history: how long has a dealer had the work? How many times has it been exhibited? Has it failed to sell at auction? As a (very) rough rule of thumb, good work shouldn’t hang around for too long. If a dealer’s had a piece for several years, ask yourself: why is that? And be aware that some media will be more vulnerable than others so you’ll need to think very carefully about where they’re hung. Photographs and works on paper, for example, should be kept out of direct sunlight at all costs. And please, whatever you do, pay to have works properly framed by a reputable framer! While this might feel expensive in the short term, the proper use of conservation grade materials is vital. And the right frame will make a work truly sing.

FURTHER READING

- The Intersection of Art & Design

- Why Do You Need to Create a Plan for Art & Collectibles?

- Avoid these Vacation Blunders While Acquiring Art

MASTERWORKS FROM THE ALANA COLLECTION

The Fine Art Group is delighted to announce Old Masters | New Perspectives: Masterworks from the Alana Collection, to be sold with Christie’s New York on June 9, 2022. This selection is one of the most important collections of Italian Old Master Paintings, Sculptures, and Antiquities to ever be offered at auction.

The Fine Art Group is honored to advise our client, a world-renowned collector and his family, in the sale of this extraordinary group of masterworks, refining the public offering to maximize return through selective curation, sales management and marketing optimization. Assembled with great expertise and passion over decades, the Alana Collection’s Gothic, Italian Renaissance, and Baroque paintings comprehensively tell the history of Italian art and have gained international renown following the acclaimed 2019-2020 exhibition at the Musée Jacquemart-André, Paris. Masterpieces by Fra Angelico, El Greco, Orazio Gentileschi and Lorenzo Monaco will be offered alongside important antiquities, rare sculpture, and spectacular jewelry.

The auction comprises over 50 outstanding works that will be sold in a single owner live auction taking place at Rockefeller Center on June 9, 2022, after completing a global tour alongside Impressionist, Modern, and Post-War highlights to London, Hong Kong, New York, and Los Angeles. Proceeds from the sale will benefit a charitable organization that focuses on arts and education. In total, the sale of these works is expected to fetch $30 million – 50 million.

Please contact our team for opportunities to preview the collection.

GLOBAL TOUR

- London: April 5-8

- Hong Kong: April 20-21

- New York: April 29-May 11

- Los Angeles: May 24-26

PRE-SALE EXHIBITION

- New York: June 3-8

AUCTION DATE

- New York: June 9

Chief Executive Philip Hoffman comments, “In recent years, The Fine Art Group has ably assisted families shape their collections for the next generation, such as the ‘white glove’ sale for prominent Saudi collector Walid Juffali at Bonhams in 2018, as well as assisting distinguished collectors to refine their extensive holdings for their next phase of collecting, such as the extraordinary Maharajas & Mughal Magnificence auction – a collection of $110 million of jewelry sold at Christie’s in 2019. Masterworks from the Alana Collection is a fantastic example of these two streams coming together and my global team and I are delighted to be working on behalf of the family, and alongside the team at Christie’s again, to bring a carefully curated selection of works from the wider collection to market.”

Bonnie Brennan, Christie’s President of Americas, comments, “It is an honor to partner with The Fine Art Group to present this once in a generation collection with some of the finest works of their kind to ever come on the public market. The profound quality and breadth of these works stand as a testament of the supreme care and vision that guided the formation of the Alana Collection. We are especially excited to debut these works alongside 20th and 21st century masterpieces, creating a dialogue across the entirety of history.”

OUR SERVICES

Offering expert Advisory across sectors, our dedicated Advisory and Sales Agency teams combine strategic insight with transparent advice to guide our clients seamlessly through the market. We always welcome the opportunity to discuss our strategies and services in depth.

Image 1: Orazio Gentileschi, The Madonna and Child, courtesy of Christie’s

Bringing Together the Complementary Skills and Resources of The Fine Art Group and Schwartzman&

New York & London – March 31, 2022:

Allan Schwartzman and Philip Hoffman, principals of Schwartzman& and The Fine Art Group, respectively, today announced plans to collaborate on key business initiatives to provide enhanced advisory services to existing and future clients. By leveraging the complementary skills and resources of their two firms, Allan and Philip will be uniquely positioned to address the needs of an ever changing market for both multigenerational and emerging collectors, in addition to artists and institutions. Specific areas of collaboration will include services ranging from valuations and collection development to investment opportunities and philanthropic giving, among others.

Allan Schwartzman commented, “What may appear as an unlikely alliance is born from mutual respect and shared values. Rather than exist as competitors, Philip and I recognize the unique opportunity that we can create for our clients and the broader market. Philip has spent decades building a specific set of skills and experience that I don’t currently offer in-house. Additionally, given the size and scope of his firm, he engages with a pool of clients that I may not necessarily encounter. Together, we can be a more meaningful resource for our respective clients.”

“As a curator and thought leader, Allan has built a unique space and reputation in the art world,” said Philip Hoffman. “His strategic vision is sought after by some of the most esteemed collectors, artists and institutions in the world. Adding his expertise and experience to even a handful of opportunities, while we each maintain our independence and separate businesses, allows us to do something truly unique in the marketplace. And as our firm has recently expanded our presence in the United States, this alliance with Allan and his team is perfectly timed. We both believe deeply in the future of collecting, and together we have the collective knowledge and resources to address not only today’s market but to help shape the future.”

Over three decades, Allan and Philip have distinguished themselves and built successful businesses serving clients across all aspects of the art world. Beginning his career as a curator and a founding staff member of the New Museum of Contemporary Art in New York, Allan has guided the formation of private and public collections, executed legacy and market development strategies for artists (including estates and foundations), and formulated cultural development plans for civic projects – services now part of his firm, Schwartzman&. Philip began his career in the financial services industry before joining Christie’s and rising to the level of the Deputy CEO of Europe. He then spent 20 years, building his firm, The Fine Art Group, into an international market leader in art investment, art finance and art advisory that operates in six countries.

The idea of a potential collaboration between the two firms gathered steam when Jan Prasens was appointed Deputy Chairman of The Fine Art Group in September 2021. During his more than two decades at Sotheby’s, Jan worked closely with Allan Schwartzman and was eager to explore ways to work together. While the collaboration does not include any financial investment or ownership stake in each other’s firms, The Fine Art Group’s New York-based team will share space with Schwartzman& in their West 22nd Street offices in Chelsea.

ABOUT SCHWARTZMAN&

Headquartered in the Dia Art Foundation building in New York, Schwartzman& offers comprehensive advisory services to the full spectrum of individuals and organizations, private and public, involved in forming, assessing, or rethinking the possibilities of art collections. The team of sixteen brings expertise from all aspects of the art world including galleries, museums, auction houses, artist studios and foundations. As part of an ongoing commitment to foster a dialogue around developments in the rapidly changing world of art, Schwartzman& is pleased to help bring the art world symposium Talking Galleries to New York on April 4 & 5, 2022. The event will bring together museum directors, gallerists, curators, artists, scholars, journalists, non-profit leaders, auction houses and art fair executives to tackle the significant issues facing the art world today. Schwartzman& also recently debuted the podcast Hope & Dread in collaboration with Charlotte Burns. The documentary series examines recent clashes of power in culture with interviews by more than 30 guests, from artists to museum directors, philanthropists to politicians.

ABOUT THE FINE ART GROUP

Recently marking its 20th anniversary, The Fine Art Group is an independent global team of nearly 60 advisors and art finance experts committed to supporting clients across all collector markets through its five core service offerings: Advisory, Art Finance, Sales Agency, Investment, and Appraisals. From asset-secured loans and consignment management to their position as the world’s leading art investment house, The Fine Art Group offers a unique set of services and expertise in today’s art world with locations in London, New York, Los Angeles, Philadelphia, and Dubai. The acquisition of Pall Mall Art Advisors in 2021 brought even greater depth and wider global reach, with in-house expertise now spanning Western Art from 1500 to the present day, as well as fine jewelry, watches and valuable collectibles, and a trusted network of vetted consultants for bespoke category insight.

MEDIA CONTACTS

Schwartzman&: Tommy Napier, tommy.napier@finnpartners.com

The Fine Art Group: Daryl Boling, darylboling@fineartgroup.com

Click here to download the full press release.

The year is off to a busy start as clients seek to release liquidity from their collectible assets with loans from The Fine Art Group. Our flexible and bespoke financing structures, as well as our unrivalled speed of execution, has drawn an increasing number of clients to utilize our financing products, particularly as confidence continues to return to the art market in 2022.

Following is a snapshot of three loans recently funded by The Fine Art Group. Each client came to us with specific financing requirements and we were able to execute each loan efficiently and to the client’s satisfaction:

PURCHASE FINANCING TO AN ESTABLISHED US COLLECTOR

Loan amount: $3 million against 2 Contemporary artworks

- The collector was the winning bidder on 2 artworks at a recent NY evening auction

- The Fine Art Group provided a loan of 50% of the purchase price of the pieces, funding the loan directly to the auction house

- The loan was funded in 3 weeks from the initial enquiry

FINANCING TO A RENOWNED BLUE-CHIP GALLERY

Loan amount: $6 million against 3 Post-War paintings

- The gallery requested a loan to provide additional working capital, supplementing their traditional bank credit lines

- A bespoke loan provided the gallery with the ability to change or add collateral in the future, allowing crucial flexibility, with the collateral held in London and New York.

IMMEDIATE LIQUIDITY USING JEWELRY AS COLLATERAL

Loan amount: $4.5 million against an important jewelry collection

- Th Fine Art Group provided a loan against 9 pieces of jewelry, including a significant diamond, vintage Cartier pieces and a magnificent sapphire and diamond necklace, held in Geneva

- The loan funds were needed for an investment opportunity that required swift action. The Fine Art Group was able to act quickly, providing financing in 2 weeks from the initial enquiry

FURTHER READING

- Freya Stewart Speaks with Artnet News about Art-Backed Loans

- Freya Stewart Quoted in The Art Newspaper about the Rise of Art-Backed Loans

- Artnet Art-Secured Lending Brokerage Program

I am delighted to announce that Pall Mall Art Advisors has been acquired by the London based company, The Fine Art Group. Over its 20-year history, The Fine Art Group, founded by Philip Hoffman, has established itself as a powerful presence in the global art market, evolving from its origin as The Fine Art Fund into a comprehensive art services group spanning art advisory, art secured lending, art agency, art investment and valuations. The Fine Art Group serves the upper end of the art market and offers unrivaled in-house expertise in fine art and jewelry.

This merger cements our position as the market leading independent art services group for every stage of the art collecting cycle. The sale makes perfect sense as we continue to focus on expanding our services and global footprint. Both companies share the same guiding principles of providing transparent and independent white glove service to exceed our clients’ expectations. Like Pall Mall Art Advisors, The Fine Art Group has a strong commitment to developing long-standing client relationships and meeting their evolving needs in a changing market.

We plan to consolidate our brand to be represented under The Fine Art Group name, which will be rolled out over the next few months. My colleagues and I look forward to connecting with you soon to discuss in greater detail this exciting news and the extension of specialty services it offers you.

Anita Heriot

President, the Americas, The Fine Art Group

Read more about the merger on Artnet.com.

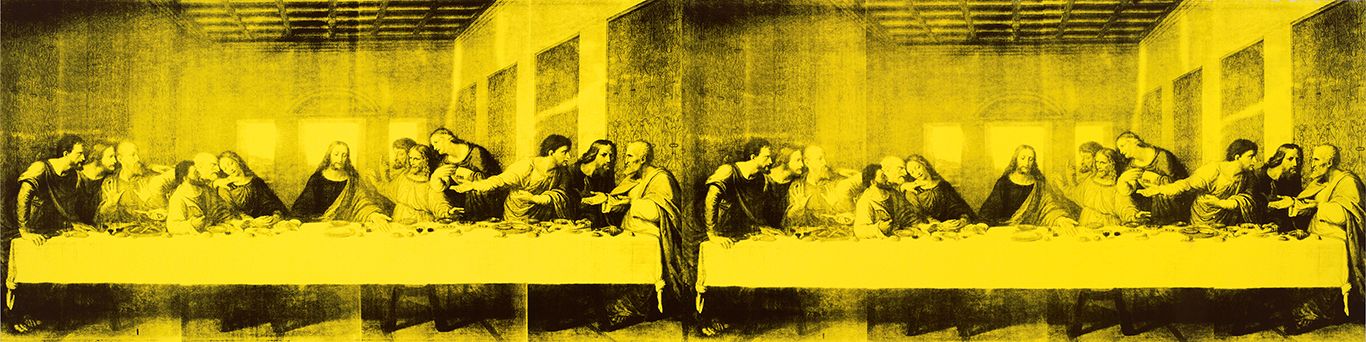

The art trade on both sides of the Atlantic has been abuzz with sales from permanent collections at public institutions, otherwise known as deaccessioning. Most prominent in the recent debate about associated ethics is the Baltimore Museum of Art (BMA). The institution offered major works – by Brice Marden (3, 1987 – 88), Clyfford Still (1957-G, 1957) and Andy Warhol (The Last Supper, 1986) – for sale at Sotheby’s in October 2020 with a combined estimate of 65 million USD. Just hours before the Marden and Still paintings were due to hit the block (the Warhol was to be offered privately), the museum withdrew both from the auction in response to a growing maelstrom of negative criticism, internal and external.

The BMA was technically operating within the bounds of newly loosened regulation from the Association of Art Museum Directors (AAMD) in America: a targeted, finite response to the ongoing pandemic which has, to all extents and purposes, obliterated gate receipts from museum balance sheets. Funds from the sale would be directed towards ongoing running costs (even though the museum was not in financial distress), ‘care of the collection’ and, crucially, new acquisitions to diversify the collection of a major museum rooted in a city with a 65% black population. The museum director had even secured public consensus from the executive director of the AAMD before proceeding with the proposed deaccessions.

Operating within the rules, with admirable objectives, the plan was still deemed controversial enough to attract bitter criticism from all sectors of the art world and, further, controversial enough to spook the institution into withdrawing the works from public sale. Why?

Long seen as one of the unassailable taboos in the UK museum sector, and generally handled with judicious caution in America, two key factors have contributed to a temporary loosening of the strict ethical codes surrounding the practice. The first is the decimation of visitor numbers to museums due to the global pandemic. The second is a growing sense of urgency, especially in American cities with black majority populations, to develop public collections which reflect the diversity of society at large.

Permanent collections housed by museums, often accumulated over decades or even centuries through a patchwork of philanthropic gifts, bequests or acquisitions, are generally intended to be just that. Caroline Douglas, Director of the Contemporary Art Society (CAS), an organisation that acquires work on behalf of their partner museums in the UK, explains: ‘Museums are the forever proposition – that’s why artists want to be in them.’ Gifts to museums, whether from an individual or an organisation such as the CAS, are usually given with the explicit proviso that such works must remain part of the collection in perpetuity.

In both America and the UK, professional membership organisations publish guidelines of best practice for their member institutions. While rules vary, there are a few broad points of consensus. Until the global pandemic, one of the most common restrictions was that works could not be sold to keep the lights on. Deaccessions – sales from the permanent collections – might be allowed where works fell outside an institution’s ‘core collection’ and with the rigorously enforced purpose of funding new acquisitions. In other words, funds raised must be reinvested back into the collection.

There is subsequently a dual aspect to the question of deaccessions: why is the work being sold? And what will the funds be spent on? Having a defensible answer for one part of this equation isn’t enough. Institutions must make a clear case for the acceptability of a sale, and there are subsequent restrictions – both written and unwritten – pertaining to the use of sale proceeds.

The risk of eroding donor confidence in the entire museum sector underpins much of the regulation at play. Not only are museums usually charities or non-profits with beneficial tax codes, they are also typically built on the generosity of private citizens and the state. Selling works from the collection – given on the explicit or implied understanding that they would remain the collection forever – is therefore seen as a grave betrayal of the trust placed in them by donors. It subsequently threatens to dismantle faith in the very mechanisms and structures which maintain museums as viable economic entities in the first place.

There is another great risk with museum deaccessions. Tastes change, fashions come and go. The world evolves. While some artists may appear utterly irrelevant to the present moment, they may come to be seen as pivotal by later generations. And what might appear frivolous and inconsequential in one historical era might be understood as prescient and vital by museum audiences of the next. There also remains – most pertinently in the case of the BMA, but generally for museums in Western Europe and America – the question of representation and the art historical canon.

It’s clear to today’s audiences that the ‘approved’ art historical account of the post-colonial age needs expansion, revision and rewriting. But it’s also impossible for anyone to know what the cultural consciousness of the future might deem important. The mission of the museum is, therefore, inherently conservative: to hold, intact, collections intended for the public good. The prevailing taste which forms a public collection is likewise, in and of itself, a historical artefact.

Similarly, selling the work of living artists can have a profoundly negative impact on their market and career trajectory. While museum acquisitions are the gold standard of validation for an artist, sale of their work from a museum, logically, can have the opposite effect. Essentially suggesting that an artist is, in the eyes of the museum (the custodians and narrators of art history) no longer of consequence. To make such a dramatic, public and negative statement about an artist’s work goes entirely contrary to what is widely understood as the Hippocratic Oath of museums vis-à-vis the wellbeing of the artistic community it serves.

2020 has shown everyone – inside and outside the art world – that systems, structures and rules that previously seemed immutable are in fact entirely contingent. Many public institutions have survived this year with furlough schemes, goodwill and inventive short term strategies. But they can’t live on vapours alone. The Victoria & Albert Museum, for example, received 15% of its usual traffic in August. Such precipitous drops in visitor numbers are untenable. Museums need donations yes, but most importantly they need an audience, gate receipts, successful gift shops and humming cafes. Another long stretch into 2021 without this revenue will bring financial distress, just as public borrowing hits record highs in the UK and the glamourous social events which generously lubricate the cogs of private philanthropy remain strictly off limits. We can therefore only foresee more – not less – works coming to market from the museum sector next year. Outcry or no outcry, reality must bite sooner or later. The debate continues.

Image 1: Image credit Sotheby’s; Image 2: Image credit Baltimore Museum of Art; Image 3: Image credit Amir Hamja/Bloomberg via Getty Images; Image 4: Image credit Katherine Hardy/The Art Newspaper; Image 5: Image credit Baltimore Museum of Art

Further Reading

- Collection Management

- When the Kids Don’t Want it: Converting Your Passion Assets into Charitable Impact

Hello from Charlotte, N.C.!

Instant wealth and fame at a young age offers great opportunity. But adding the expertise of an art advisor gives those with sudden early success the enhanced prospect to pursue a sound and wise investment strategy in tangible assets.

This crucial need for the suddenly wealthy crystalized for us when our senior jewelry appraiser and I met with a newly contracted professional athlete, his business manager and risk manager to discuss and implement a plan of action when acquiring unique and unusual luxury timepieces. Throughout 2019 and 2020 this client made a substantial investment in what can be a robust and volatile collecting market, often working directly with dealers and without sound guidance from experts in terms of investment. In one instance before working with us, this client acquired an 18-karat yellow-gold Rolex Daytona set with diamonds and sapphires for $70,000 – a big purchase for a young man who overnight went from less than $20,000 a year to over $5 million a year!

In the late spring of 2020, a trusted friend and insurance broker called me to ask if we could establish appropriate retail replacement values for this growing collection. Our appraisal process began like any other: confirming available dates, scheduling onsite appointments, completing inspection and beginning valuation research. However, during this process we learned that our client had significantly overpaid for a watch that regularly retails for $25,000. A delicate conversation followed in which our team discussed the details of the luxury timepiece market and how to avoid overpaying in the future.

This made me pause and realize that most appraisers and art advisors are accustomed to opining on a range of tangible assets, such as jewelry, luxury accessories, rare automobiles and similar asset classes for private clients. However, there exists another segment of high net-worth individuals whose youth, wealth and celebrity regularly bring new challenges to their financial advisors and business managers. These individuals are often household names, from actors and celebrities to models or government officials – all people who have attained fame and wealth but have neither the time nor expertise to manage the range of investment-quality tangible assets that exist within their collections.

Although the enormous cash influx realized by many of these high-profile clients is properly protected by a team of business managers, wealth managers, accountants and attorneys, suitable guidance from an experienced art advisor who understands the challenges of the tangible asset market is missing. As a result, seemingly common purchases like a fine Swiss timepiece, a luxury handbag or a work of art from an emerging artist can become unstable investments.

SUDDEN WEALTH SYNDROME

Sudden Wealth Syndrome, a term coined by psychologist Stephen Goldbart to describe the stress, guilt, and social isolation that often accompanies a large windfall, often strikes first-round NFL draft picks, overnight IPO millionaires and actors plucked from obscurity. Sudden wealth can overwhelm those who have made it big and encourage overspending coupled with poor decisions when making a significant purchase. The result can be financial ruin. Goldbart and his associates at the Money, Meaning & Choices Institute say that much like the four stages of grief, there are four stages people go through when coming to terms with their new wealth:

- Honeymoon: Like the beginning of a romantic relationship, people who come into money feel powerful and invulnerable. Many go on spending sprees, buying things and making risky investments which often lead to disastrous results.

- Wealth Acceptance: A realization that there are unknown factors associated with wealth and the need to set limits.

- Identity Consolidation: During this stage, people accept that they are now rich but realize that their money does not define who they are.

- Stewardship: In the final phase, people reach a mature resolution of what their money means to them and have established a plan for what to do with their money in terms of personal, family and philanthropic missions.

These cash windfalls are a nice problem to have; however, there are numerous stories detailing the recently wealthy burning though their money in just a few short years, ending up with a collection of expensive toys and objects that hold little return on investment. There are important pitfalls to avoid particularly when managing investment quality tangible assets – the first step being to assemble the right team of experts.

A QUALIFIED ART ADVISOR OFFERS PROTECTION

All newly minted high-profile clients should be encouraged to hire and consult with an art advisor. In fact, it is paramount that the client hires an art advisory firm with a vast range of specialists, experts and conservators who can consult and bring significant insight to any asset class including expert purchase negotiations on the client’s behalf. This team can provide expert advice and analysis on the acquisition of a new asset whether it is a piece of jewelry, sports memorabilia or something more traditional such as a first-edition manuscript. Additionally, an art advisory firm can provide an unbiased opinion on the quality of the investment as well as the condition of the object, steering the client to more solid footing in terms of the client’s overall investment portfolio and potential long-term gains.

Secondly, avoid the dealer dilemma! While a traditional retail setting such as a gallery, fine art show or fine jewelry salon can be an interesting arena to acquire unique and unusual tangible assets, there is a built-in bias on the dealer’s behalf. The seller’s goal is to garner the highest amount possible for any object marketed or sold. Additionally, while a collector’s discount can often be negotiated, the seller has the upper hand because the seller’s understanding of the market is greater. In many cases, and particularly with our watch-collecting client, we see specific instances where high-profile clients are taken advantage of even with negotiated discounts, simply due to the fact that there is money to spend and impulse to buy without sound financial guidance.

In this circumstance, it is important for high-profile clients to have knowledgeable professionals advocating on their behalf in order to avoid additional pitfalls to acquisition, such as authenticity, fakes and forgeries, clear title and condition issues.

When acquiring high value tangible assets, the most important factor beyond understanding value is due diligence. Before payment is made, the potential owner should have a complete grasp of the item’s condition, including previous conservation or restoration. A solid and transparent provenance should also be available to the buyer and his or her team, thus providing a clear knowledge of authenticity and title which alleviates concern surrounding fakes and forgeries. Without proper due diligence, a $250,000 purchase can depreciate to $1,000 in the blink of an eye!

Finally, when working with an art advisory firm, many of the unseen details of acquisition are instantly handled by an experienced team and vetted third-party sources solving unforeseen concerns such as framing, conservation, repair, shipping, fine art storage and other needs associated with ownership of high value tangible assets. It is important for a high-profile client to “not go it alone” because doing so could have unwanted ramifications. For instance, storing a high value painting or print in an untested storage facility could mean significant financial losses if this facility does not meet appropriate standards. Further, if a work requires conservation or repair, an art advisory firm is able to facilitate the proper way forward. In many cases, if an owner does not hire the appropriate conservator, which is often designated by the artist or maker’s estate, foundations and/or other top experts, then a significant loss in value is imminent.

The art market is often considered by many to be the last great unregulated segment of the financial market and can often make for a treacherous experience for new collectors without the proper guidance.

OUR HIGH-PROFILE CLIENT DIVISION

We understand the unique challenges facing our clients and can offer high-profile individuals a full suite of services, and related white-glove concierge support, on a global scale.

We’re experienced working with actors and celebrities, directors and producers, musicians, athletes, models, authors, journalists, and industry executives. Offering the high-quality, collection-specific solutions to help make informed decisions around the strategic, long-term management of fine art, jewelry, and other high-value collectibles.

FURTHER READING

The art world is an unregulated and opaque market with significant private and public transactions. Advisors guide collectors and investors, ensuring they do not overpay while offering discipline and market analytics. This model doesn’t necessarily exist when acquiring jewelry. Retail prices are often higher than the intrinsic value of the material and stones, and clients are shocked to discover their fair market value.

Jewelry connoisseurs understand the three c’s (cut, clarity, and carat) but are unaware of additional factors influencing value. Color saturation is important, and its interpretation and identification change as the market evolves. When diamonds are mounted, color can be enhanced by the mount or foil backing. Additionally, the mount or cut of the stone can hide flaws. This isn’t always disclosed when acquired through a dealer or designer, and accompanying certificates give the client a false sense of security.

It is imperative to work with a knowledgeable advisor such as The Fine Art Group’s Advisory Team when acquiring jewelry and loose stones. The following article discusses the myths surrounding red diamonds, highlighting the importance of seeking experienced advisory when navigating the jewelry market, as independent advisors can bring discipline, market analytics and due diligence to collecting.

The Diamond Investment & Intelligence Centre (DICE), Published August 9, 2020

RED DIAMONDS: UNDERSTANDING THEIR RARITY

Red diamonds are not the rarest color in the world! Now we can review the myths…

There are other colors that are rarer such as violet, purple and orange. So why are people under the impression that red diamonds are the rarest? There are so many individuals in the world that claim they know how many red diamonds exist. Some auction houses claim that there are only 29 red diamonds in existence. That is false. Some dealers claim that there are only 30 red diamonds in the world, which is also false. Even some geological websites claim that red diamonds are the rarest colors, which is also false. Do red diamonds even exist? if so, how many do exist? and if they don’t exist, then why does the GIA (Gemological Institute of America) certifies them as such?

What are the various theories? What is the truth about red diamonds? How many exist? These are all very good questions, and it is time to address them all properly.

RED DIAMONDS THEORY #1

The Argyle mine in Australia produces 90% of all pink and red diamonds.

It is believed that the majority (90% as stated) of all pink and red diamonds are mined in the Argyle mine. This theory can be easily verified. There are official documents (mostly Kimberly Process) that can trace back the majority of rough diamonds to mines and therefore we can use this method as a way to verify. Some red diamonds were found in India decades ago from the Golconda region which was also famous for its blue diamonds. This can also be verified as the GIA can easily determine the origin of such diamonds. If we go back less than 40 years, we will find that the Argyle mine has indeed produced the vast majority of pink and red diamonds; just follow the money and sales…

RED DIAMONDS THEORY #2

There are only 29 or 30 red diamonds in existence.

That is completely false. I am personally aware of at least 100 red diamonds in existence, and I am sure that some of the top fancy color diamond dealers that trade in red diamonds are aware of a few more…There is a single collection that has 51 red diamonds in it, from as large as a 4.59 carat red diamond to a 0.24 carat red diamond. With a total weight of just above 50 carats. There is another large collection of 25 red diamonds.

A very well-known dealer, who also produced a rare diamond cross with 11 red diamonds in it, has many other red diamonds in his personal collection. There is an online dealer (which has the largest diamond collection offered on the internet) that has more than 25 red diamonds listed. Let’s not forget that there are many other red diamonds owned by private individuals that have been acquired over the years that we are not aware of.

RED DIAMONDS THEORY #3

Are red diamonds real? The answer is yes, but only relatively recent.

The best-known gemological laboratory is the GIA based in New York and Carlsbad, with many more satellite labs around the world. Before the 1970’s color diamonds were such a rarity that they were discarded by the trade. The GIA started certifying red diamonds only recently (as recent as the 80’s). Prior to that they were all certified as pink diamonds, and in fact, if we look at the pink diamond color chart by the GIA, we will find that at the bottom right corner, there is an area called Fancy Red.

That is the reason that the red color has only 4 categories; Fancy Brownish Red, Fancy Orangy Red, Fancy Red and Fancy Purplish Red. You will not find a single GIA certificate that certifies a red diamond as Intense Red or Vivid Red. The most desired color is Fancy Purplish Red. It has a more lively color than a pure Fancy Red color, and therefore more attractive to the eye. A pure Fancy Red diamond has a more dull color.

RED DIAMONDS THEORY #4

The current largest certified red diamond is the 5.11 carat Moussaieff Red diamond. It has a flawless clarity. There are 2 more known certified red diamonds in the 5 carat size, there is a 4.59 carat red diamond and then the weight scale goes down to the 2.00-3.00 carat area with a 2.71, a 2.29 carat, a 2.26, a 2.11 carat, a 2.09, a 2.06 carat, a 2.03 and a 2.00 (to my knowledge). Then we go down into the 1.00-1.99 weight area with many more.

I heard that there is a 3 carat red diamond that exist, but I have not seen the certificate to confirm it myself. The vast majority of red diamonds are below the 0.50 carat mark. It is extremely rare to find red diamonds with clarities better than SI1. The vast majority are SI1 and below down to an I3 (or half cert). Rarely we see a VS2 or better such as the 2.11 Argyle Everglow. Such a combination makes a Red diamond extremely rare and very much desired by investors and collectors.

RED DIAMONDS THEORY #5

There are not many red diamonds sold in auctions.

It is true that since 1987 when the 0.95 carat round brilliant Hancock Red Diamond was sold for whopping $880k (a newsworthy sum at the time), there have been only 22 red diamonds (or 25 if we count multi red diamond jewelry pieces) that have been offered and sold at auction. The question is why not more red diamonds have been offered (like blue and pink diamonds)? The answer is simple. The vast majority of people, including dealers, do not really understand red diamonds and therefore prefer not to deal with them, unless they have a client that specifically asks for one.

Another famous red diamond that sold at auction, which also holds the current record price per carat for any red diamond sold at auction, is the 2.09 carat, Fancy Red, Heart Shape, with SI2 clarity. It was sold by Moussaieff. It was sold in November 2014 at a Christie’s auction in Hong Kong for over $2.4 million per carat. This 2.09 is the perfect example proving the Red Diamonds Theory #3. This 2.09 carat red diamond was an Argyle tender diamond which was certified as a pink diamond when it was offered.

CONCLUSION

This article summarizes the information and theories about red diamonds and their rarity. Are red diamonds rare? Yes. Are red diamonds the rarest color on earth? No. Violet and purple are; both in terms of quantities as well as in sizes. There are no pure violet and purple diamonds in the 5 carat size like red, not even a single diamond.

When buying a red diamond, one has to work with a trusted advisor that will not have a conflict of interest. The advisor will point out those red diamonds that may have a brown tint or an orange tint to it which should be avoided. The advisor will also help in properly valuing such a diamond and will also help acquire such a rarity.

Read this article at The Diamond Investment & Intelligence Centre (DICE).

The market has changed faster than ever before and two recent art market reports have added considerable detail to this picture. According to Artnet’s autumn 2020 Intelligence Report, fine art auction sales fell 60% from 1 January to 10 July 2020. The Art Basel & UBS Report – The Impact of COVID-19 on the Gallery Sector – records a comparable slimming of sales for surveyed galleries, with sales declining an average of 36% when compared year on year. How, then, has the market innovated in response?

Covid has clearly accelerated digitisation of the art market. Christie’s, Sotheby’s and Phillips held 131 online sales in the year to 10 July 2020, more than twice as many for the equivalent period in 2019. The move to seemingly continuous online sales has further driven down the average price for a work of art sold at auction by 41.3% (to 25,926 USD) compared with the same time last year, according to Artnet’s report.

Within the gallery sector, the ongoing digital migration has increased online purchases from 10% in 2019 to 37% in the first half of 2020. The Art Basel & UBS Report highlights further changes. Sales at art fairs have dropped from 46% in 2019 to 16% for the first half of 2020 as entire swathes of the calendar have been postponed or cancelled. Notably, commercial strategies have also shifted. Last year galleries listed their top priorities as art fair exhibitions and widening the geographical reach of their client base. Naturally the outlook for dealers is far more defensive in 2020, with cost cutting, development of online channels and maintaining existing client relationships now the order of the day.

Works on Paper from a Distinguished Private Collection. Pace, East Hampton.

Over the past decade the distinctions between dealers, auction houses, museums and art fairs have become increasingly blurred. Top tier galleries have long mimicked the reverential aura of museums; museums frequently use auctions to raise funds; auction houses now ‘curate’ sales and selling exhibitions; while numerous fairs contain thematic sections, some with entirely non-commercial ‘public’ presentations.

Recent developments continue this trend. Even before covid, Acquavella, Gagosian and Pace collaborated to win the revered Marron estate, intentionally challenging the received wisdom that such a significant assortment of high value works was automatically the preserve of the auction houses. In a recent profile of Pace Gallery for the Wall Street Journal (Michael Shnayerson, 9 September 2020), it was revealed that this initial collaboration has given rise to a longer term partnership – called AGP – that will compete for similarly important collections and estates in the future. Such collusion among fierce rivals is one of the more notable evolutions in response to the auction houses’ perceived encroachment on gallery turf.

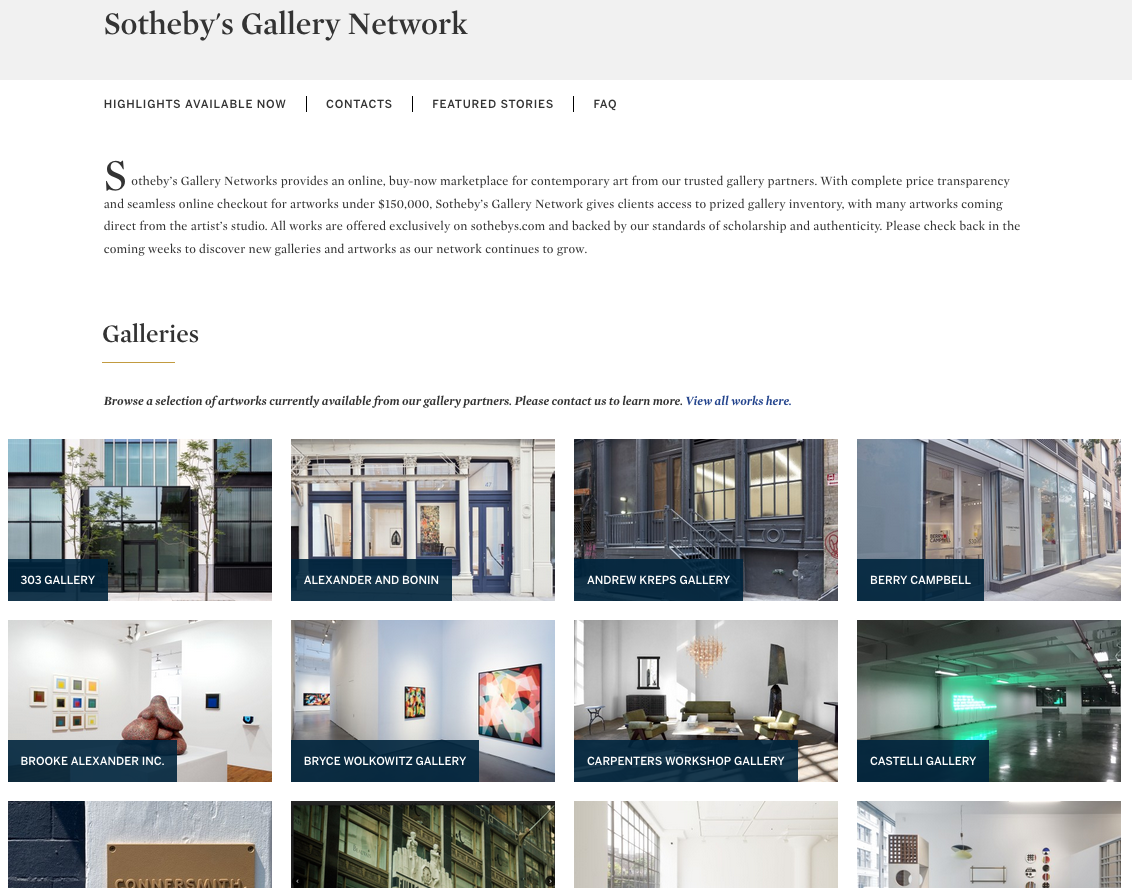

Despite competition for consignments, galleries and auction houses are also collaborating in new ways. Sotheby’s Gallery Network – an online, buy-now market place for works under 150,000 USD – hosts virtual storefronts for 34 dealers including 303 Gallery, Andrew Kreps, Fergus McCaffrey, Lévy Gorvy and Peres Projects, among others. Such partnerships would have been unimaginable not long ago. While quality of works is mixed – most dealers don’t want prime stock available to anybody at the click of the button – it demonstrates the softening of traditional enmities in a moment of crisis. For the time being, at least.

Messe in St. Agnes. König Galerie.

In Berlin, König Galerie is hosting Messe in St. Agnes #2 from 12 to 20 September. A ticketed selling exhibition – hung salon style – with primary and secondary market consignments, the enterprise was an unusual but apparently effective way of generating revenue in the ultra-contemporary Berlin gallery scene which has historically demurred from such outright mercantile endeavours. Lingering somewhere in the murky interstitial space between art fair, auction hang and selling exhibition, the project seems an intelligent way of maintaining close contact with gallery clients looking to offload works or trimming collections as a consequence of long periods of confinement at home.

One of the most successful new ventures to join the fray is a new concept remarkable for its simplicity. Former Christie’s ‘rainmaker’ Loic Gouzer has developed an invitation only auction app, Fair Warning, which offers a single work at auction on an almost weekly basis. Auction participants are closely vetted and results have so far been impressive. Pieces by Steven Shearer, David Hammons, Steven Parrino, George Condo and others have all been offered, with the highest price to date achieved for an Untitled 1982 Basquiat work on paper, which sold for 10,810,000 USD premium. Not bad for a sale orchestrated from a garage on Long Island, albeit the Hamptons end.

While historically resistant to the technological ‘disruption’ so common in other industries, the art market has found the inclination this year to be a little more experimental. Most market commentators are united in welcoming the silver lining of greater price transparency from the migration online. In this alone, 2020 may have delivered a meaningful transformation for the industry.

Image 1: Image courtsey Gagosian; Image 2: Image courtesy Sotheby’s Gallery Network; Image 3: Image courtesy König Galerie; Image 4: Image courtesy @loicgouzer

Further Reading

ART ADVISORS HELP CLIENTS NAVIGATE THE ART MARKET

Art advisors have assisted collectors for centuries, demystifying the seemingly opaque art world and helping passionate individuals assemble legendary collections with meaning and value.

In the early 1900s, the young American-Lithuanian art historian Bernard Berenson, barely in his 30s, traveled across Italy to personally inspect Renaissance masterpieces by Raphael and Titian. His clients across the Atlantic had lots of questions, sending flurries of telegrams back and forth: “Wire whether they are authentic. Are they in good condition? Must have your advice.”

Berenson personally contributed to the stellar Old Master collections of Gilded Age luminaries such as Isabella Stewart Gardner, who purchased her Titian’s Europa and the Bull through Berenson. Today it hangs in her eponymous museum in Boston and remains one of the very best Titians in the United States. As a good art advisor, Berenson was able to provide access to the great treasures of European aristocratic families and held unparalleled expertise in Venetian paintings as the author of the 1894-published book The Venetian Painters of the Renaissance.

In the 18th century ambitious art collectors like the formidable Russian monarch Catharine the Great relied on a network of agents to source important paintings whose owners had a change of fortune. The Russian ambassador to the Netherlands Prince Dimitri Gallitzin was a trusted art agent and advisor to the Empress and was instrumental in securing for her Rembrandt’s The Return of the Prodigal Son among countless other masterpieces to enter her collection. Catharine viewed the process of collecting art as a competitive sport and a point of national pride. In 1772 she wrote to her friend the French philosopher Voltaire: “You have heard correctly, Sir, that this spring I raised the pay of all my military officers . . . by a fifth. At the same time, I’ve bought the collection of paintings of the late M. de Crozat and I am in the process of buying a diamond bigger than an egg.”[i] With her own collecting drive and expert guidance by her art advisors, Catharine amassed a spectacular art collection which in turn formed the basis of the Hermitage Museum in St Petersburgh Russia, one of the most important public art collections in the world.

Art advisors in the early 21st century do not (fortunately) have to fulfill the double function of political envoy/spy and art detective while serving their clients. Much like Catharine the Great, many art collectors are deeply passionate and highly competitive about acquiring great art. As a result, an art advisor’s role is first and foremost to take a dispassionate and critical view of each potential acquisition and find reasons not to buy it. Then and only then, if the work is deemed appropriate, can a good art advisor recommend a purchase.

Art advisors should possess a combination of attributes to best serve their clients: insight into current curatorial trends and changing collecting tastes which steers the market into the future; a deep understanding of artists, their work and their scholarship; and a concrete and up-to-date market knowledge and lines of communication to the key actors in the art market. Most of all they should be independent and invested only in the process of helping their clients acquire the very best art at the best price point.

HERE ARE FIVE QUESTIONS YOU SHOULD ALWAYS ASK YOUR

ART ADVISOR BEFORE ADDING TO YOUR ART COLLECTION

- What trends are you seeing in the market at the moment? How will they move the needle when it comes to my collection’s value in the future?

- Why is this artist so important and what should I know before I buy their work?

- What concerns do you have about this particular work? Are there any condition or provenance questions to be resolved before purchase?

- What is the appropriate market price for this type of work within the artist’s oeuvre?

- Should we buy at auction, galleries, fairs or directly from private collectors?

The answers to these questions are as varied as the types of paintings, sculpture, furniture and jewelry we source for our clients.

FURTHER READING

- The Art Detective: How to Find a Qualified Art Advisory Service

- May 2023 Auction Season: Our Team’s Top Picks & Insights

- The Asking Price: Understanding Value 1

OUR SERVICES

The Fine Art Group’s Art Advisory department’s expertise and deep market knowledge ensure that our clients can focus on passion knowing that the due diligence is taken care of. Best of all, unlike Catharine the Great, you won’t have to balance your war chest to make that perfect acquisition. We hope!

[i] Catherine II to Voltaire, 1 September 1772, Correspondence, 168, as quoted in Documents of Catherine the Great: The Correspondence of Voltaire and the Instruction of 1761, ed. W. F. Reddaway (Cambridge: Cambridge University Press, 1931).